Category: News

Younger Partners Closes Four-Acre Deal in Active East Fort Worth Submarket

Site Near Loop 820 & SH 121 Closed Within Three Months of Listing

RICHLAND HILLS, Texas (Sept. 24, 2024) – Younger Partners Senior Vice President Michael Ytem successfully negotiated the sale of a four-acre parcel zoned business park in the active East Fort Worth submarket.

Ytem represented the seller, Bridge Cap Partners, in the 2525 Handley Ederville Rd. transaction. Forrest Cook, a Senior Vice President at Stream Realty Partners, represented the buyer, G-Catch LLC.

The site near Interstate 820 and State Highway 121 once held the 150,000-square-foot Advanced Foam Recycling which was destroyed in a fire in 2021. Following that event, the structure was razed, and the pad scraped, with the seller acquiring it in 2022 as an opportunistic play.

“The location drove interest in the site. It’s at the very edge of where the East Fort Worth submarket ends and the Mid-Cities begins,” Ytem added. “With major thoroughfare access, it’s ideal for servicing both Fort Worth and Dallas.”

The property sold within three months of its listing date.

“The buyer was highly motivated to close on this deal,” Ytem said.

Cook said that the new owner is an established player in the DFW market, with plans to build flex and retail buildings on the acreage.

“East Fort Worth continues to be a highly sought-after industrial market due to high barriers to entry coupled with excellent labor and connectivity with the Dallas-Fort Worth Metroplex,” he added.

Ytem explained that the seller is a long-term client of Younger Partners Managing Principals Trae Anderson and Sean Dalton.

“It was a true privilege working for Sean and Trae’s client as the designated land expert.” Ytem said, adding that the transaction sailed through with few obstacles. “Forrest Cook was easy to work with on this transaction.”

Ytem, along with Younger Partners Executive Managing Director John St. Clair, recently listed Bell County 707 Ranch in the fast-growing Central Texas city of Temple to the market for immediate sale. The 707-acre ranch at West Adams Avenue and Texas 317, two of Temple’s main arteries, just minutes from Interstate 35 has a starting list price of $40 million. On-site amenities include an operational horse ranch, a working stone quarry and several natural springs. Also included is a 4,000-square-foot, 19th-century house built from stones sourced from the land and remodeled in 2015.

McCutchin Family is a Tangible Reminder of North Texas Land Development

Ben McCutchin reminisces about Pilot Knob and his family’s land legacy

Sitting at Interstate 35W and Robson Ranch Road lies Pilot Knob, a North Texas landmark southwest of Denton. The 900-foot-high natural rock protrusion provides a breathtaking 360-degree view of North Texas. Once the highest point in Denton County, the closer someone gets to the top, the slower they must walk because of the uneven terrain. Before the McCutchin family took over, infamous outlaw Sam Bass used this site as a hideout because of its cave-like structure. Today, Hillwood Communities plans to incorporate the knob and transform its surrounding areas for a combination of residential and mixed-use development projects.

How did Pilot Knob go from a hideout to an iconic landmark in North Texas? The McCutchin family might have something to do with that. Long before Younger Partners Executive Vice President Ben McCutchin was immersed in the world of real estate, his dad, Alex, started off drilling wells in the oil business, which piqued the family’s interest in land development. After Alex passed away, Ben’s mom, Alma, continued to invest in North Texas real estate. She possessed the foresight and vision to know that North Texas held the growth opportunities to become a major metroplex one day. Eventually, Ben caught on to the family’s passion for real estate and got involved in shaping North Texas to be what it is today.

Pilot Knob was owned by the McCutchin family until they sold it to Ross Perot in 1987. Ben recalls that this land was a hot commodity with numerous entities interested in the land in addition to Perot. In the middle of finalizing the deal, Texas was going through the Savings and Loan (S&L) crisis that caused the financial collapse in the late 1980s affecting the banking industry throughout the United States. Caused by several factors ranging from speculative lending, fixed-rate loans and interest rate hikes. The chaotic experience of selling this land amid turmoil taught Ben about the highs and lows of owning land. There is a certain tenacity and resilience that he developed while owning this land during that difficult time.

Recently, North Texas developer Hillwood (founded by Perot in 1988) finalized plans to develop the property. Because of Pilot Knob’s rich history, they plan to preserve the knob within the planned residential communities. Pilot Knob and the post oak trees will be incorporated into a trail system with recreation areas and parks. The 360-degree view that Ben mentioned is here to stay. In addition to Hillwood, a portion of the land was sold several years ago to single-family land developer, Zena Development, which is in its last phase of successful build-out. What was once an endless sprawl of cattle grazing land is now going to be a major hub for Denton County homeowners.

When thinking about the legacy of his family in the North Texas area, the main sentiment that Ben expresses is immense gratitude. His family’s legacy is a tangible reminder of the evolution of North Texas land development. He is thankful to have grown up in Dallas and acknowledges how good the city has been to him and his family. As far as working in real estate, Ben says he never wants to retire because this industry has given him a purpose and something that he loves all in one.

The cliché saying that “love what you do, and you will never work a day in your life,” rings true for Ben McCutchin. As for the future of North Texas land development: it won’t slow down, he says. “I can see development going all the way up to the state line bordering Oklahoma,” he predicts. In the future, keep your eyes on the lookout for the next development in North Texas. The McCutchins just might have something to do with it.

