Tag: steve triolet

A Breakdown of Available Office Space in DFW

By Steve Triolet, Younger Partners Director of Research

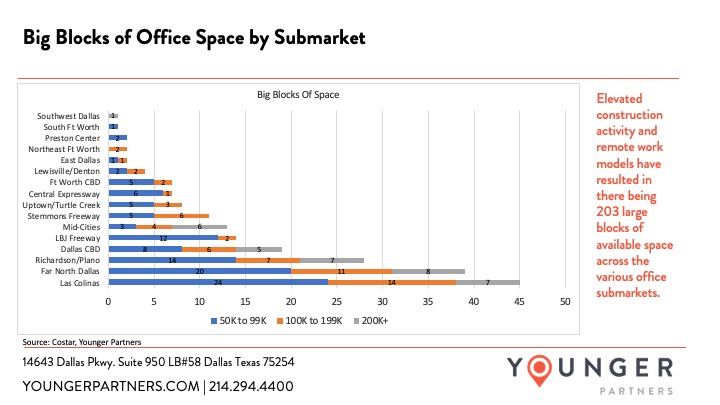

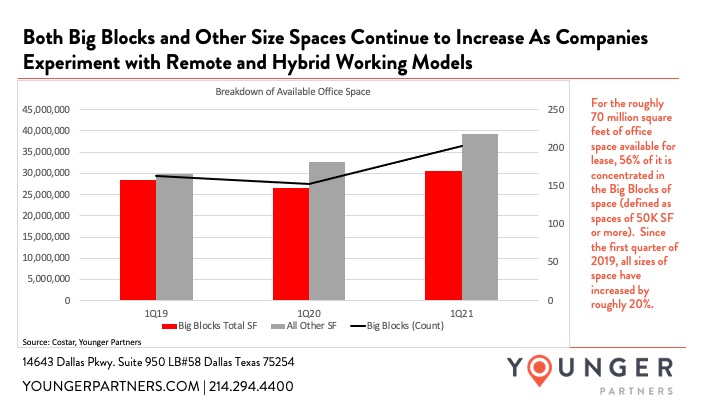

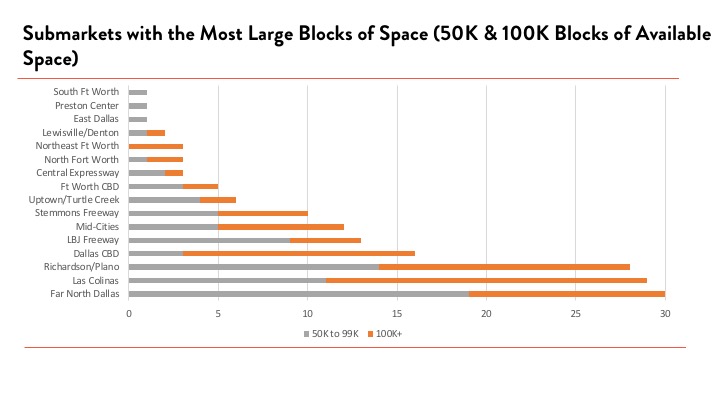

A few times a year I show where the highest concentrations of large blocks of space are. In the second chart below, there is an updated breakdown of the 203 Big Blocks of space currently available by size category and submarket. Outside of that update, I wanted to take a look at the increase in all sizes of space (not just the big blocks of space).

What surprised me most when I analyzed the data is the increase in space was not just in the big blocks of space, but also all size categories. Since the first quarter of 2019, the amount of space being marketed is up 20%. While sublease is a large component of this increase over the past year, sublease space only accounts for roughly 14% of all the available amount of space out in the market.

