A Look at Office Asking Rates: Class A & B

By Steve Triolet, Younger Partners Research Director

DFW office asking rates, overall, continue to look largely unchanged from one year ago. This is especially true in some of the top office markets like New York City and San Francisco, which have seen double-digit rate declines. Rates are a lagging indicator and previous cycles show that most of the downward movement in rates don’t typically impact the overall average until 12 to 18 months after the economy goes into a recession. So far, effective rates have decreased, mostly in the form of free rent.

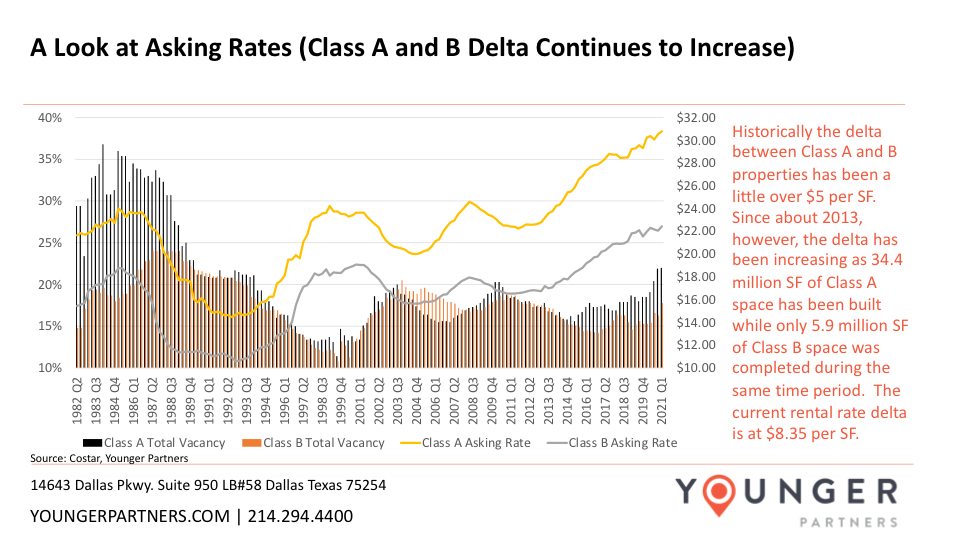

One major trend that has taken place over the past year is moderate rate increases for Class-A properties. This is slightly misleading as most of the increases have been driven mainly by the newest construction been delivered to the market. Existing stock, especially in older properties are seeing pressure on rates. Class-B rates have remained flat from an asking rate perspective. With 6.3 million square feet currently underway (95% of which is classified as Class A and quoting an average a $41.95 FSG per sf asking rate), this trend is expected to continue while the construction pipeline remains elevated through 2022.