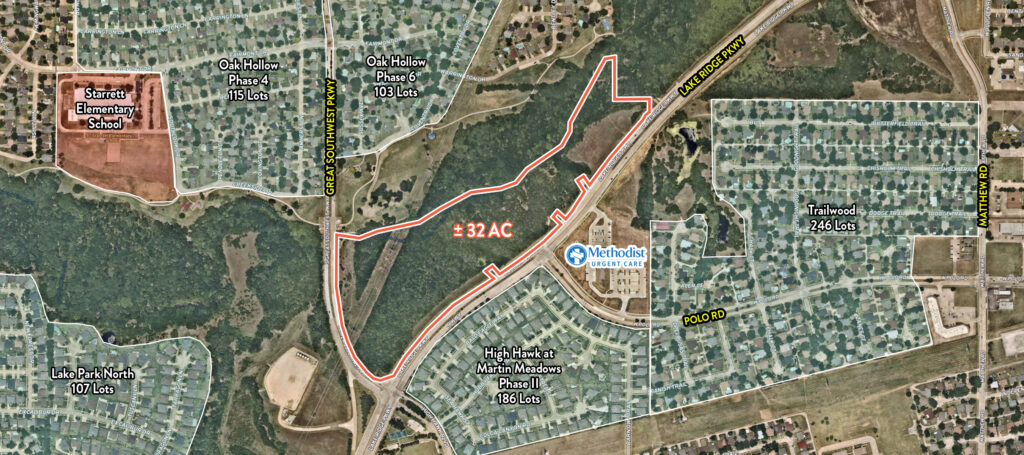

Younger Partners Brokers 32-Acre Sale to Multifamily Giant JPI

GRAND PRAIRIE, Texas (Aug. 14, 2024) – Younger Partners Executive Managing Director John St. Clair and Associate Davis Willoughby brokered the sale of 31.8 acres at the northwest corner of Lake Ridge Parkway and Great Southwest Parkway in Grand Prairie, Texas, to JPI, a leader in the development of best-in-class multifamily communities.

St. Clair and Willoughby represented the undisclosed seller, the property’s longtime owner. The transaction was a direct deal with JPI.

“This tract has been overlooked for years because of its topography and the city’s floodplain challenges, but JPI saw the potential to make those issues an asset,” St. Clair said. “This is an amazing acquisition for JPI and a wonderful addition to the city of Grand Prairie’s multifamily offerings.”

Like most North Texas cities, there is demand for housing units, particularly multifamily, throughout Grand Prairie. “Infill multifamily sites are highly coveted, and it is difficult to find them in the right location with the appropriate zoning,” Willoughby said. “When these parcels are found, they have great value. This site was a rare gem for JPI as it was already zoned for multifamily usage.”

Occupancy for all multifamily units across DFW hovers around 92%, according to Q2 data. The city also has some of the region’s largest employers with Lockheed Martin, Grand Prairie ISD and Poly-America Inc. leading the way, according to the City of Grand Prairie.

“City leadership recognizes the need for these kinds of projects,” Willoughby said. “The city’s planned development provision for this property was written in the 1980s, which required some discussion to ensure the multifamily stipulated within the zoning complies with the city’s multifamily standards of today. It was a unique situation to have the purchaser, seller and city working together to bring the project to fruition.”

Additionally, because about half of the land is located in the flood plain, it inspired some out-of-the-box thinking for JPI in considering this site, St. Clair added. “On the positive side, the flood plain creates a site featuring natural, wooded views which JPI can take advantage of to create an amenity for the residents,” he said.

“It is a testament to JPI to select this parcel for a project,” St. Clair said. “JPI has a quality team. The combination of a long track record of success and its ability to perform sets the firm apart. From a broker’s perspective, JPI appreciates and values the work we bring to a transaction. This is not always the case with sellers and buyers.”

Younger Partners Helps Secure Old Lake Highlands Site for The Goddard School

LAKE HIGHLANDS, Texas (Aug. 13, 2024) – Younger Partners Senior Vice President Michael Ytem and Associate Luke Nolan successfully negotiated the sale of 19,000 square feet on 1.15 acres at 10620-10624 E Northwest Highway in the Old Lake Highlands area in Northeast Dallas.

Younger Partners represented the seller, Johny Kenny, in the transaction. The buyer, Noori Abdulghani, president of Linhope Companies, was represented by Cushman & Wakefield Senior Director Steve Wentz.

The site has been various businesses, ranging from a Hollywood Video to a Dollar General and a furniture store. The buyer plans to transform a majority of the building into a new location for The Goddard School, bringing the inquiry-based learning experience to area families.

“Conveniently located on Northwest Highway, I had no doubt this site would lend itself to something great,” said Ytem. “Old Lake Highlands is the place to be; this sale will fulfill the demand of a growing population.”

Abdulghani said the retail storefront is an ideal location for adaptive reuse into a childcare facility. “As a local resident with young children, I know firsthand the need for additional childcare in this part of Dallas. We look forward to partnering with Goddard to develop a leading childcare facility and invest in quality education and care for our youngest generation,” Abdulghani said.

Currently, only 14 childcare facilities are within 15 miles of Lake Highlands. The facility is surrounded by multiple residential communities, giving those parents a convenient location and high-quality childcare option, Ytem said.

The Goddard School’s inquiry-based education program embraces how children learn best—through their innate curiosity—because research confirms that when wonder leads, learning follows. The program features a cutting-edge curriculum developed by a diversely skilled group of educators, researchers, physicians and early childhood experts, as well as built-in assessment of academic and social-emotional progress and family communication via a proprietary app.