DFW Office Sublease Space is Near a 5-Year Supply

By Younger Partners Research Director Steve Triolet

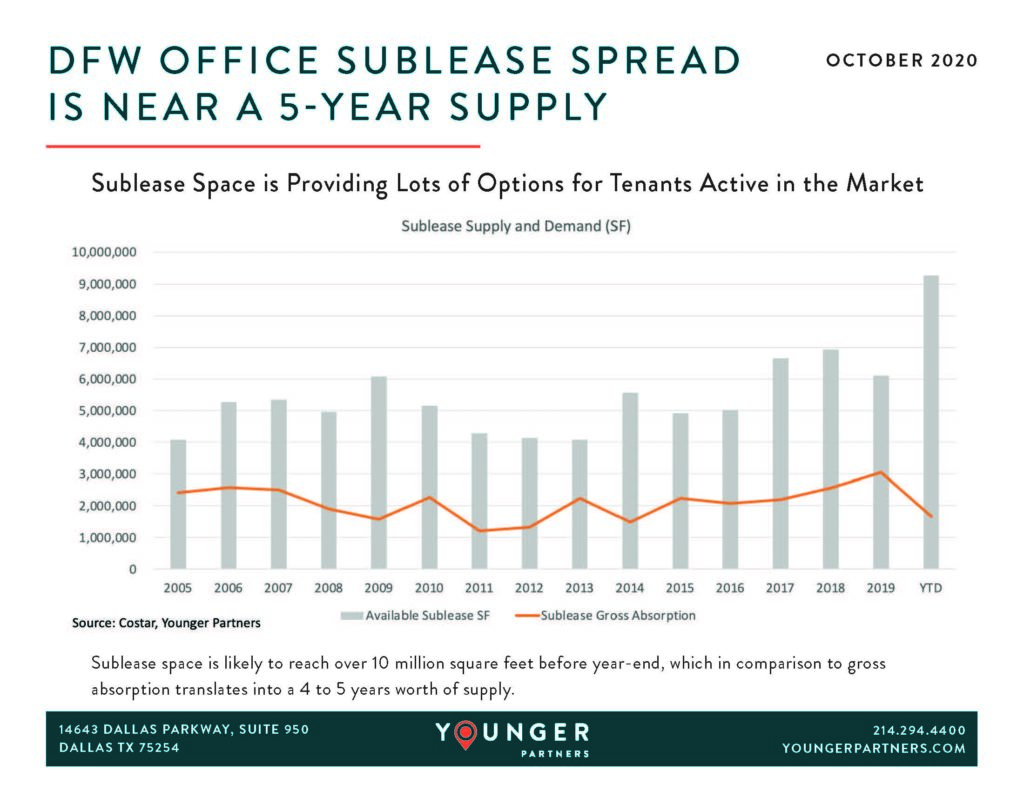

It’s not really new that office sublease space across the US has been rising rapidly over the past 6 months. Dallas, like many markets, are seeing all-time highs. Currently, DFW has just under 9.3 million square feet available with some larger blocks likely to hit the market before year-end (Pioneer Natural Resources, for example, will place 400 to 600K of its headquarters’ space on the market soon). Current estimates point to sublease space surpassing 10 million square feet before the end of the year. That’s a big number, but what does that translate to? I took a historic look at how much sublease space was absorbed on a yearly basis. Typically, there is a little more than 5 million square feet of sublease available and a little more than half of that is absorbed (2.8 million square feet). The other remaining half does not lease and eventually hits the market as direct vacant space (once the master lease gets to a 2-year term or less).

