Author: Amy Chavez

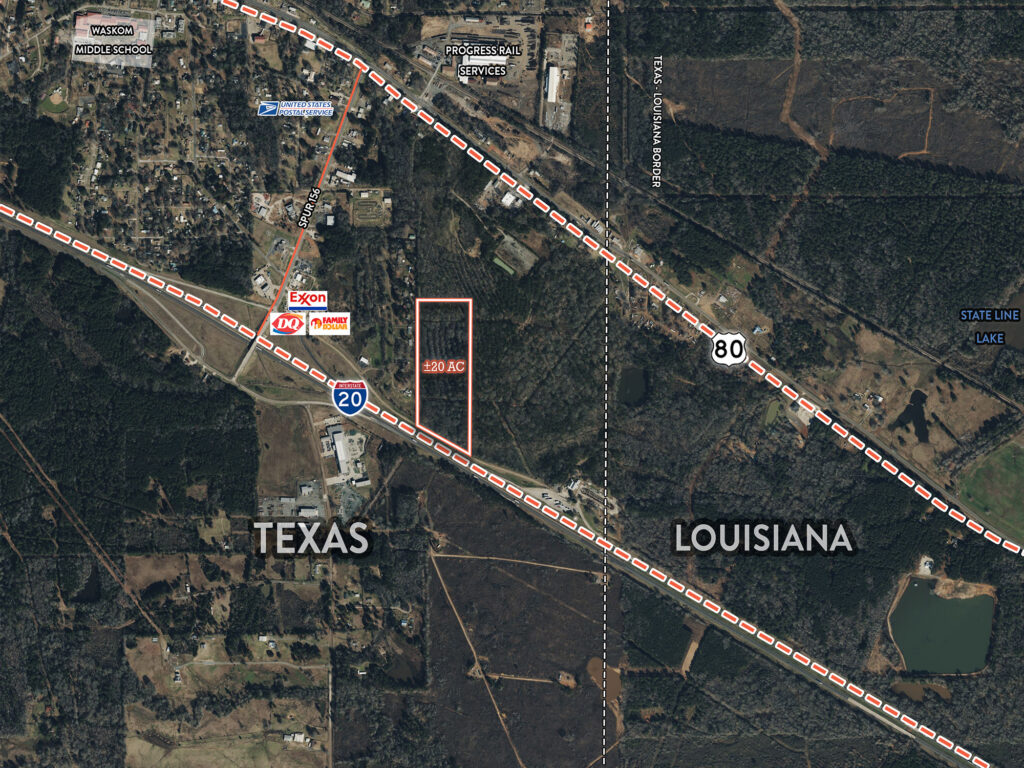

20-Acre Texas–Louisiana Land Deal

WASKOM, Texas (Nov. 18, 2025 )— Younger Partners Executive Vice President Ben McCutchin brokered the sale of the 20 acres fronting I-20 in Waskom on the north side of I-20 at the state line of Texas and Louisiana. Another 134 acres are still for sale at the location, just 25 miles west of Shreveport.

McCutchin represented the seller, Johnson Investments, in a direct deal with the buyer, JF3 Properties LLC, Inc. Plans for the property call for a future construction equipment yard for the existing business in the next six months.

“This is a deal where the signage made the difference,” McCutchin said. “The buyer was looking for acreage for development and business implementation in the power distribution industry, and this site fit the requirements. This transaction was successful because of the cooperation from the Texas Department of Transportation and the City of Waskom working together to help the buyer receive permission to include an entrance across the flood plain on the southwest end of the property.”

The property had been in the Johnson family for more than 50 years, McCutchin said.

Throughout 2025, McCutchin has brokered a handful of deals totaling almost 400 acres across the state, including the sale of about 95 acres in Pilot Point to Texas grocer H-E-B. He also brokered a 260+-acre sale in Pilot Point for a future home development.

Younger Partners Sells Bent Tree Plaza in Dallas

DALLAS (Sept. 23, 2025) – Younger Partners Principal Tom Strohbehn and Managing Principal Scot Farber brokered the sale of Bent Tree Plaza, an 82,144-square-foot professional office and medical complex located at 16610-16660 North Dallas Parkway and 4950 Westgrove Dr. in Far North Dallas.

Situated along the North Dallas Tollway, Bent Tree Plaza spans more than four acres across two parcels and offers a strong mix of long-term tenants, with the opportunity for new tenants to capitalize on its prime location.