The Goddard School serves almost 100,000 students from six weeks to six years old in 37 states and Washington, D.C.

About The Goddard School

For 36 years, The Goddard School has nurtured the extraordinary in every child, providing a warm, caring and safe environment that supports their individual social, emotional and academic development, appreciates their unique talents and personalities, and fosters skills they need for long-term success in school and in life. The Goddard School’s exclusive inquiry-based education program, Wonder of Learning, embraces how children learn best—through their innate curiosity—because research confirms that when wonder leads, learning follows. Wonder of Learning is backed by expert knowledge, data-driven insight and unwavering compassion for growing minds, encouraging children to explore their curiosities and interests as they discover the joy—and wonder—of learning. The Goddard School serves almost 100,000 students from six weeks to six years old in 37 states and Washington, D.C. To learn more about The Goddard School, please visit GoddardSchool.com.

Three Takeaways from ICSC 2024

By: Masen Stamp, Office and Retail Leasing Senior Associate

If you’ve ever been to ICSC Las Vegas, you know it is an eventful, three-day gathering of the biggest retail CRE dealmakers and industry experts. These retail influencers and leaders are driving the innovation and evolution commercial real estate has to offer, specifically in the retail sector.

Younger Partners sent a team including Co-Managing Partners Moody Younger and Kathy Permenter, Investments-Land Division VP Renzo Cella, me and Retail Leasing Associate Carson Mitchell. And, if you even think about bringing heels, don’t! We walked over 15,000 steps daily with back-to-back meetings on both Monday and Tuesday. I made some amazing contacts and although I returned tired from the day-in and day-out of the convention, I am also refreshed for the work!

If you haven’t been and are thinking about going next year, here are three of my takeaways:

- Set the meeting: Whether you’re nervous to call and ask or think someone won’t give you the time of day—try anyway. People appreciate the hustle and likely will fit you in. You can get something out of every single meeting. You never know what one meeting can lead to or what you can learn from somebody else in the industry just by taking the time to have a conversation.When scheduling meetings, make sure to put the calendar invite in the time zone of the location of your meeting to avoid confusion. The convention center is huge—give yourself plenty of time between meetings or group them in the same halls.

- Amp up the energy: With long days, it can be easy to succumb to fatigue, but bring your energy. Be the broker people look forward to running into at these events. Drink three cups of coffee if you must. A lot of energy can go a long way. It’s contagious!

- Bring water and a snack: A pro tip for big events is to eat/drink water when you can. You don’t know when the next meal is going to happen. It’s also a good idea to bring a big water bottle as you hop from meeting to meeting. Bring electrolytes…you’re in Vegas!

ICSC showed me the importance of building relationships, especially in the commercial real estate industry. Networking and putting yourself in the room with decision-makers and other dealmakers is crucial. It’s much easier to negotiate deals with brokers and tenants you have a relationship with because you’ve built trust and camaraderie. Moving forward in my role at Younger Partners, I plan on being more intentional with my relationship building.

As a group, we ventured through some of Vegas’ most iconic hotels, such as the Bellagio, Cosmopolitan, Encore/Wynn, Caesars Palace and Paris. We proceeded to eat and drink our way through Vegas as well. Since the NBA playoffs were happening, we didn’t miss our chance to place a bet at the Wynn Sportsbook. We put $100 on the Dallas Mavericks winning the game— the Mavericks won, so we won!

We can’t wait to explore all the opportunities given, and we are already planning for ICSC 2025! Not everything that happens in Vegas has to stay in Vegas.

Younger Partners Brings Rare 707-Acre Parcel to Market

Central Texas region

TEMPLE, Texas (July 9, 2024) – Younger Partners Executive Managing Director John St. Clair and Senior Vice President Michael Ytem have brought the 700+ acre Bell County 707 Ranch, in the fast-growing city of Temple, to the market for immediate sale.

Located about 128 miles south of Dallas and 74 miles north of Austin, the Central Texas tract is currently zoned for agricultural use and offers rare and compelling commercial and residential opportunities in a fast-growing Texas city.

The 707-acre parcel is at West Adams Avenue and Texas 317, two of Temple’s main arteries, just minutes from Interstate 35. On-site amenities include an operational horse ranch, a working stone quarry and several natural springs. Also included is a 4,000-square-foot, 19th-century house built from stones sourced from the land and remodeled in 2015.

“The sellers held the land for decades,” St. Clair said. “Potential buyers expressed interest in the site in the past, but it wasn’t for sale until now.”

The location is in the growth path for Temple, he added. The city has an active health and life sciences sector, anchored by Baylor Scott & White Health. Temple also attracts companies active in the technology and financial services arenas. According to the U.S. Census Bureau, the population increased by 13.4% between 2020 and 2023 to more than 93,000 and is anticipated to reach 100,000 residents by spring 2025.

“Temple’s growth has moved west and gone as far as it can,” Ytem said. “Ranch 707 is between that growth and Lake Belton, which is the property’s western edge.”

The acreage offers a convenient location, situated close to new retail outlets and educational institutions while offering the peace and serenity of the agricultural land. Ranch 707 is also the only parcel of its size available in the immediate area.

St. Clair said the land would be ideal for residential and commercial mixed-use purposes, both of which are in demand. “It’s also a great investment that could offer a good long-term hold strategy,” St. Clair said.

