Author: Younger Partners

Record Demand for Land in North Texas

The DFW market still expects to absorb an additional expansion of more than 20,000 acres over the next 15 to 20 years, according to Younger Partners’ Robert Grunnah.

By Robert Grunnah | January 27, 2022 | 9:00 am

As 2021 has now come to a very fascinating and positive end, the North Central Texas land market has experienced significant influences modifying its prior accelerating four years of sales and absorption activity. To some surprise, the effects of COVID-19, an unstable political environment, rising inflation in Federal denial, Federal taxes, CRE threats, and significant increases in construction costs have not had a serious impact on land pricing and activity. Additionally, a profound market disruption in retail, entertainment, and hospitality has had an even lesser impact. In reviewing last year’s report, only a few observations have changed to any great degree.

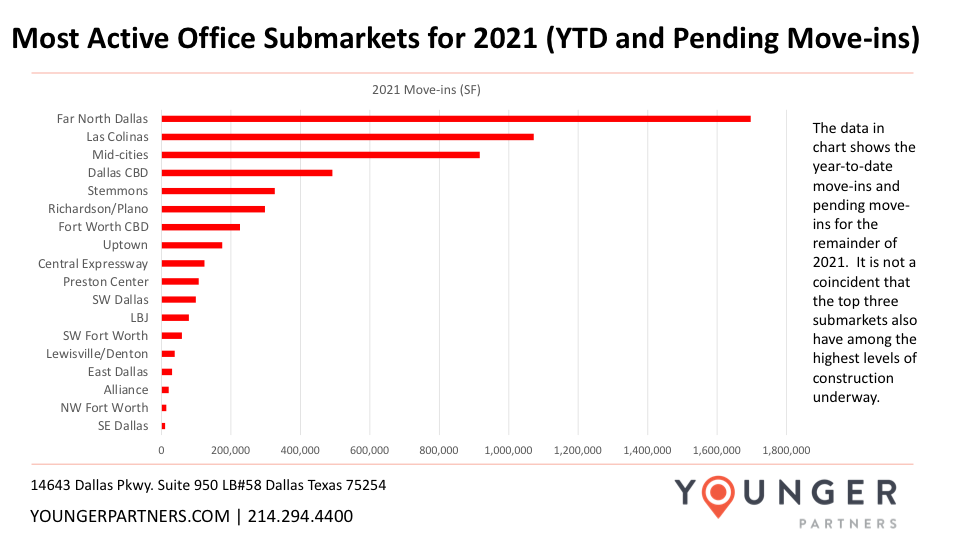

Most Active Office Submarkets for 2021 (YTD and Pending Move-ins)

Far North Dallas and Las Colinas are the two most active submarkets. They both have high levels of construction (both recently completed and projects currently underway). For Far North Dallas, JPMorgan Chase has a phase 2 built-to-suit and along with other construction projects in the Legacy area (Keurig Dr Pepper, Reata Pharmaceuticals) and various spec projects. Las Colinas has Cypress Waters, which continues to deliver multiple properties per year. Mid-Cities has emerged over the past couple of years as a very active submarket due almost exclusively to large built-to-suits like the American Airlines Headquarters that was completed in late 2019 or the multiple phases of Charles Schwab built-to-suits.

Submarket outliers to watch in the future include Uptown and Preston Center (with 1 million and 700K SF, currently underway, respectively). These two smaller, more expensive submarkets have high levels of construction underway, but leasing activity and pending move-ins has not been keeping pace.

Why so many corporate relocations are coming to North Texas

By CeCe Grosz, Marketing Intern

It’s no secret that the Dallas/Fort Worth metroplex boasts a business-friendly tax climate, talented workforce, and profitable market for many industries. But why exactly are we seeing so many businesses relocate to North Texas recently?

Adriana Cruz, executive director of Economic Development and Tourism for the Governor’s office, was recently quoted as saying that Texas has seen “a tremendous increase in the number of prospects and projects we have in very diverse industries” since the pandemic started.

Cruz credited the increased relocations to Texas to a “timely shutdown of the state economy when the pandemic struck and to a careful and methodical, data- and doctor-driven reopening of businesses” (Biz Journals).

Many of the relocations are coming from one place in particular: California. From the beginning of January 2021 to the end of June 2021, the state of California lost 53 headquarters to other locations across the country. Almost half (23) of those relocations moved to the Lone Star State. Since 2018, 107 California headquarters have moved to Texas, five times more than the closest competitor – Tennessee drew 22 CA relocations.