Strohbehn and Farber represented the seller.

Consistent housing growth and the expansion of nearby amenities have supported steady rent increases in the area. With a diverse tenant base and strong ties to the local community, Bent Tree Plaza offers investors long-term stability and reliable returns, Strohbehn said.

“Dallas continues to grow as a global destination for corporate relocations,” Farber said. “Strong market fundamentals should drive demand for well-located suburban office space, particularly for small tenants.”

Currently leased at 72%, Bent Tree Plaza provides a strategic “bite-size” entry point into one of Dallas’ premier submarkets, with clear value-add potential, Farber added.

The transaction follows a major milestone for Younger Partners, which recently ranked No. 12 nationally and No. 2 in the Dallas-Fort Worth Metroplex in Green Street’s Real Estate Broker Rankings — a recognition that reflects the firm’s strong transaction volume and leadership in the region.

Younger Partners Principal Bryon McCoy handled leasing for the property’s previous owners and will continue representing the new ownership in ongoing leasing efforts.

Andrew Boster Promoted to Lead New Industrial Tenant Rep Services at Younger Partners

DALLAS (Sept. 8, 2025) Younger Partners added to its industrial vertical with a specialization in tenant representation at the full-service brokerage. Andrew Boster was promoted to managing director of industrial sales and leasing to lead the service line.

Younger Partners (YP) launched in 2012 as a full-service commercial real estate firm providing investment, leasing and management services to investors and tenants in the Dallas/Fort Worth region. Over the years, the firm has added expertise in the acquisition and disposition of land, office, industrial and retail properties.

“Expanding a service line is rarely just a reaction to market conditions or demand—it’s about people,” said YP Co-Managing Partner Moody Younger. “We believe that real growth happens when we find individuals who have the talent and drive to succeed but also align with our culture and values. That’s exactly the case with Andrew. His optimism, energy and vision are a perfect match for what we aim to build. His passion for industrial real estate and his commitment to fostering a collaborative, entrepreneurial team make this the right moment to elevate our focus on industrial leasing and sales.”

YP Co-Managing Partner Kathy Permenter added, “Andrew has significant leadership experience and is a skilled salesperson, and that background is crucial when recruiting and building a brokerage team. He will be collaborating closely with Younger Partners Principal Carter T. Crow in leading the industrial group. Carter has an extensive background in Dallas industrial markets, and his expertise in this effort is invaluable.”

In his new role, Boster will focus on enhancing YP’s industrial platform with recruiting and developing a client-centric and collaborative industrial team to support user representation, opportunistic leasing assignments and one-off property sales.

“Developing this vertical was the next logical step for YP,” Crow said. “Tenant rep adds value to the relationships we have already built within the industry, and as the business needs of our clients evolve, this is an added layer of service we can provide.”

Younger Partners Vice President Tanja McAleavey, Associate Adam Farber and Associate Kim Snow have already joined the team. Boster envisions growing the industrial group of 10 to 15 members over the next two to three years.

Boster and Crow have designed a mentorship program aimed at cultivating expertise in industrial representation, as well as ensuring an entrepreneurial and strategic approach to growth and development for the brokers on the team.

“There are a lot of new and talented commercial real estate professionals who are searching for a quality firm where they can partner with a seasoned mentor to learn about the industry fundamentals and industrial client representation,” Boster said. “There is no one more knowledgeable about the best practices for industrial representation in North Texas than Carter Crow. The intentionality of our training program, led by Carter and me, will differentiate us from other firms.”

Boster said a significant aspect of the ongoing training program draws on his experience in generating business through a key performance indicator-oriented, time-blocked, in-person and over-the-phone cold-calling program, which will include essential practices such as building a robust database, focusing on a specific industrial submarket and setting a clear vision for success through an annual goal-setting process.

“All of these elements will be integral to YP’s broker development initiatives,” Boster emphasized. “One thing that will absolutely stay true to the Younger Partners spirit of entrepreneurialism is the freedom our industrial brokers will have to do business throughout the Metroplex on a variety of transaction types. There won’t be any handing off of deals; the broker will service their client and have full participation in the deals they bring in from the initial conversation to the closing of the transaction.”

As the team grows, Boster said he expects to create strong synergies with YP’s successful land team for potential developments, as well as with Apricus Realty Capital and YP’s Green Street award-winning investment sales team, comprised of Managing Principal Scot Farber and Principal Tom Strohbehn, for portfolio sales assignments.