Ytem added that its strategic location also provides an opportunity for a business park with retail and residential components. “It’s about 1.5 hours away from Austin and two or so hours from Dallas,” he said. “With the massive growth along the I-35 corridor and more connectivity between these cities, this ‘tweener’ position could be an ideal home base for companies that do business in both cities.”

St. Clair and Ytem said that Ranch 707 would be an ideal opportunity for an imaginative developer or investor who understands and appreciates the growth occurring west of I-35 in Temple.

“Although Younger Partners is a Dallas-based company, we have successfully transacted Austin-area deals,” St. Clair added. “We anticipate this offering will attract much attention.”

Kelly Stewart Named General Manager of Artisan Circle

FORT WORTH, Texas (June 27, 2024) – Younger Partners announced today the appointment of Kelly Stewart as the new General Manager of Artisan Circle in Fort Worth, Texas. With more than 20 years of experience in commercial real estate, Stewart brings extensive expertise and a proven track record in property management and strategic development.

Artisan Circle is a 282,805-square-foot urban village located at the corner of University Drive and 7th Street. Spanning five walkable blocks, this vibrant destination features salons, spas, gourmet and fast-casual restaurants, virtual reality gaming and a movie theater. It also offers pedestrian-friendly, Class A office space in the heart of the Fort Worth Cultural District.

Stewart previously served as the Director of Property Management for Younger Partners, leading a team managing 5 million square feet of office and retail space. She streamlined operational processes and implemented innovative budgeting software. Her extensive background includes roles as Senior Property Manager and General Manager, highlighting her exceptional financial, operational and client management skills.

Stewart holds a Bachelor of Arts in Chemistry and a master’s degree in Land Economics and Real Estate from Texas A&M University. She is a Certified Property Manager and a licensed Real Estate Salesperson.

“We are excited to see Kelly transition into the role of General Manager at Artisan Circle,” said Kathy Permenter, co-owner of Younger Partners. “Her vast experience and commitment to excellence make her the ideal leader to guide our team as we transform Artisan Circle into a vibrant lifestyle hub for dining, shopping and entertainment. Kelly’s talent for finding innovative solutions to complex challenges aligns perfectly with our mission to establish Artisan Circle as a premier destination for Fort Worth residents and visitors alike.”

Stewart’s leadership will enhance Artisan Circle’s operations, build strategic partnerships and elevate the overall visitor experience. Her dedication to maintaining quality assets while balancing business, technology and people ensures that Artisan Circle will thrive and grow under her guidance. For more information, please visit www.artisancirclefw.com.

Younger Partners Welcomes Three Dynamic Interns

Isabella Dennis, Ben Burke & Cade Doggett

Please join us in welcoming three new interns to Younger Partners this summer. We are pleased to introduce them to the world of commercial real estate and help guide them as they start their career journey.

Our interns are Isabella Dennis, Ben Burke and Cade Doggett.

Isabella is a San Antonio native and rising senior marketing major from the University of North Texas. She is ready to shine and showcase her enthusiasm for the industry in the office while reminding everyone that it is possible to work hard and still have fun. When she’s not working, she enjoys hitting the gym, spending time with her friends and doing philanthropy for her sorority, Pi Beta Phi.

Hailing from Oklahoma City, Ben attends Southern Methodist University. He demonstrates his philanthropic spirit, showcased through his volunteer work with St. Jude’s and the Oklahoma City Regional Food Bank. Outside of work, he spends his time golfing, watching football, writing and listening to music.

Rounding out our interns is Cade from Argyle. He is a rising senior at Ole Miss where he studies Business Real Estate. He is a member of the Kappa Sigma fraternity and a volunteer with the Kappa Sigma Military Heroes Foundation. He’s eager to learn more about the CRE industry during his time at Younger Partners. His hobbies include fishing, golfing and anything that involves being outdoors.

New Property Management Assignments for Two Dallas Office Buildings

DALLAS (June 11, 2024) Younger Partners Property Services (YPPS) was awarded property management and leasing assignments for Park Cities Tower at 7001 Preston Rd. in Dallas. YPPS was also awarded the management assignment for Hillcrest Oaks at 6600 Lyndon B. Johnson Fwy. in Dallas.

“We are thrilled to add these properties to our growing portfolio,” said Greg Grainger, president of Younger Partners Property Services. “Our property services platform caters to investor clients who demand an entrepreneurial mindset. We tailor our property services to the client’s needs, not the other way around.”

These assignments boost YPPS’s property portfolio of office, retail and industrial to more than 50 properties.

The five-story, 66,814-square-foot Park Cities Tower was built in 1986 and is ideally located property near University Park at the corner of Lovers Lane and Preston Road, close to the Dallas North Tollway. The building is located within walking distance of multiple amenities, including restaurants and coffee shops. The property offers its tenants ample parking and on-site management. It is owned by Swiss-headquartered PCT Partners Ltd. Younger Partners Managing Principal Sean Dalton leads the leasing efforts for Park Cities Tower.

Hillcrest Oaks is a two-building, 183,967-square-foot office park offering an on-site conference center and café, complimentary 24/7 fitness center, security card access, and covered parking. The location fronts LBJ Freeway (Interstate 635) and provides outstanding access to local restaurants, shopping centers, and all three DFW airports. Baltimore-based Pratt Street Capital owns Hillcrest Oaks. “We are delighted to continue our long-term relationship with Pratt Street Capital. We already oversee the property management for three other Dallas buildings they own – Brookriver Executive Center I & II, Woodview Tower, and Wellington Centre,” Grainger added. “It is a testament to our outstanding team of professionals that we have been awarded this additional assignment.”