The last five Fortune 500 companies to relocate their headquarters to DFW have all come from California within the last six years. These include CBRE Group, engineering firm Jacobs, health care company McKesson Corp., convenience store supplier Core-Mark International, and financial services company Charles Schwab.

A notable recent relocation is First Foundation, a California financial services company which is now headquartered in the Crescent (Uptown Dallas). The company’s CEO, Scott Kavanaugh, says that “a lot of the move had to do with politically some of the things that are affecting many companies in California… It led to us thinking about where would we geographically want to be, and when you look at the landscape, in my mind, the clear winners are Florida and Texas.”

As of July 2021, the Dallas Regional Chamber is tracking 109 new projects in the city, including corporate office relocations as well as headquarters relocations.

A huge factor in relocations to DFW and Texas as a whole is the affordable cost of housing. The median cost of a house in Texas is only $195k, which is $36k cheaper than the national average. An explanation for all of the California companies relocating here is that the median cost of a California house is $552,800, a huge deviation from the national average. Corporate employees will have a much less burdensome cost of housing if they move to Texas.

The additional reasoning for all of these relocations generally remains consistent across many industries: the pro-business climate and lack of corporate or personal income tax, the central location, the proximity of DFW International Airport, the state’s large talent pool and the quality of life that Texas offers.

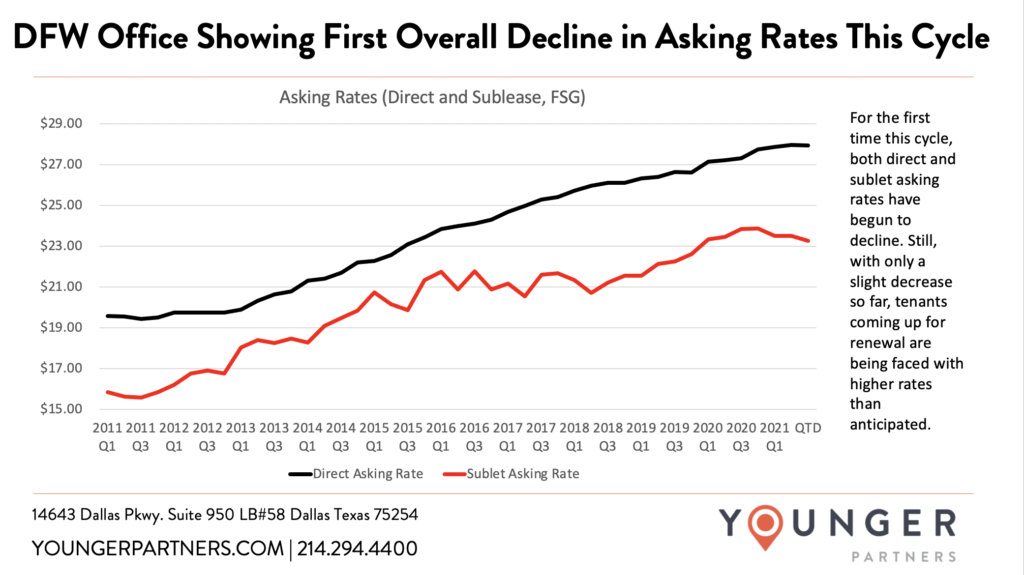

DFW Office Rates Showing First Overall Decline in Asking Rates This Cycle

Asking rates are a lagging indicator to the market fundamentals. After a market downturn, asking rates are not typically significantly impacted until 4 to 6 quarters after the market has shifted. The decline in both direct and sublet asking rates since the end of the second quarter of 2021 should not be surprising as it falls into the typical time range. This decrease in rates, however, has only been slight to date, with overall averages still up on a year-over-year basis.

Specific properties that have reduced their rates since the end of the second quarter include International Plaza II, The Palace Office Center, Westpark Plaza and the Lakes at Bent Tree.

