The Spread Between the Availability Rate and Vacancy Points to Continued Negative Absorption Over the Next Few Quarters

With most properties taking roughly two years between breaking ground and occupancy, the construction pipeline takes time to shift from changing market conditions. Still, I think it is informative to see how the various property types have changed over the past few years, along with some data on the current under construction pipeline.

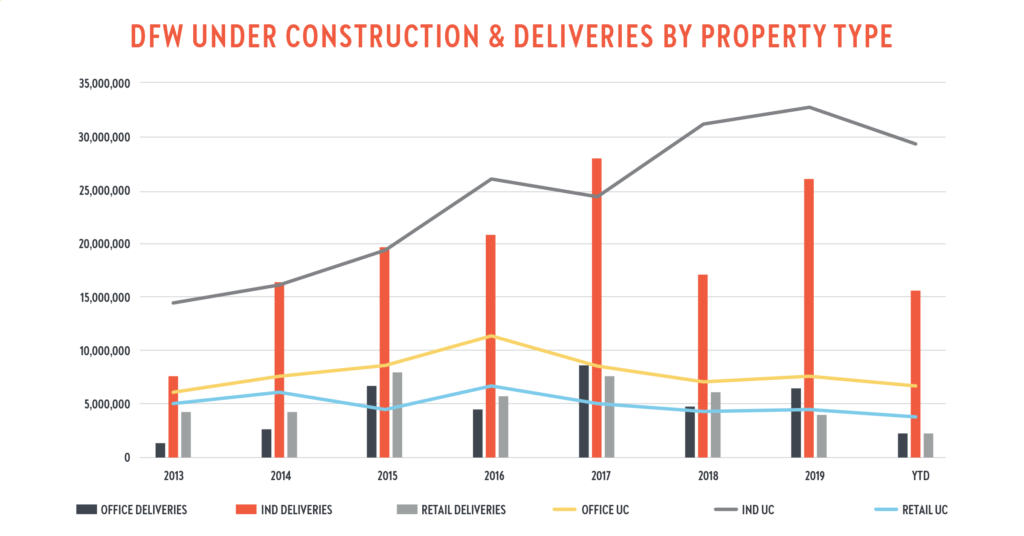

As you can see in the chart below, the industrial market seems almost unfazed by the current recession, with almost 30 million square feet of space currently under construction (note this does not include flex properties).

Office and retail properties are show parallel trend lines of peaking in 2016 and trending downward since (The current office pipeline is 7.1 million square feet, while the retail pipeline is 3.3 million square feet).

With recent announcements for the office sector though (Cawley is kicking off The Parkwood, a 120,000-square foot office building in Far North Dallas. First United Mortgage Corp. will occupy about half of the property and

Harwood announced Harwood 14 in Uptown. Harwood 14 is a 27 story, 360,000-square foot office project. Haynes and Boone will be the lead tenant and will occupy about 125,000 square feet).

Of the projects currently under way for office and retail, roughly half of the square footage has been pre-leased (54% and 52%, respectively), so the market is scheduled to have over 5 million square foot of new vacant office and retail space delivered over the next two years (3.6 million square feet for office and 1.7 million square feet for retail).