“I’m looking forward to incorporating a strategic plan that focuses on quality leadership, operational oversight and team management,” he added.

“A key aspect of his role centers on establishing and fostering a strong, purposeful, disciplined, entrepreneurial culture within the industrial division. Andrew is the perfect fit for this new role,” Permenter said.

“Since joining our team, Andrew has consistently delivered outstanding results, building strong client relationships and contributing to the growth and success of our company,” Younger said. “His energy, leadership and positive vision have made a lasting impact on both our business and our culture.”

YP Secures Lease for Unique Infrared Fitness Concept

DALLAS (July 23, 2025)— Younger Partners Vice President Tanja McAleavey brokered the lease for Club Burn, a one-of-a-kind infrared and vacuum technology fitness center in the Preston Hollow submarket. McAleavey’s love for fitness, commercial real estate market knowledge and understanding of entrepreneurial priorities landed Club Burn in an iconic location within the heart of Dallas.

The 1,710-square-foot space, on an end cap at 11909 Preston Rd. in Preston Forest Square, is in a prime spot for Club Burn’s targeted demographic. McAleavey (along with Younger Partners Associate Adam Farber) represented Club Burn and its owner, Tangela Patrizi, in the direct deal with the landlord, Preston Forest Square, L.P. The lease was signed in July 2024 with a grand opening in April 2025.

The facility features infrared and vacuum technology equipment, including VacuTherm treadmills and recumbent bikes, as well as infrared stair climbers and infrared body rollers. The location also includes a dressing room, shower facilities and a sauna.

“Nowhere else in the Dallas-Fort Worth Metroplex is there equipment like this,” McAleavey said. “This technology is in big demand in Europe and major metropolitan areas like Los Angeles and Miami.”

“Preston and Forest is a great location for Club Burn. The location and demographics align with the ideal customer, and the space is easily accessible with great parking,” McAleavey said. “For those who are looking for creative ways to stay fit, Club Burn’s focus on infrared fitness and lymphatic drainage brings a new approach to staying in shape.”

McAleavey, a marathon runner and former TCU track athlete, has a history of representing business owners who cater to a healthy lifestyle. She has worked with Front Porch Pantry, Pure Green and Self-Made Training Facility, among others. Patrizi, Club Burn’s owner, is an entrepreneurial spirit and breast cancer survivor who was searching for biohack methods and discovered infrared and vacuum technology.

“I’m passionate about harnessing science-backed innovation to accelerate fitness results, support recovery and improve overall health through the power of infrared and vacuum technology,” said Patrizi. “Club Burn is designed for anyone looking for a low-impact yet highly effective workout—whether the goal is weight loss, enhanced wellness, skin toning, or simply prioritizing self-care. In today’s fast-paced world, Club Burn delivers an efficient and results-driven solution.”

The fitness center is in the heart of Preston Hollow, one of Dallas’ most desirable and tightly held submarkets, known for its beautiful, tree-lined streets, upscale homes and a vibrant mix of boutique retail, dining and local businesses. Preston Forest Square is an 85,000 square foot neighborhood center that was built in 1961 with 18 stores. Current tenants include Meso Maya, Torchy’s Tacos, Sola Salon Studios, The Little Gym, Starbucks and the Emler Swim School. The area is bustling with new tenants and activity, including the recently opened Hudson House and Oishii, with other brands expected to join them soon at the intersection.

Younger Partners Sells Legacy Retail Property in Dallas

DALLAS (June 5, 2025)— Dallas-based Younger Partners recently completed the sale of a prominent, multi-tenant retail building at the northeast corner of Preston Road and Forest Lane in the highly sought-after Preston Hollow area. The sale of the 4,840-square-foot property at 11810 Preston Rd. was arranged by Younger Partners Senior Associate Luke Nolan, who facilitated the deal between the buyer and the seller.

The area is bustling with new tenants and activity, including the recently opened Hudson House and Oishii, with other concepts expected to join them soon at the intersection.

Preston Hollow is one of Dallas’ most desirable and tightly held submarkets, known for its beautiful, tree-lined streets, upscale homes and a vibrant mix of boutique retail, dining and local businesses. With an average household income of around $324,000, the neighborhood offers an attractive, refined lifestyle and continues to draw discerning tenants and investors alike. “It’s rare to see assets like this trade hands, particularly because many are held by the same families for decades, often passing from one generation to the next,” said Nolan.