Top Office Design Trends for 2021

By CeCe Grosz, Marketing Intern

Many companies in the Dallas-Fort Worth Metroplex are enjoying the normalcy of returning to the office, with employees once again able to chat by the coffee machine or mingle in the break room. However, some aspects of office design will continue to adapt to the post-pandemic state of the world, and likely won’t return to how they were before. These new office design trends will incorporate new technology and practices into the work environment to improve employee wellness boost employee morale, promote collaboration and corporate culture. Here are the top office design trends we are noticing for 2021:

Hybrid Office

COVID-19 prompted most companies to have their employees work fully from home for several weeks or months. This rapid change in the work environment resulted in employees realizing that they could be productive outside of the office, while being in closer proximity to family and the comfort of their homes. While most employees have already returned to the office, many expect to maintain some remote work, even for one or two days a week: according to Fortune, 63% of high-growth companies are embracing a hybrid work model. Companies can adjust to that by requiring less office space and having employees come into the office in shifts.

Employers are adjusting their office design to feel more “homey” and reduce the stark contrast between working at home versus the office. This includes natural lighting, relaxing spaces around the office for rest or social interaction, as well as incorporating more artwork into the environment.

Increased Sanitization Practices

A trend that has manifested itself throughout the past year is the importance of employees feeling safe when coming to work. Office spaces now feature hand sanitizing stations, increased cleaning of surfaces and touchpoints such as elevator buttons, and the addition of handwashing sinks in kitchen/break room areas.

Kitchen area at Republic Center.

Hot Desks

A new phenomenon for most offices is unassigned seating for employees, also known as “hot desks.” While previously thought that Coronavirus particles were transmitted heavily through shared surfaces, now that we know transmission mainly happens through the air which means unassigned seating could have many benefits for your office.

Research from the University of Arizona found the average office desk to be covered in 400 times the number of bacteria that a toilet seat has. This unsettling finding is the result of office cleaning crews being told not to touch employees’ desks and personal areas. If offices forgo assigning desks and have employees reserve their space before work, the desks can be sanitized after hours to promote a much cleaner workspace.

Biophilic Design

This concept, which aims to incorporate living plants into the corporate office, is taking off in 2021. Biophilic design is inspired by the visual connection between humans and nature. Bringing the outdoors inside boosts the overall quality of life for employees, as well as improving air quality of the office. Companies should consider investing in a “living wall” or adding more plants around the office to improve the health and happiness of their employees. Offices that incorporate plants see increased productivity, improved oxygen flow, and reduced toxins in the air.

Air Quality

In addition to biophilic design, companies have many options to choose from to promote improved air quality around the office. Since COVID-19 began, many offices are updating HVAC systems to enhance the circulation and filtration of air throughout the space.

According to Younger Partners’ Roy Smith, we should be on the lookout for updating HVAC systems to a rating of MERV13. The MERV rating scale stands for Minimum Efficiency Reporting Value and measures the efficiency of the air filter based on what particles it can filter out. “The higher the number, the higher the efficiency of filtration,” says Smith.

While the highest ratings of 16-20 are used mostly in hospitals or nuclear power plants, many offices are upgrading their filtration systems to MERV 13. This rating means that pollen, dust, dust mites, mold, bacteria, pet dander, cooking oil smoke, smoke, smog, AND virus carriers are all filtered out of the air. This would be an excellent investment for the health and safety of your workplace.

When new office spaces are built, companies should seek smart materials that resist mold and have antimicrobial properties, such as copper. The use of these materials will promote better air quality for employees.

Play Ball! Younger Partners Family Day with the Texas Rangers

After skipping a year, the Younger Partners annual Family Day event returned even bigger than before with four homeruns, more $1 hot dogs than we can count, a Rangers win and lots of camaraderie.