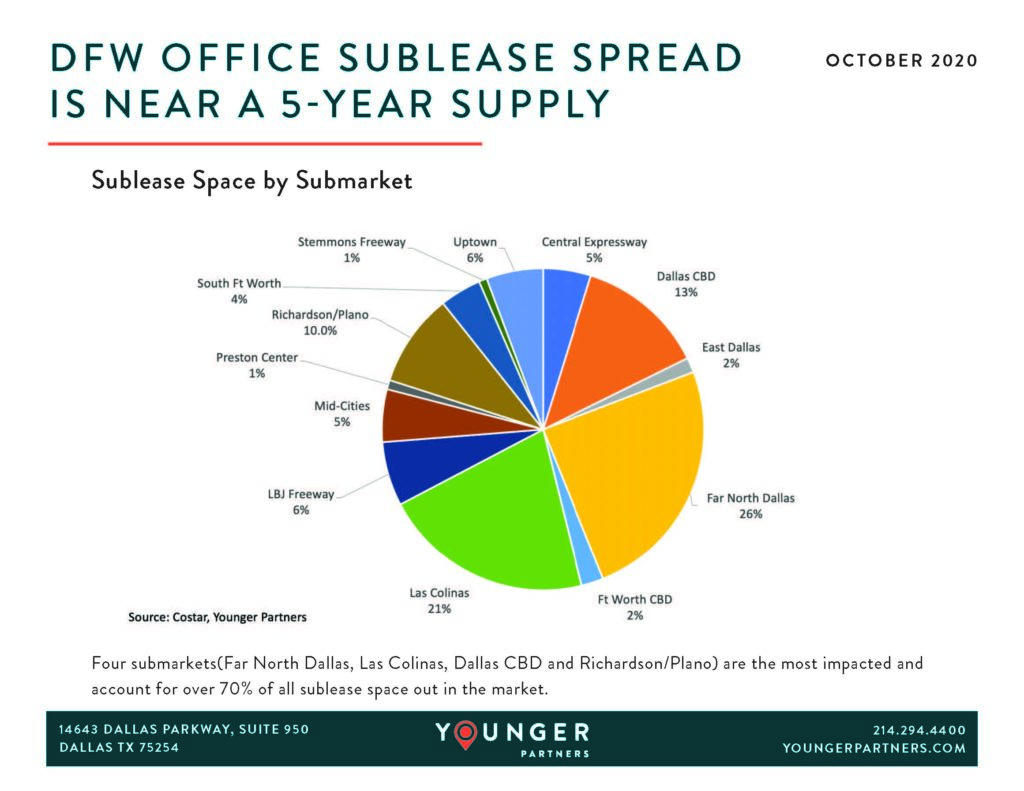

Below you can see these numbers in chart form, along with a pie chart showing the four submarkets that have the highest concentration of sublease space (Far North Dallas, Las Colinas, Dallas CBD and Richardson/Plano).

DFW Office Sublease Space Beginning to Rise Again

By Steve Triolet, Younger Partners Research Director

One indicator of the market’s health is the amount of sublease space available. The DFW office market saw almost 7 million square feet of sublease space in early 2018 (as several tenants opted for new construction). In 2019, sublease declined, but has been on the rise again over the past few quarters as the market has slowed.

Most submarkets have only a little or moderate amount of sublease space. The exceptions being the Dallas CBD, Las Colinas and Richardson/Plano. These three submarkets each have over half a million square feet of sublease space available. For the Dallas CBD, it is over 1 million square feet.

Recent additions to sublease space on the market have mainly been mid-sized to smaller sublease spaces. Some of the larger additions so far this year include, Interstate Hotels, which is trying to sublease 31,596 SF at 125 E John Carpenter, PCI is trying to sublease the top floor (18,371 SF) at 4835 LBJ, and a new 43,162 SF sublease was recently added at Amber Trail Corporate Park.

With the current upheaval in the market, the amount of sublease space is expected to increase over the next few quarters.

YP Research Talks DFW Infrastructure Options

Dallas-Fort Worth is one of the fastest growing metropolitan areas in the U.S. With that comes growing pains, especially in infrastructure. Today’s research features the second and third part of Younger Partners’ exploration of the various infrastructure options and how they will impact the region. Today features Alliance Airport and Intermodals.

Click below to read the full report.

What Does the Future Hold for DFW Infrastructure

Dallas-Fort Worth is one of the fastest growing metropolitan areas in the U.S. With that comes growing pains, especially in infrastructure. In the coming weeks, Younger Partners is exploring the various infrastructure options and how they will impact the region. We’re starting off with two planned light rail projects, the Cotton Belt and the D2 Subway.

Click below to read the full report.

YP Research: DFW Office Sublease Space Trends Down from All-Time High

By Steve Triolet, YP Research Director

In late 2018, the amount of DFW office sublease space reached an all-time at just under 7 million square feet. In early 2019, however, several large sublease transactions have brought that number down significantly where it currently stands at 5.8 million square feet.

This is a good, healthy sign for the market, especially with over 2.2 million square feet of unaccounted for spec office construction scheduled for delivery over the next year and additional new spec sites announced but not yet started.