Younger Partners Awarded 500 E. John Carpenter Office Tower

LAS COLINAS, Texas (June 4, 2024) – Irving-based Koa Partners selected full-service commercial real estate firm Younger Partners to exclusively lead the leasing efforts of 500 E. John Carpenter Freeway in the upscale Las Colinas-Irving submarket. The eight-story 204,665-square-foot Class-A urban center building is on nine acres with prominent visibility along John Carpenter Freeway (SH 114).

Younger Partners Managing Principal Sean Dalton, Senior Vice President Parker Morgan, and Co-Managing Partner Kathy Permenter will oversee the leasing efforts for the project.

“Discerning tenants will appreciate the building’s unobstructed views, which include downtown Dallas, the Las Colinas Country Club and the surrounding Urban Center,” Dalton said. “Additionally, area amenities are some of the best in class. 500 E. John Carpenter is just minutes

from the Toyota Music Factory and Water Street mixed-use developments, restaurants, hotels and golf courses.”

“This building offers prospective tenants amazing amenities, as well as a great location in Las Colinas,” said Koa Partners Chief Executive Officer Harry Lake. “We strive to offer office space that provides solutions to companies looking to attract and retain top-quality talent, all while emphasizing our core value of stewardship. We have great faith in Sean, Kathy and Parker to make matches that benefit tenants and Koa, alike.”

Morgan said the building offers tenants a spacious conference center equipped with A/V, ample lounge seating, a full-service café, a fitness center with locker rooms and showers, picnic tables and 24-hour building security.

Built in 1986 and renovated in 2009, the building features 44,000-square-foot floor plates on the first three floors with 16,000-square-foot floor plates on floors four through eight. The building also features a 5/1,000 parking ratio in its six-level covered garage, electric car charging station and plenty of visitor parking.

“500 E. John Carpenter is one of the best corporate office locations in the Metroplex just 10 minutes from DFW International Airport, 15 minutes from the Dallas Love Field Airport and 20 minutes from the Dallas CBD,” Permenter said. “The building is also just one mile from DART’s (Dallas Area Rapid Transit) Orange Line running from the Dallas CBD to Las Colinas and into DFW Airport.”

About Younger Partners

Dallas-based Younger Partners is a full-service commercial real estate firm providing investment, leasing, and management services to investors and tenants in the Dallas/Fort Worth region. They also specialize in the acquisition and disposition of land, multifamily, office, industrial, and retail properties. Younger Partners Investments (YPI) is a Younger Partner’s platform designed to acquire retail properties. Launched in July 2020, YPI targets retail properties from lifestyle to neighborhood centers throughout the DFW area. Younger Partners and YPI are also affiliated with the Apricus Realty Capital. For more information, please visit www.youngerpartners.com.

About Koa Partners

Dallas-based Koa Partners is a character-driven team delivering real estate solutions. As a real estate acquisitions, development, and transaction management firm, the firm’s primary focus is on commercial real estate opportunities in US markets. With a proven track record in both entrepreneurial and institutional environments, Koa Partners’ services include real estate acquisition, development, asset management, advisory, and project management in office, healthcare, industrial, and mixed-use projects. For more information, please visit www.koapartners.com.

NTCAR’s Newest Hall of Fame Inductees

As of 2019, it took exactly 288 pages to tell the story of North Texas Commercial Real Estate. That number is about to grow.

Bound in a textured forest-green, the cover of “The Book” features silver-embossed letters, all capitalized, that spell out its title. It tells the story of the region from the context of the people who helped shape it: giants like Trammell Crow, Henry S. Miller Jr., Roger Staubach, Ray L. Hunt and the Stemmons family. The volume’s intent is summed up on page 5: “We strongly believe in the fact that those committed to a successful future must have an appreciation of the past.”

Iconic Stemmons Towers Sale Earns Finalist Recognition as One of the Best 2023 Property Sales in DFW

Younger Partners’ Stemmons Towers sale earned finalist consideration for D CEO’s 2024 Commercial Real Estate Awards in the category of Best Commercial Property Sale alongside NOVEL Turtle Creek, Qorvo Semiconductor and Texas Osprey Portfolio. The CRE firm was also named a finalist in the Dallas Business Journal’s 2024 Best Real Estate Deals in the Commercial Property Sale category, alongside CityLine campus sale, Link Logistics acquisition of Stockbridge business parks and the Plaza of the Americas sale.

Both news organizations selected the iconic four-story four-building Stemmons Towers project for the awards competitions. The historic 285,312 SF project, on 13 acres, at 2700 N. Stemmons Freeway in Dallas was sold to Sava Holdings Ltd. Younger Partners Executive Managing Director John St. Clair and Managing Principal Trae Anderson represented the seller, 2700 Stemmons LP, in the transaction.

“Though we did not end up winning either award, it is an honor to be recognized alongside other transactions of such high caliber,” St. Clair said. “Congratulations to Richardson’s CityLine for its selection by both the D CEO and DBJ BRED awards.”

“We are proud of the work we did in this transaction and can’t wait to see how Sava transforms these buildings,” Anderson added.

Built in the 1960s, the Stemmons Towers have a storied history of being one of the first Dallas high-rise office projects outside of downtown. This project will be one to watch with the transformation of a highly visible four-building office campus on I-35 into a residential complex with 10+ acres of park-like landscaping and amenities.