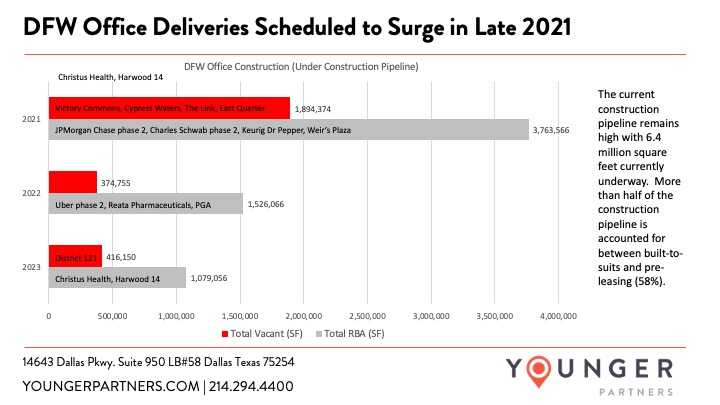

DFW Office Deliveries may be high in late 2021, but taper notably in 2022-23

By Steve Triolet, Younger Partners Research Director

Recently, we looked at current leasing volume trends in comparison to the historic norm. I thought it might be helpful to take a look at the construction delivery pipeline and what it likely indicates for the future market fundamentals for the DFW office market. The construction pipeline remains elevated at 6.4 million square feet. The majority of this construction was started in 2019 and is scheduled for delivery in the second half of 2021. While more than half of the construction pipeline is accounted for between pre-leasing and built-to-suits (58%), there is still almost 2 million square feet of vacant space scheduled for completion before the end of this year. This surge of new vacant construction in 2021 has the potential to move the total vacancy rate up roughly 40 basis points (preliminary numbers show the second quarter total vacancy rate will be 20%).

For 2022, the amount of new vacant space is less than 400,000 square feet, but it is worth noting that the dynamics of Uber at the Epic. The Epic Phase 1 was built in 2019, but most of the project is currently largely available for sublease (115,995 square feet of Uber space), direct space (68,785 square feet) or via co-working space (42,862 square feet). The Epic Phase 2 is 469,000 square feet and scheduled for delivery in mid-2022. The Uber Air division was supposed to be based in Phase 2 and be the primary pilot program for the company. In December 2020, Uber Air was officially discontinued and the app technology behind the division was sold to Joby Aviation. Given the current uncertainty of Uber and its near term growth, there is a high probability that all or a large portion of phase 2 will be placed on the sublease market (similar to what we have seen with Liberty Mutual). Still, even if the Uber space is placed on the market the amount of new unaccounted for space should be about 800,000 square feet or less.

The tapering of construction is expected to accelerate in 2023, with the majority of the pipeline accounted for by Christus Health (456,000 square feet) and Haynes and Boone (125,789 square feet at Harwood 14).

Note: Data is all currently under construction office properties over 15,000 (excluding medical). The larger projects are listed by name within the chart, with largely vacant projects in the red and the larger built-to-suits and spec projects with significant pre-leasing in the gray columns.

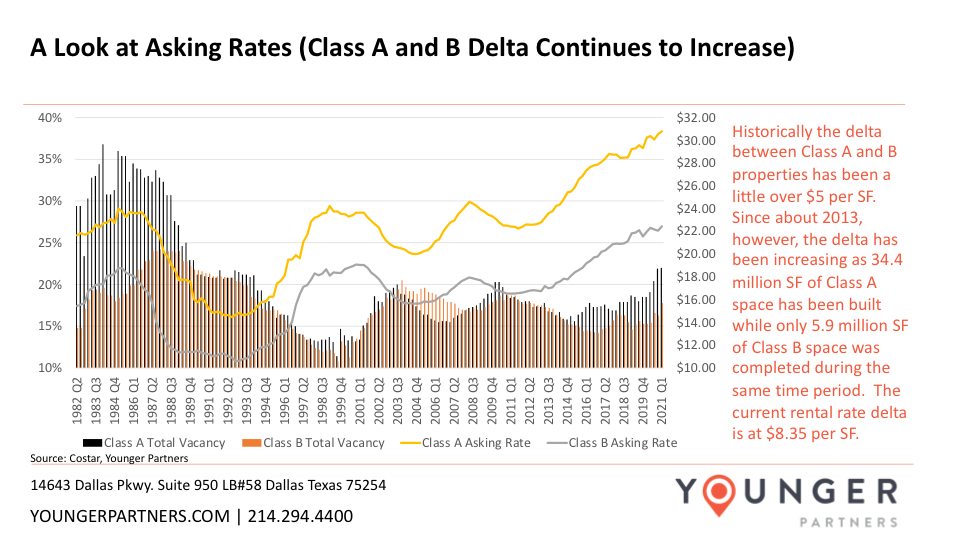

A Look at Office Asking Rates: Class A & B

By Steve Triolet, Younger Partners Research Director

DFW office asking rates, overall, continue to look largely unchanged from one year ago. This is especially true in some of the top office markets like New York City and San Francisco, which have seen double-digit rate declines. Rates are a lagging indicator and previous cycles show that most of the downward movement in rates don’t typically impact the overall average until 12 to 18 months after the economy goes into a recession. So far, effective rates have decreased, mostly in the form of free rent.