DFW Construction Boom: What Does it Mean for Big Blocks of Space?

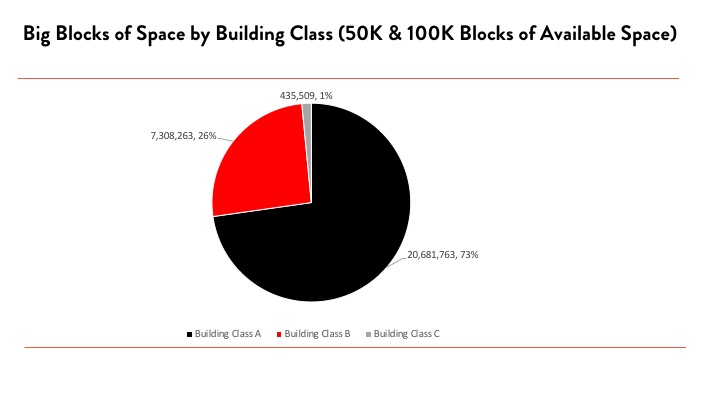

Dallas/Fort Worth is in a construction boom: between 2015 and 2018 almost 23 million square feet of new office inventory was completed with an additional 7.1 million square feet currently underway, says Younger Partners Director of Research Steve Triolet.

All of these numbers are among the highest in the United States for the respective time periods. With a few notable exceptions (Toyota), the vast majority of the tenants taking occupancy of the new space are leaving behind older Class-A space that will need to be backfilled. Class-A space makes up the vast majority of the space available at 20.7 million square feet or 73% of the large blocks of space.

Move Over Co-Working; Financial Industry is the Real Powerhouse

By Steve Triolet, Younger Partners Research Director

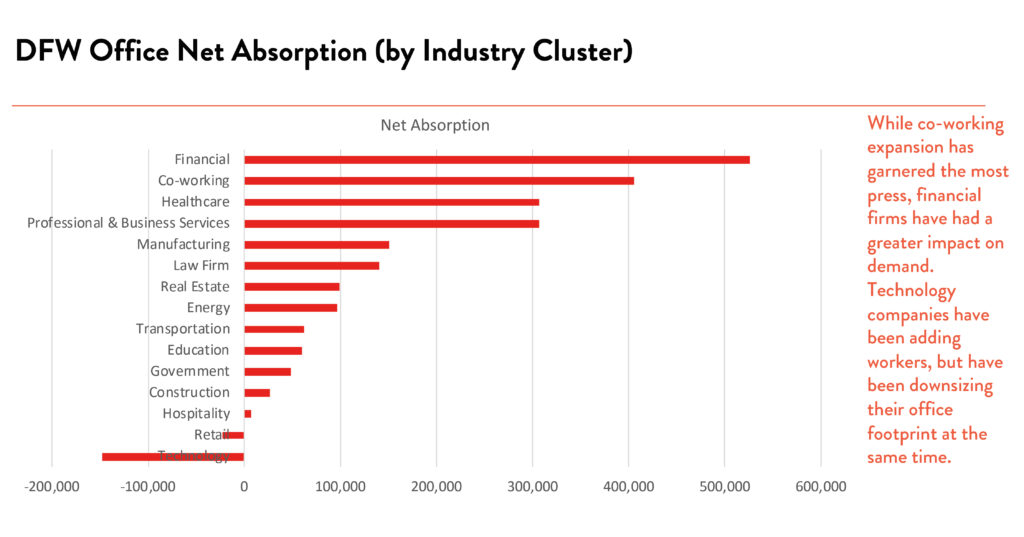

While co-working companies have dominated much of the headlines as far expansion in DFW, the financial industry (which includes insurance companies) have been taking down more office space in 2018. Companies like Allstate Insurance, Mr Cooper (formerly Nationstar Mortgage), New York Life and others have contributed to the majority of positive net absorption over recent quarters. On the opposite end, technology companies been very active as far as leasing activity but have been responsible for overall negative net absorption.

Much like we saw law firms squeezing more attorneys into less space over recent years, a similar trend has been impacting the technology industry, with tech companies downsizing their real estate footprints. NTT Data, Nokia, NetScout and other technology related companies have been moving into newer space and shedding excess square feet in older properties in the process. The attached chart shows the industry clusters and whether in aggregate they have been expanding or contracting in the DFW office market.