The Preston Hollow submarket’s strong residential base and location in the heart of North Dallas make it especially appealing to high-end tenants seeking a well-established and prestigious setting.

As the property transitions into new ownership, leasing efforts are being led by Venture Commercial Real Estate.

“This legacy asset sits at one of Dallas’ most exclusive intersections, now undergoing a commercial renaissance with high-profile tenants,” said Mike Geisler, Founding Principal and Managing Partner of Venture Commercial Real Estate. “Led by Amanda Welles, our team is already seeing robust interest on the leasing front. With excellent visibility, accessibility, and convenience, we’re excited to refresh these spaces with elevated concepts tailored to the local demographic.”

Younger Partners put together the deal between the buyer, Berlin Interests, and the seller, a private family partnership. The sales price was not disclosed.

“This transaction was special for me,” Nolan said. “It’s in my proverbial backyard, just down the street from where I grew up, so having the opportunity to unlock and lead this deal was personally meaningful.”

Area residents can look forward to ongoing updates in tenancy and property improvements in the coming months, Geisler added.

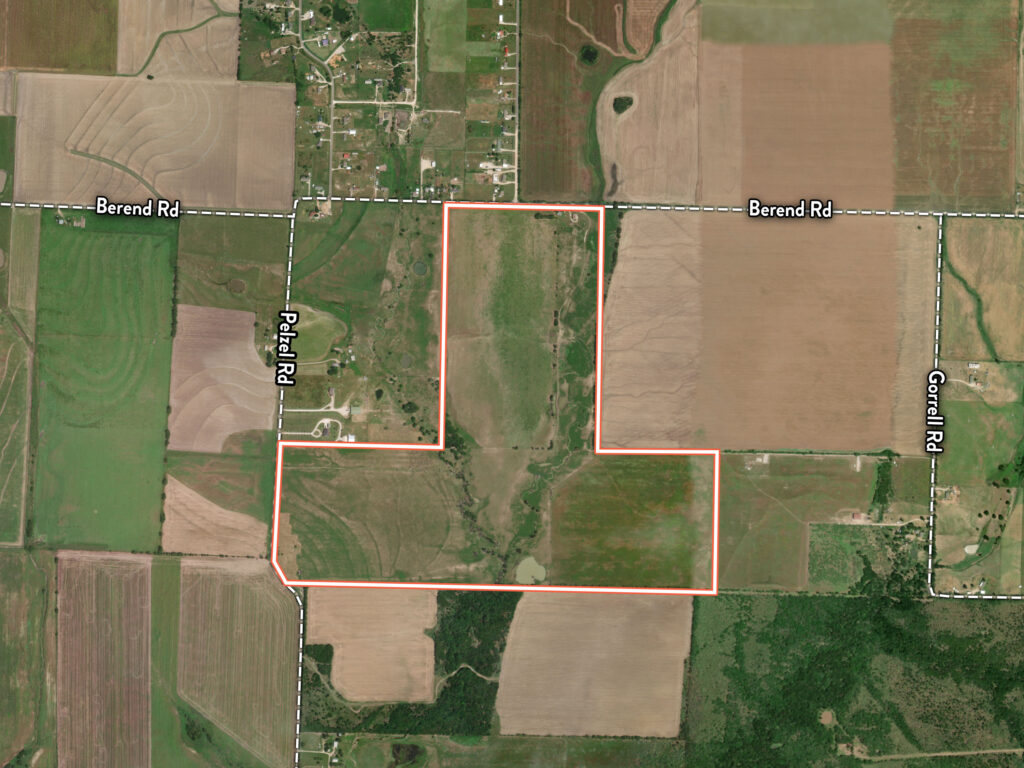

Younger Partners Brokers 260-Acre Land Sale in Pilot Point

PILOT POINT, Texas (May 28, 2025 )— Younger Partners Executive Vice President Ben McCutchin brokered the sale of the 260.4 acres at 3497 Berend Road in Pilot Point for a future home development site.

“Over the past few years, Pilot Point’s population growth has surpassed well over 25% annually, placing it among the fastest-growing communities in North Texas,” McCutchin said. “There are multiple incoming master-planned communities and a lot of development going on down Farm to Market Road (FM) 1385.”