One major trend that has taken place over the past year is moderate rate increases for Class-A properties. This is slightly misleading as most of the increases have been driven mainly by the newest construction been delivered to the market. Existing stock, especially in older properties are seeing pressure on rates. Class-B rates have remained flat from an asking rate perspective. With 6.3 million square feet currently underway (95% of which is classified as Class A and quoting an average a $41.95 FSG per sf asking rate), this trend is expected to continue while the construction pipeline remains elevated through 2022.

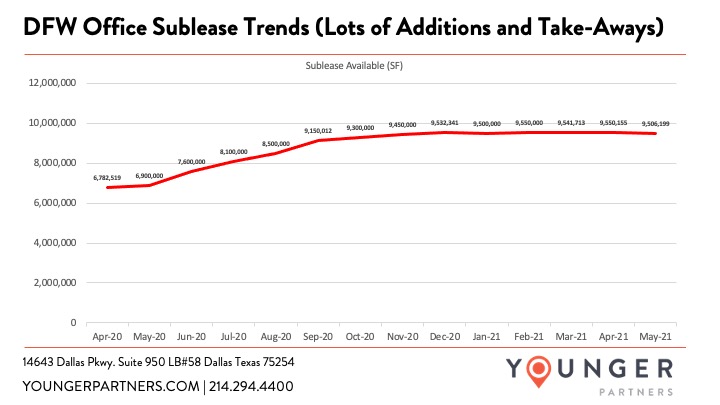

DFW Office Sublease Trends & Takeaways

Over the past seven months, the 9.5 million square feet of sublease office space available across DFW has been largely stagnant. However, there has been an increasing amount of movement over the past two months. We’ve discovered a few primary trends that have been keeping the total flat.

First, there have been short-term subleases with expiring leases rolling over to direct vacant space. Second, some tenants have decided that they want to re-occupy their own space like NTT Data at One Legacy West and PLH Group at Canal Centre. Meanwhile, other tenants continue to put additional sublease space on the market such as Securus Technologies, RealPage, Mitel, PwC and Lockheed Martin.

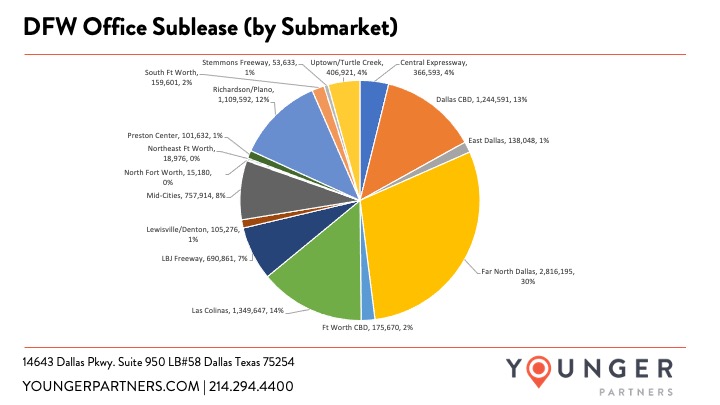

Four submarket account for the vast majority of sublease space available (Far North Dallas, Las Colinas, the Dallas CBD and Richardson/Plano). These four submarkets account for 69% of all sublease space currently available.

DFW Office Usage Update

By Steve Triolet, Younger Partners Research Director

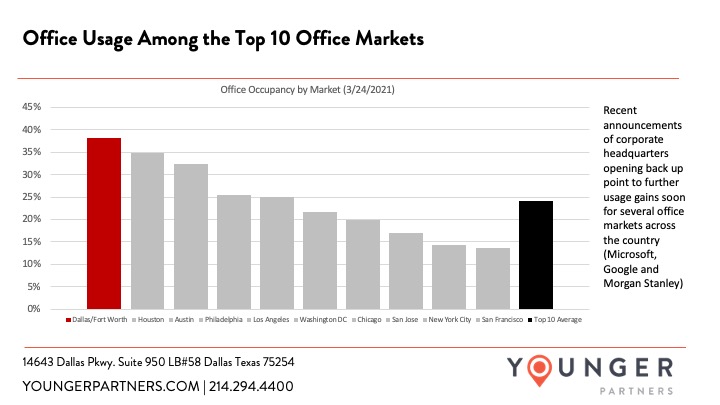

Near the beginning of the year, I shared some info from Kastle Systems on office usage for the top 10 office markets across the country. Back then and now, DFW remains the top market for office usage (office workers being physically back in the office on at least a hybrid model).