What Submarkets Have Changed the Most?

Younger Partners Research Director Steve Triolet took a long look at how much asking rates increased on a submarket level over the past five years (1Q13 vs 1Q18). It probably won’t come as much of surprise that Preston Center and Uptown have seen the biggest increases over that time period, which has in turn pushed rates in Central Expressway (Central often attracts tenants priced out of Uptown and Preston Center), but some of the other submarket trends are a little surprising. LBJ Freeway has seen a good push in rates, but this is partially due to the freeway expansion project wrapping up a couple of years ago.

Meanwhile, the Fort Worth CBD has struggled over the past four years largely due to the energy price collapse that started in mid-2014. While, oil prices have been recovering some in recent months, any rate growth in the Fort Worth CBD in the near term is unlikely as the XTO division of Exxon Mobile is leaving several large blocks of space in Fort Worth this summer and moving 1,200 jobs to Houston.

Meanwhile, the Fort Worth CBD has struggled over the past four years largely due to the energy price collapse that started in mid-2014. While, oil prices have been recovering some in recent months, any rate growth in the Fort Worth CBD in the near term is unlikely as the XTO division of Exxon Mobile is leaving several large blocks of space in Fort Worth this summer and moving 1,200 jobs to Houston.

YP’s Steve Triolet Featured in D CEO’s CRE Opinion

CRE Opinion: Extremes of the Investment Spectrum

The number of office properties being marketed for sale in Dallas-Fort Wort is up, especially in types of commercial properties.

In early 2018, Younger Partners noticed a surge in office properties that have been marketed for sale, far above the norm we’ve seen over the past several years. Part of this increase in properties for sale is certainly tied to interest rates and the anticipated movement in cap rates that are expected to follow. In early 2018, there was more than 11 million square feet of office properties being marketed for sale. Since then, the number and square feet of office properties available for sale has steadily increased and now is more than 17 million square feet.

The thing is, the most active parts of the office investment market in DFW seem to be at either end of the risk spectrum, with large built-to-suit investments like State Farm’s Richardson campus that sold in late 2016 as a sale-lease back for $400 per square foot. Institutional investors prefer core, Class A properties and the large built-to-suits are generally very low risk. In fact, most are single tenant assets with 10 to 15-year leases. Some of the current inventory is similar to this, like AT&T’s Whitacre Tower, in the Dallas core, which is currently for sale.

The other end of the spectrum are the high vacancy properties, which are commonly referred to as value-add. These vacated properties (which, in many cases, are the old locations for new built-to-suit projects) can be an attractive investment for investors with a higher appetite for risk.

In late 2017, International Plaza I and II were vacated by JPMorgan Chase and Fannie Mae (both tenants moved into new built-to-suit properties in the Legacy area) and the two properties were then sold in early 2018 for $152 per square foot. These two adjacent properties are currently one of the largest contiguous blocks of Class A space in DFW. Sometimes the vacated properties go through distressed sales, where the banks take back possession or they sale at foreclosure auction. The former Zale Corp. property at 901 Walnut Hill Lane in Irving went through foreclosure in October 2017.

Outside of the extremes, there are more investment grade office options currently available in DFW than we’ve seen in well over a decade. With so much inventory available, sales transaction volume will either be delayed due to lack of buyers, or a record number of office properties will trade hands in 2018. Currently the market is already on pace to surpass 2016, which was the highest year this business cycle.

Steve Triolet is the research director at Younger Partners.

You can see the article here.

Younger Partners in Bisnow: 3 Impacts All This New Office Supply Is Having On Fundamentals

By Catie Dixon, Bisnow

DFW loves new.

Younger Partners Research Director Steve Triolet delved into the impact of Dallas’ huge office pipeline on the market and found that deliveries — 20.1M SF of Class-A and 3.8M SF of Class-B office has come online since 2013 — are shaping the city in a few ways.