The Texas Department of Transportation (TxDOT)’s plans call for widening FM 1385 from a two-lane rural road to a six-lane urban road along 12 miles between US 380 and FM 455. This project is part of a larger corridor improvement effort, including the reconstruction and widening of other roads like US 380, FM 2931, and others.

“This road construction will continue to influence the growth of Pilot Point, located at the end of the project,” McCutchin said. “Pilot Point and the surrounding communities are likely to experience exponential growth in the coming decades.”

More than 20,000 new housing units are planned within surrounding master-planned communities in a largely unrestrained state regulatory framework, according to the city of Pilot Point’s website. It lists major developments including Bryson Ranch, Talley Ranch, Four Seasons, Pecan Creek, Mustang Ranch, Eland Ranch and Creekview Meadows, as residential projects. According to Esri, Pilot Point’s median home value of $391,685, which is lower than both Frisco at $575,000 and Prosper at more than $700,000.

The buyer of the 260-acre parcel is Dallas-based Talley Land Development. The seller is Gene McCutchin Ltd III, the estate of the late Gene McCutchin. Currently, the land is used for agricultural purposes. McCutchin represented both the buyer and seller in the transaction.

“The land is not ready for immediate development, but it is in a great location just east of FM 377 and one mile north of FM 455. The buyer owns adjoining land to this site, and the Pilot Point Independent School District owns 100 acres across the road for future development,” McCutchin said. “This will be an ideal site for a new home development in the next five to 10 years, located near schools in a more affordable part of this growing region.”

The late Gene McCutchin saw the northward movement of development and purchased the land in 2000 for a long-term investment. The region is seeing growth in industrial, logistics and retail sectors, creating local job opportunities such as e-commerce, distribution centers and service industries that are expanding northward from Frisco and Denton, according to city of Pilot Point data. Additionally, the Dallas North Tollway expansion and the Denton County Outer Loop projects will improve regional connectivity with access to employment hubs in Frisco, Prosper and Denton, McCutchin added.

Younger Partners Brokers 42-Acre Land Sale for Grocery-Anchored Retail in the Collin County City of Lucas

LUCAS, Texas (April 2, 2025 )— Coming soon to the Collin County city of Lucas: a highly anticipated commercial planned development featuring a 130,000-square-foot grocery-anchored shopping center, a 25,000-square-foot restaurant village with 15 adjacent pad sites and a community park.

Younger Partners Senior Vice President Michael Ytem and Executive Vice President Tom Grunnah brokered the sale of the 42-acre parcel of undeveloped land at the northwest corner of Parker Road and Southview Drive (FM 1378) in Lucas, 30 miles northeast of Downtown Dallas in Collin County.

Ytem and Grunnah represented both the buyer, Lucas Crossing LTD – led by Malouf Interests – and the seller, JCBR Holdings, in the transaction. The sale price was not disclosed. Construction is set to begin in Q4 with an estimated completion in 2026.

“This prime retail and commercial project has been years in the making,” said Ytem. “The extensive planning and city approvals reflect the commitment to bringing a best-in-class development that meets the needs of the growing community. This project enhances Lucas’ retail and dining landscape while also creating a vibrant gathering place for residents and visitors that supports local businesses and fosters long-term economic growth.”

Lucas Mayor Dusty Kuykendall agrees. “This will be our first true grocery store serving the community,” he said. “The development team worked with city leaders, as well as the residents, to plan this project based on our comprehensive plan from the start.

“From the roof design to the paint colors, we wanted to be involved in every part of the plan and they were willing to work with us on that,” Kuykendall added. “This project will drastically increase our sales tax base, which is great to bolster funds for our infrastructure and roads. This will be a unique addition to the largely residential town because it is all commercial with some green spaces included. Our feedback on materials, the aesthetic and the layout were all incorporated. For some time, our residents have wanted a full-service restaurant, and this planned development will incorporate a few of these.”

Malouf Interests is leading its retail transformation in the highly desirable suburban area in northeastern Dallas. The development is strategically positioned to serve not only Lucas but also neighboring communities including Parker, North Wylie, Northeast Murphy and St. Paul. With its strong residential growth and appeal, Lucas continues to attract families and professionals, drawn to its high-quality lifestyle and expanding amenities.

Lucas, with almost 10,000 residents, has no multifamily or high-density neighborhoods. Home lots tend to be around two acres with an average value of $1.2 million, Kuykendall said.