To date, the usage numbers have not moved much this year, but several recent announcements (Microsoft, Google, Morgan Stanley, PwC, Fannie Mae, FDIC) all point toward improvement over the next few months, with post-Labor Day being the most common soft return date for several large corporations. This date seems to be the consistence because of the start of a new school year and the end of summer.

A Breakdown of Available Office Space in DFW

By Steve Triolet, Younger Partners Director of Research

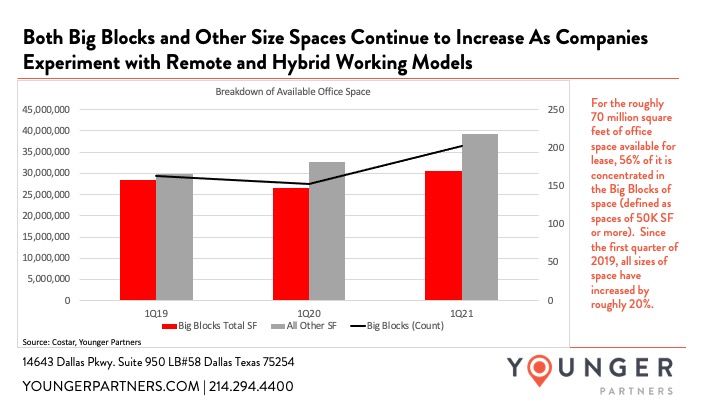

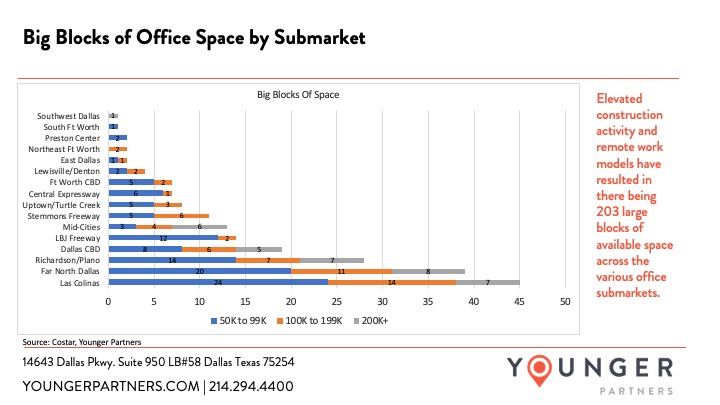

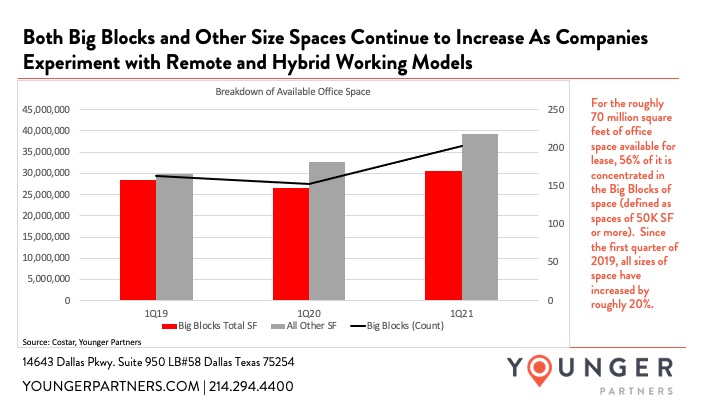

A few times a year I show where the highest concentrations of large blocks of space are. In the second chart below, there is an updated breakdown of the 203 Big Blocks of space currently available by size category and submarket. Outside of that update, I wanted to take a look at the increase in all sizes of space (not just the big blocks of space).

What surprised me most when I analyzed the data is the increase in space was not just in the big blocks of space, but also all size categories. Since the first quarter of 2019, the amount of space being marketed is up 20%. While sublease is a large component of this increase over the past year, sublease space only accounts for roughly 14% of all the available amount of space out in the market.

Younger Partners Spotlight: Trae Anderson

February’s Younger Partners spotlight is our 2020 Top Producer, Trae Anderson. Trae has been with Younger Partners since its inception almost nine years ago and is a Principal with the company. Trae is an avid golfer, history buff, crossword puzzle lover, and a trivia aficionado.

He and his wife of eight years, Rachel, have an almost 2-year-old son, Thomas, and a 10-year-old lab, Finley. The OU alum (and superfan) was also a 2013 recipient of the University of Oklahoma Regents’ Alumni Awards for service to the university. Little known Trae fact: he won the 1989 National Limbo Championship in Chicago. Thank you for all of your contributions to the team!