1) Rent Explosion

The delta between Class-A and Class-B office rents is widening as new supply sets new bars for pricing. Historically, there was a $4 to $5 gap per square foot between what tenants paid for a top-tier building and a Class-B one, but that has been increasing over the past five years, Triolet said. The delta is now $8/SF.

2) New-Build Is Low-Risk, But Could Hurt Everyone Else

The best performing submarkets are typically the ones with the newest buildings, and those properties are almost guaranteed to do well. “Even in an overbuilding situation, it’s rare for the newest buildings to go into distress,” Triolet said. “The properties that struggle the most at almost any point in the business cycle are the older, outdated properties.” Even with a growing discount on pricing, these properties are more often struggling to attract tenants.

3) Time On Market Is Shrinking, Which Is Unexpected

The overall vacancy rate in DFW office has been rising for three years. Typically, the average time to lease space is directly correlated to vacancy — as competition increases, so does the amount of time it takes to fill a building. Not this time.

The average time on market has been trending downward for the past five years and particularly the last three. Basically, tenants are quickly jumping on new space, and there has been more new space to jump to recently. DFW has been absorbing a strong 5M SF per year for about five years, making it one of the most active leasing markets in the U.S.

No surprise: Time on market is much longer for older properties than new or newly renovated ones.

“The underlining message is old, unimproved space tends to languish on the market, while there continues to be a healthy appetite for higher-quality space, especially new and improved office space,” Triolet said.

CoStar Article Features Younger Partners Research, Leadership

CoStar article by Candace Carlisle

New Office Buildings Delivering Low Vacancy Rates in Dallas-Fort Worth: The Areas With the Lowest Vacancies Also have the Newest Office Options

Developers putting new office buildings on the ground in Dallas-Fort Worth are also helping boost occupancy rates in key neighborhoods as tenants flock to the younger generation properties.

It’s no accident some of North Texas’ submarkets with the lowest vacancy rates, including Far North Dallas, Uptown, Richardson and Las Colinas, have all delivered buildings in this real estate cycle, said Steve Triolet, research director for Dallas-based Younger Partners. “Tenants really prefer new product over old product,” Triolet told Costar News. “If you look at the 1980s vintage of buildings from the heyday of construction in Dallas, most of those skyscrapers are 35 years old and, to stay competitive, they have to renovate.”

Those skyscrapers in downtown Dallas, including Trammell Crow Center, Bank of America Plaza, Fountain Place, Ross Tower and Chase Tower, have all recently undergone or are undergoing massive multimillion-dollar upgrades. The facelifts help those buildings compete with new buildings coming to the market, including PwC Tower and The Union.

That is exactly what happened in the case of downtown law firm Vinson & Elkins, which had originally planned to relocate its Dallas office to The Union. But construction delays led to the law firm staying put at Trammell Crow Center after the downtown skyscraper unveiled a massive renovation and adjacent development to compliment the high-rise office building.

And the suburbs around Dallas are also following suit, with Far North Dallas in Plano’s Legacy Business Park and northward on the Dallas North Tollway to Frisco boasting one of the region’s submarkets with the most construction — and one of the lowest vacancy rates of 15 percent, said Triolet, who has been studying the tenant movement in North Texas for the last decade.

“We are seeing the vacancy rates get chronically larger when it comes to older buildings,” he added.

Older, build-to-suit are often the most difficult to fill, Triolet said, with few companies seeking to lease or buy the aging office stock designed specifically for an early 1980s business.

This is a trend longtime Dallas leader Moody Younger has seen for some time.

“The new office buildings are not for everyone, but Dallas does like bright, shiny new stuff more so than older buildings,” Younger told CoStar News. “In Dallas, we are also still able to provide new buildings at a reasonable cost.”

For tenants seeking new digs, Younger said they want a combination of amenities in a new building coupled with the walkable location coming with new buildings being delivered today in North Texas.

“Well-located properties with amenities are leasing up and I don’t see that trend stopping,” he said. “This is what is hot right now and it’s here to stay for the foreseeable future.”

http://product.costar.com/home/news/shared/192928

DBJ Amazon HQ2 Article Features YP Research Director Steve Triolet

Halo or horns? The impact of Amazon’s HQ2 hunt on other major relocations

By Bill Hethcock, Dallas Business Journal

Two schools of thought prevail on the impact of Amazon’s second headquarters search on other major corporate relocations and expansions scouting Dallas-Fort Worth and the rest of the United States.