The location stretching along Stemmons Freeway near the Medical District and Dallas Love Field in conjunction with the property’s iconic history and architecture makes this a prime redevelopment site for Sava Holdings. A huge thank you to Sava Holdings for making the shrewd decision to reposition the properties.

Trae Anderson Shares Insider Tips in Latest CRE Project Podcast Episode

If you’re seeking insights into the dynamic world of commercial real estate (CRE), the latest CRE Project Podcast is a must-listen. In this episode, Trae Anderson, a prominent figure at Younger Partner, shares invaluable wisdom on #RelationshipBuilding, #DealMaking, and #Mentorship within the realm of Commercial Real Estate. With a captivating conversational style, Trae delves into the intricacies of forging meaningful connections, navigating negotiations, and the profound impact of mentorship in this ever-evolving industry. Tune in for an enriching dialogue that promises to enlighten both seasoned professionals and aspiring newcomers alike.

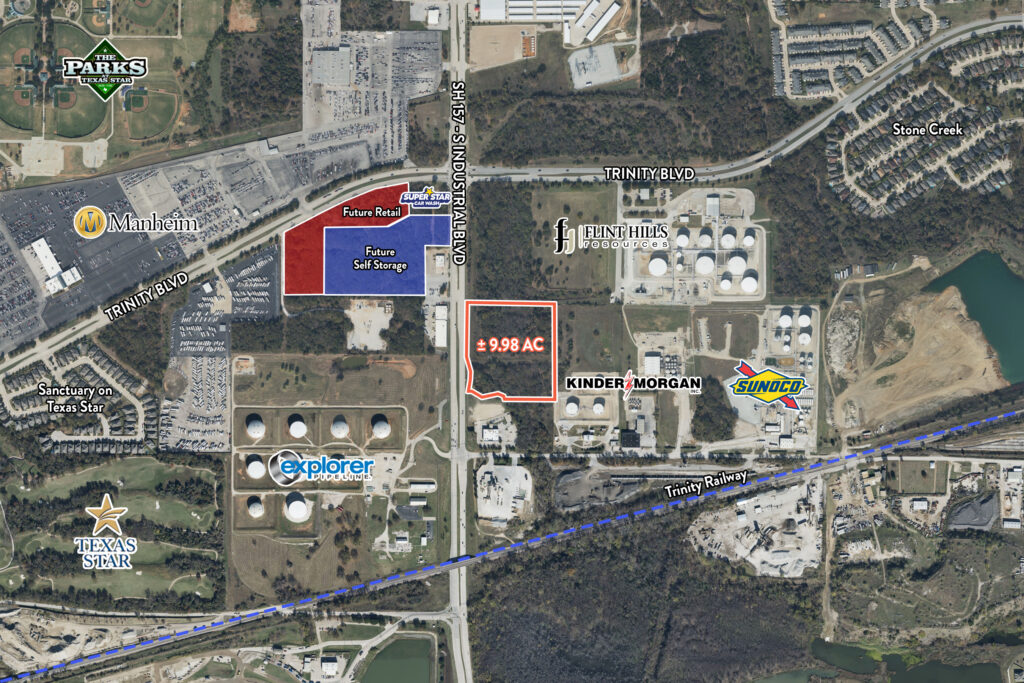

10-Acre Land Parcel Near DFW Airport Acquired

EULESS, Texas (April 16, 2024) – Windhaven Investments Inc. acquired a 9.98-acre infill parcel at 3300 FM 157 in Euless, Texas, near Dallas-Fort Worth International Airport. Younger Partners Executive Managing Director John St. Clair and Associate Luke Nolan brokered the deal between the buyer and seller, Clubwise Finance LP. The sale price was not disclosed.

Zoned light industrial, the acreage fronts Euless’ major north/south FM 157 route. The land’s proximity to DFW Airport and access to Texas Highways 10 and 183 generated potential buyer interest but “Windhaven had the confidence in the tract to close it,” St. Clair said.

The current buyer got the deal across the finish line with plans to hold the land for investment, potentially repositioning it for future sale or attracting developers.

“During the past decade, industrial developers have been focused on larger buildings of at least 200,000 square feet or more,” St. Clair said.

However, Nolan said, the land on FM 157 provides an excellent opportunity to develop smaller buildings that are in demand, thus attracting industrial tenants who don’t require large amounts of square footage.

“That was a big part of the appeal of this transaction,” Nolan added. “This is a great piece of real estate for smaller light-industrial buildings. The new owner won’t have a shortage of tenants or buyers.”