The Spread Between the Availability Rate and Vacancy Points

By Steve Triolet, Younger Partners Director of Research

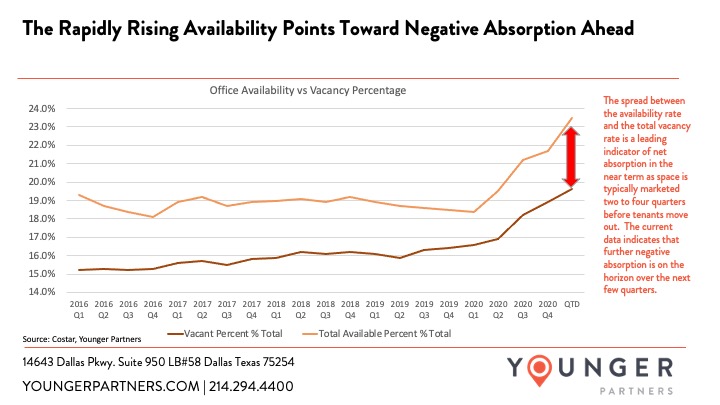

While most numbers like vacancy, net absorption and asking rates that are reported in our quarterly reports give a current pulse on the market fundamentals, there are a few that can be leading indicators of where the market is heading in the quarters ahead. One of those is the availability rate and its relationship with the total vacancy rate. If spread between the availability rate and the vacancy rate is narrowing that means that there is less of pipeline of space coming to the market or as we’ve seen in 2020 and 2021 (to-date) the availability rate for DFW office market has been steadily climbing, outpacing the rising vacancy rate. This indicates negative net absorption ahead, along with softer fundamentals like a higher total vacancy rate.

The rapid rise in the DFW office availability over the past year has been due to a combination of direct and sublease space. While sublease has been gaining more attention in the news, the rise in direct space available (mainly due to new construction) has far outpaced the rise in sublease space. Available sublease space and direct space have increased by roughly 3.5 million and 6 million square feet, respectively over the past year.

YP’s 2020 Top Producers

Congrats to the YP Top Brokers for 2020! Top Producers are Trae Anderson, Sean Dalton, Scot Farber, Jack Gail, Tom Grunnah, David Hinson, Ben McCutchin, John St. Clair and Tom Strohbehn. A new award this year goes to the broker who generated the most revenue by working with other YP brokers. Congrats to Michael Ytem for being our Teammate of the Year. We can’t wait to see what 2021 brings for our great team.

D CEO Selects Nine YP Brokers to 2021 Power Brokers List

Congratulations to the Younger Partners brokers who made D Magazine‘s D CEO 2021 Power Brokers list.

Included in the list for office leasing are Trae Anderson, Kathy Permenter and Sean Dalton. For land and commercial property sales are Scot Farber, Tom Strohbehn, Tom Grunnah, David Hinson, Ben McCutchin and John St. Clair.

See the full list at: https://bit.ly/37PyBKZ

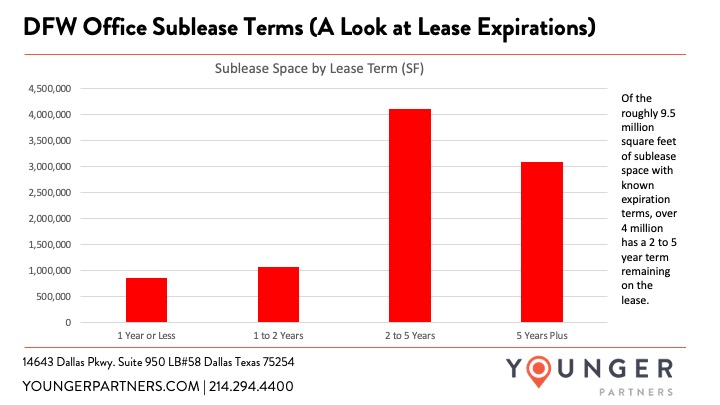

A Look at Office Sublease Terms (How Much Term is Left on the Master Lease)

By Younger Partners Research Director Steve Triolet

With roughly 9.5 million square feet of office sublease space currently available, it’s important to take a look at how long the lease terms are for the various sublease spaces. Traditionally, subleases with 2 years or less of term left are very difficult to lease unless a direct deal is also worked out (due to the high cost of moving into a new space for a short term lease). As of February 2021, roughly 20% of the current subleases being marketed have lease terms of 2 years or less, making them likely to roll to direct vacant space before a sublessor is found.