One school posits that Dallas and many of the other 19 metro areas still in the running for Amazon’s HQ2 are experiencing a “halo effect,” or an attraction from other businesses due to the hype surrounding the Seattle e-commerce juggernaut’s interest. If a city is good enough for Amazon’s consideration, this line of reasoning goes, it’s good enough for ours.

The other school counters that companies considering HQ2 finalist cities are hitting the slow-mo or pause button on their own searches until after Amazon names its final HQ2 resting place. Cities on Amazon’s list have the equivalent of devil’s horns that scare away companies worried that the 50,000-job project will soak up available IT talent, drive up salaries and cause housing costs to soar to levels their own employees couldn’t afford.

King White, CEO of Dallas-based Site Selection Group, falls in the second camp.

With the economy going strong, site selection activity has been strong across the U.S. for high-end corporate campus projects, White said. In addition to Amazon, some of the names on the list include Apple, Snapchat, JPMorgan Chase, Google, Infosys, State Farm, Liberty Mutual and more.

The quest for more labor is the top factor behind most of the largest site selection searches, White said. Most companies have gotten so big at their headquarters location that they are tapping out their existing labor markets, he said.

Apple and Amazon, for example, are both searching for new labor markets after outgrowing their headquarters labor markets. When leaving high cost labor markets like San Francisco and Seattle, these companies often can reduce their labor costs by 20 to 30 percent, White said.

“The impact of these mega-deals on your site selection decisions is critical,” White wrote in a recent blog to his company’s clients. “Most of these projects are branded employers paying premium wages, so they can be an employer of choice. Just think of the impact of Amazon landing in your city as they ramp up to 50,000 employees. Your employee attrition and labor cost for quality talent are going to skyrocket.”

A spokesman for the Dallas Regional Chamber, which coordinated the DFW market’s combined pitch for HQ2, said chamber executives haven’t noticed an increase or decrease in interest in DFW since being placed on Amazon’s list.

“The ‘halo’ the DFW Region enjoys comes from the fact that this market continues to be one of the most dynamic economies in the country and a homing beacon for companies and jobs,” the chamber’s Darren Grubb wrote in response to questions from the Dallas Business Journal. “Since 2010, more than 125 companies have relocated here, hundreds of other local businesses have grown and expanded, and more than 100,000 new jobs are created every year.”

Steve Triolet, research director for Dallas-based commercial real estate firm Younger Partners, said the company hasn’t seen evidence of a halo or horns effect in regard to relocations to North Texas.

With few exceptions, DFW is considered for almost all national corporate relocation searches because of the lack of a corporate income tax, affordable office rents, relatively affordable residential housing, lack of a personal state income tax and other factors, Triolet said.

”The biggest concern has been in regard to potential labor shortages, but this generally is only impactful on certain job roles — usually on either extreme end of the pay spectrum,” he said.

Those include low-paying jobs like call centers, or jobs where advanced scientific or Ph.Ds are required, Triolet said.

“DFW has a large enough labor pool to accommodate most industries and companies, and migration data points to DFW being able to attract whatever talent shortfalls that might emerge,” he said. “People will move for good jobs.”

Amazon sent a letter this month to Dallas and the other 19 finalists to say it’s still weighing its decision. Grubb said the chamber received the letter. He said Amazon has not provided a timetable for its decision other than to say it will announce the winner sometime in 2018.

Younger Partners’ Moody Younger & Steve Triolet Featured in Dallas Morning News Article

Businesses are paying a bigger tab for the newest D-FW office digs

By Steve Brown

North Texas businesses are paying a lot more for the newest office digs.

With the recent building boom, costs for the newest, first-class buildings are at an all-time high.

And the gap between what companies are paying for the top-of-the-market space is growing compared to older, so-called Class B buildings, a new study by real estate company Younger Partners found.

“The spread is definitely getting wider,” Younger Partners’ Steve Triolet said. “Office rental rates are at an all-time peak – well above where we were in the ’90s and the 2000s.