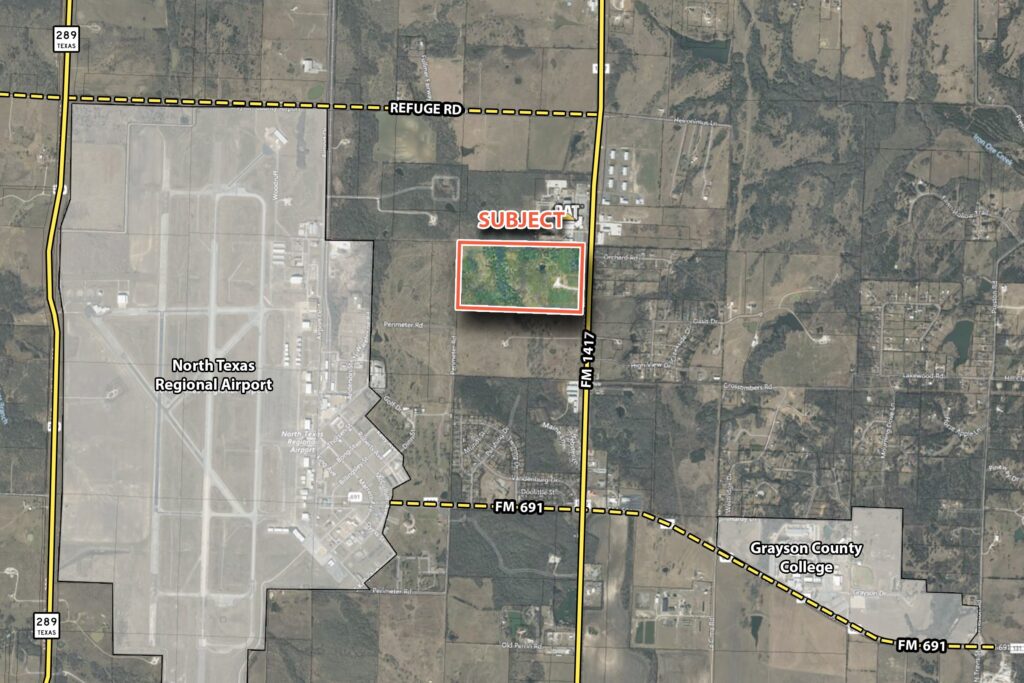

Younger Partners Brokers 76-Acre Land Sale in Growing Grayson County

GRAYSON COUNTY, Texas (April 10, 2024) – Investment Catalysts LLC of Southlake, Texas, acquired 75.9 acres on Farm-to-Market Road 1417 in Grayson County, about 70 miles north of Dallas, with the intent to hold the parcel for investment purposes.

Younger Partners Executive Managing Director John St. Clair, Associate Davis Willoughby and Executive Vice President Tyler Hemenway represented the seller, the Estate of Douglas Lee Shankles. The sale price was not disclosed.

“This land acquisition represents perfect timing by the buyer,” St. Clair said. “They made this purchase right there in the bullseye, where everyone is looking for this type of land today. The estate has additional tracts nearby that are available and just as desirable.”

Grayson County borders Oklahoma and is reachable from other parts of Texas via U.S. highways 75 and 377 (north/south), U.S. Highway 82 (east/west) and multiple state highways and farm-to-market roads. The county also benefits from Lake Texoma, one of America’s largest reservoirs, multiple farm-to-market roads, and Texas highways, Hemenway said. The infrastructure and Lake Texoma attracted the interest of Texas Instruments and GlobiTech, who are building multibillion-dollar chip plants near the county seat of Sherman, Texas.

Because of all of these factors, Younger Partners has received significant interest in the land tract, which fronts FM 1417, a major north-south route, Willoughby said.

“Light distribution or light manufacturing companies will need access to these chip plants,” St. Clair said. “The Shankles tract is well-suited for this purpose. Investment Catalysts is the ideal buyer because of its excellent reputation, the best offer and its ability to close.”

“The buyer has a reputation of getting things done and paid a good price for the land,” Hemenway added. “They’re placing money in the path of growth and have an outstanding exit strategy.”

Younger Partners’ Kathy Permenter and Michael Ytem selected for 2024 TREC Executive Committee

Congratulations to Younger Partners’ Co-Managing Partner Kathy Permenter and Senior Vice President Michael Ytem for their selection to The Real Estate Council (TREC) 2024 Executive Committee. TREC is the state’s largest real estate organization, representing more than 600 companies and 95% of North Texas’ commercial real estate industry. Executive committee members provide the expertise and leadership that support the growth of TREC, the Dallas real estate industry and the development of the area’s most underserved communities.

Kathy has more than three decades of commercial real estate industry experience and has been involved with Younger Partners’ overall strategy, vision and growth since its inception in April 2012.

Kathy has served on the TREC Programs Committee and joined the Board of Directors in 2022. As an executive committee member, she will serve as programs chair leading the way for the TREC Speaker Series.

“What I enjoy about TREC is the high level of exposure it has with every company that touches real estate,” she said. “We started this year with a Speaker Series called ‘A Global Perspective.’ We had a great panel talking about events going on globally that affect us locally.”

Joining Kathy on the executive committee, Michael will serve as the Associate Leadership Council (ALC) Class Representative. The ALC program is designed to inspire and educate future commercial real estate leaders in Dallas-Fort Worth. Michael graduated from the 10-month program in 2023, where he participated in monthly leadership development programs and lunches, received personalized executive training, and implemented a community investment project.

Michael focuses on land transactions including development opportunities and long-term holds. A consistent top producer at the company and industry award-winner, he has brokered more than 800 acres of sales totaling some $92 million. He was selected as a D CEO Power Broker from 2019 to 2022 and named a finalist in the 2023 D CEO Emerging Commercial Real Estate Professional of the Year.

“ALC is one of the best opportunities someone in this industry can do for themselves,” said Michael. “Being an active member in this organization has opened the door to a tremendous number of possibilities by connecting me with several folks of the same mindset and objectives in life. It goes beyond what the industry can do for you and allows you to tap into a cause much greater than what you stand to gain.”