Among the leases with longer terms (5 years plus), several of these are concentrated in newly constructed office properties (Uber 115,995 SF, Liberty Mutual 357,500 SF, DXC 100,267 SF and HPE 71,296 SF, among others).

Making Your Own Luck in Commercial Real Estate

Playmakers Talk Show Guest for the February 5th edition of PlayMakers Talk Show: Kathy Permenter, Co-Founding Partner, Younger Partners

Subscribe to the PlayMakers Talk Show Podcast

Kathy Permenter serves as co-managing partner and has a proven track record of creating value for her clients. Kathy is responsible for leasing select assignments and the overall performance of the property leasing team. She attributes her real estate success to her CPA background, years of transaction experience, and a passion to exceed her client’s expectations.

Younger Partners is a full-service boutique commercial real estate firm providing investment, leasing, and management services to investors and tenants in the Dallas/Fort Worth region. Since its founding in April 2012, Younger Partners has grown from its two original partners to over 90 employees responsible for eight million square feet of properties in the Dallas/Fort Worth market.

Kathy has a passion for serving clients. She creates a team atmosphere and has tremendous energy that she brings to everything she does. She’s one of the heavy hitters in DFW Commercial Real Estate and has accomplished that with tenacity and grit.

Younger Partners Investments Acquires Grocery-Anchored Shopping Center

Younger Partners Investments (YPI) completed its first retail acquisition: Heath Town Center, a 77,669-square-foot grocery-anchored retail center at FM 549 and Laurence Drive in Heath. YPI is Younger Partners’ newest platform designed to acquire retail properties. YPI was launched in July 2020 to target retail properties from lifestyle to neighborhood centers throughout the Dallas-Fort Worth area.

The newly built shopping center is anchored by a top-performing Tom Thumb grocery store alongside its 12-pump fuel station and in-store Starbucks. The property’s occupancy is 98 percent with one small vacancy of 1,827 rentable square feet. Younger Partners will handle the property management and leasing of the property.

Younger Partners’ Micah Ashford, Moody Younger and Kathy Permenter represented YPI in the acquisition. JLL’s Adam Howells represented the seller, Malouf Interests, Inc. Financing arranged by Adam Mengacci of Hamilton Realty Finance. Terms of the deal were undisclosed.

“This is a great property to launch our new platform,” says Micah Ashford, who leads YPI’s efforts. “This high-performing Tom Thumb provides consistent traffic patterns to the property and serves as an excellent anchor for the shop tenants, who benefit from maximum exposure. This location is incredible as the City of Heath has seen population growth of 40 percent over the last 10 years.”

Demand has increased at the intersection of FM 549 and Laurence Drive, which was recently expanded. The property is also located immediately adjacent to two heavy daytime traffic generators, Rockwall-Heath High School to the north and Amy Park Elementary School to the south, Ashford adds.

“We feel like retail is one of the most disrupted sectors of commercial real estate,” says Younger Partners Co-Founder and YPI Partner Moody Younger. “While we can relate to the tough times COVID-19 has created, we are confident in the resilience of Texas and we are excited to make this investment in the future of retail and our region. We are actively seeking our next acquisition now.”

Younger Partners Co-Founder and YPI Partner Kathy Permenter says the new division has been part of the partners’ long-term strategy. “With the market going through dramatic changes, this is a good time to do it. I started my career in retail, and it continues to interest me. I look forward to investing in this sector,” she says.

YP Spotlight: Elaine XU

YP’s January Spotlight is broker Elaine Xu, who focuses on land, industrial, office buildings and investment properties. The three-year YP veteran appreciates the teamwork and insightful mentors Younger Partners has to offer. She enjoys that every deal is different with much to learn from each one – from strategic thinking to negotiation tactics.

On weekends, she can be found on the tennis court with friends. Her husband and their two sons, a college freshman and a high school sophomore, love to visit national parks (and have visited more than 20 so far). Thank you, Elaine for being a valued member of the Younger Partners team!

Sharing our Blessings with Toys for Tots

This year, YP collected new toys, bicycles, scooters and helmets for children from infants to teens for Toys for Tots. This organization’s primary goal is to bring the joy of the holiday season and send a message of hope to America’s less fortunate children.