Historically the difference in average asking office rents between Class A and Class B buildings in D-FW runs just over $5 per square foot. Currently, the difference is more than $8 per square foot, Triolet said.

That shouldn’t come as a surprise with most of the newer buildings quoting rents in the $30s and $40s per square foot. Average asking rents for all types of buildings are more than $25 per square foot.

Tenants who don’t want to pay the extra rate for the shiniest new offices are finding more options.

“We are seeing an increase in Class B space availability because you have had a lot of new construction and that has pulled tenants to new buildings,” Triolet said.

While the rate of office rent growth is slowing in North Texas, Younger Partners’ founder Moody Younger said he’s not seeing a lot of giveaways yet to attract tenants.

“If there are some concessions creeping back in, it’s building specific,” Younger said. “But I do think that concessions are something to be aware of.

“Where we are seeing concession increases is in the tenant improvement packages which are continuing to escalate.”

Rather than give free rent, some new building owners are sweetening the deal with fancier interiors for their new tenants.

Younger Partners Research Featured in D Magazine Article

Number of Offices Marketed for Sale Up in 2018

There’s an additional 3 million square feet of office product up for grabs compared to this time in 2017, which is the highest in five years.

By Julia Bunch, D Magazine

Office properties being marketed for sale are up compared to this time last year, and roughly 10 percent higher than North Texas has seen at any point over the last five years.

“Currently, there are almost 600 office properties in Dallas-Fort Worth being marketed for sale, which total 11,063,686 square feet. This is much higher than [this time in] 2017 when 473 properties were listed for sale for a total of 8,232,695 square feet,” Younger Partners Research Director Steve Triolet says. “When you’re talking about 600 properties, there’s a 1 or 2 percent change everyday, but the main thing to consider is that there’s 3 million square feet of additional product above what was on the market last year.”

Not only is that 11 million square feet above the five-year average, but you’d have to go back to 2010 to see more than 10 million square feet being marketed for sale at any given point in time. So, why is this happening?

For one thing, Triolet says investors have a big appetite—and not just for large, well-occupied buildings in hot submarkets, such as AT&T’s Whitacre Tower, which went up for sale earlier this month. “We’re seeing appetite for buildings that have higher vacancy, and a value-add component. As the market heats up, people are willing to take more risk,” Triolet says.

Several buildings with above-average vacancy have traded in the last few quarters, such as 901 W. Walnut Hill Ln. in late 2017, International Plaza I & II (formerly occupied by JPMorgan Chase and Fannie Mae) in April 2018, Cottonwood Office Centre (formerly occupied by Liberty Mutual) sold in April 2017. Younger Partners is currently marketing 2100 Tower at 2100 Valley View Lane (pictured) in Farmers Branch for sale, which has an occupancy of 65 percent.

Plus, as Marcus & Millichap First Vice President and District Manager Tim Speck says, it’s a seller’s market. “Absorption of office space has been very good, and that has resulted in a pretty good increase in rent. We’ve seen rents go up 25 percent. If you have rents going up 25 percent in five years, and we’ve seen the price per square foot for transactions go up more than that—a little over 30 percent. So owners who have owned for a long time, they have ability to get out now and make money.”

It also serves to keep in mind that of all the offices being marketed for sale, many will not end up trading, Speck says. “Yes, you have more people looking at taking something to the market, but a lot of that is just people kicking the tires. I don’t think the number of transactions will be up [for example] 25 percent this year. … Because of the favorable market, many owners are hoping to get a certain number.”

A building Marcus & Millichap just closed, Danari Office Park in Richardson, is a good example. The undisclosed California owner sold to an undisclosed local investor, who plans to update the 11,000-square-foot office to increase occupancy. “As a marketplace, we for sure wouldn’t have traded close to the number we ended up selling for. The owner wasn’t thinking they would necessarily get out. Without investor activity and interest, historically that property wouldn’t have traded.”

Marcus & Millichap, which tracks office sales greater than $1 million, has seen around 300 trades per year in the recent past. Speck expects office sales greater than $1 million to be up around the 330 or 340 in 2018.