Andrew Boster Selected to 2024 NTCAR Board of Directors

Andrew Boster, Senior Vice President at Younger Partners, has been named to the 2024 NTCAR Board of Directors. Founded in 1993, NTCAR (North Texas Commercial Association of Realtors) exists to enhance the business opportunities of its members through real-time access to critical real estate information, education, recognition and networking events. Members benefit from proprietary industry resources and customized services.

In his role, Andrew hopes to enhance business opportunities by creating favorable circumstances for people to get to know each other and do business together. He values spending time with other board members and appreciates each member’s expansive professional network and knowledge within the industry.

“I believe there are many varying recipes for success,” Andrew says about his membership. “Two key ingredients are education within an industry and involvement within the industry. Being on the NTCAR board allows me to get to know the people I want to do business with, not just a voice on the phone or a faceless email signature. More importantly than that, service on the board allows me to promote and improve the broad array of NTCAR initiatives which afford members more opportunities for making long-term business connections.”

With his emphasis on a personal touch in business, Andrew demonstrates the importance of putting a face to a business transaction.

“Andrew is the only currently serving board member who exclusively has a land focus. Though it was not intentional, it puts Andrew in a great place to be the household expert on land-exclusive opportunities,” said Younger Partners Executive Managing Director John St. Clair.

At Younger Partners, Andrew is known for cultivating collaborative partnerships between the landowner and developer. His specialty is finding and assembling off-market opportunities for investors and developers in sought-after submarkets in North Texas. Through the years, Andrew’s efforts have proven his ability to focus on an area considered by many to be too picked over, and quickly pull out off-market opportunities with willing sellers, previously unknown to investors and developers. The results of his work are mutually beneficial arrangements between landowners and developers, maximizing returns for both. Andrew’s present-oriented approach and industry knowledge make him a great asset to the NTCAR Board of Directors.

Elizabeth Meredith selected to join BOMA Greater Dallas Board of Directors

Younger Partners’ Senior Property Manager Elizabeth Meredith was selected to join The Building Owners and Managers Association of Greater Dallas’ Board of Directors. BOMA is a professional organization representing the commercial real estate industry and related service providers by establishing the industry standard of excellence through advocacy, education and networking.

Elizabeth is a seasoned Senior Property Manager with 18 years of expertise in commercial property management, specializing in industrial, retail, office, and new construction properties. She started with BOMA Greater Dallas by joining the Gala Committee. She has served on the Gala Committee as a member and chair and the Networking Committee. She has been active in BOMA attending trade shows, educational seminars, monthly luncheons and various charity drives. In her new role, she will be the board liaison for the Networking Committee and will assist the chairman and co-chairman to ensure they are following the bylaws and reporting back to the board. Elizabeth will serve for three years starting March 2024.

“Elizabeth is an indispensable member of our property management team, tackling day-to-day challenges with tenacity and ingenuity,” said Greg Grainger, Younger Partners Property Services (YPPS) principal. “Clients and tenants alike trust Elizabeth for her reliable and professional approach, which has cemented lasting partnerships. Her ability to cultivate strong relationships and drive success in even the most demanding environments makes her an invaluable asset to our team.”

Elizabeth’s illustrious career includes notable tenures at several well-respected commercial real estate firms, where she consistently delivered outstanding results. As a licensed Real Estate Agent, she brings an understanding of the industry’s intricacies, and handling diverse property portfolios has equipped her with the adaptability required to excel in the real estate market.

“It is an honor to receive this invitation to join the boards of directors,” Elizabeth said. “I feel like this is a significant achievement for me considering the amazing real estate professionals vying for this role.”

With over 700 members, BOMA Greater Dallas is one of the biggest and most successful local associations in the BOMA International Network. YPPS is a dedicated member of the property industry through its BOMA service. Greg was elected to serve on BOMA International’s Executive Committee and was selected as a BOMA Fellow, a group of selected individuals who have displayed exemplary and sustained contributions to commercial real estate and have continually answered the call to leadership and service throughout their careers. An active BOMA member at every level, Greg was president of BOMA/Greater Dallas in 2009 and chair of the BOMA Southwest Region in 2012. He has also served as a chairman on the board of trustees for BOMI International, where his efforts helped facilitate the new BOMA/BOMI joint education initiative and the launch of the Certified Manager of Commercial Properties (CMCP) certification.

Top 10 Producers Shine Bright: Celebrating Excellence

In a year marked by challenges and opportunities, our top 10 producers have undoubtedly risen to the occasion and exceeded expectations! We’re thrilled to extend our warmest congratulations to Ben McCutchin, Trae Anderson, John St.Clair, Tom Grunnah, Andrew Boster, Scot C. Farber, Tom Strohbehn (not pictured), Sean Dalton, Byron McCoy, and Parker Morgan for their exceptional achievements. Their unwavering dedication, expertise, and tireless efforts have not only bolstered our team but also set a remarkable standard for excellence in our industry. We are grateful for their contributions and look forward to continued success together!

DCEO Recognizing Region’s Top Industry Leaders

We’re thrilled to share that 10 members of the Younger Partners team have been honored on the D CEO Power Brokers 2024 list, recognizing the region’s top brokers. Congratulations to Ben McCutchin, Trae Anderson, John St.Clair, Tom Grunnah, Andrew Boster, Scot C. Farber, Tom Strohbehn, Sean Dalton, Byron McCoy, and Parker Morgan for their well-deserved inclusion. This recognition highlights their dedication and expertise in the industry. We’re grateful for their outstanding contributions to our team.