“The planned development will create a dynamic new retail destination for the area and tremendous amenities for the region,” Grunnah said. “This transaction will have a lasting impact on the community and create value for the city, its residents and the new property owners.”

Younger Partners Earn Green Street’s Top 20 National and Top 5 Local for Sales Transaction Volume

Younger Partners earned a Top 20 recognition for the Top Office Brokers 2024 list, ranked by Green Street. The firm also earned a Top 5 ranking for Top Office Brokers within the DFW area. Both accolades were for deals with a $5 million to $25 million value. These rankings are published in Green Street’s February 2025 Real Estate Alert report.

Younger Partners’ Capital Markets Principals Scot Farber and Tom Strohbehn inked three transactions in 2024 earning them the Green Street accolades. Among their transactions is the 90,980 SF 3200 Broadway Blvd., in south Garland. Located off Interstate 635, it is a convenient location for office workers to reach to their office with ease. The second deal, also located off 635, at 8111 LBJ Freeway is an impressive 266,412 SF in north Dallas, which allows office workers proximity to the heart of downtown Dallas.

On the other side of the Metroplex is the third deal in Arlington. The 115,700 SF building, at 1521 N Cooper St. off I-30, offers convenient proximity to major attractions such as entertainment districts, AT&T Stadium and multiple amenities.

“These recognitions highlight Younger Partners’ adaptability to the ebbs and flows of the industry,” Farber says. “Our team is encouraged to lean into our competitive streak as we strive to build on the success of 2024 by working even harder in 2025.”

As companies continue to evaluate their RTO mandates, the landscape of CRE is changing, according to Green Street. Since 2020, remote work has become more common, leaving office spaces desolate with a lack of urgency for companies to invest in empty buildings. Securing these deals highlights the grit of Younger Partners because of the challenges of selling office spaces within the current landscape of the working culture. However, companies are scaling back on remote work and shifting back to an in-person setting. According to a KPMG survey, 83% of CEOs expect a full return to the office within the next three years. These deals preview the back-to-office reality, where life is breathed back into previously shunned office spaces, Farber said.

On his whiteboard for the year, Farber made it a goal to earn recognition for YP’s accomplishments from 2024. By the end of Q1 ‘25, he’s already checked one goal off his list—and if these rankings are any sign, there are plenty more wins ahead for Younger Partners as the year rolls on.

Younger Partners Negotiates Sale of 54 Acres in Alvarado for Future Use

ALVARADO, Texas (Feb. 24, 2025)— Younger Partners Senior Vice President Andrew Boster brokered the sale of 54 acres in Alvarado, 21 miles from the Fort Worth CBD and 29 miles from the Dallas CBD, for future development.

Boster represented both the buyer and seller.

The site is just two miles from U.S. 67 and less than six miles from both I-35W and U.S. 287 in unincorporated Johnson County. “This provides the flexibility of unzoned development in a strategic location for easy access while allowing for a wide range of potential uses,” Boster said. “The submarket has become a sought-after location for industrial investment and development making this a great opportunity for both the buyer and the seller.”

This site lies within the rapidly growing Midlothian-Venus submarket, making it a prime candidate for various types of development. The deal closed on Jan. 16, 2025.

“The seller’s family, like many of the families in the Midlothian-Venus submarket owned the property for generations,” Boster added. “Much of the area’s undeveloped land is still being held by long-time landowners who have historically been reluctant to sell. However, after three years of substantial growth, many are reconsidering, creating new opportunities in a previously scarce land market.”

With land still priced per acre rather than per square foot, the Midlothian-Venus submarket remains one of the last affordable options within 25 miles of both downtown Fort Worth and Dallas, making it highly attractive to developers.

“The location of the 54 acres is at the intersection where investor pricing meets developer pricing,” said Boster.

This transaction highlights the increasing demand for land south of Fort Worth, driven by the region’s affordability and expanding infrastructure. The Chisholm Trail Parkway has played a significant role in spurring development in the southern part of the Metroplex, along with I35W, attracting investors and developers looking for opportunities beyond the traditionally high-growth corridors north of Dallas. As expansion continues, Venus remains well-positioned for future development.

Boster, along with Younger Partners Executive Vice President Tom Grunnah, are also marketing 67 acres in Prosper (Denton County) with frontage along FM 1385 and 1.5 miles north of U.S. Hwy. 380. This site is just west of the Windsong Ranch Master Planned community and immediately east and south of several additional new residential developments.

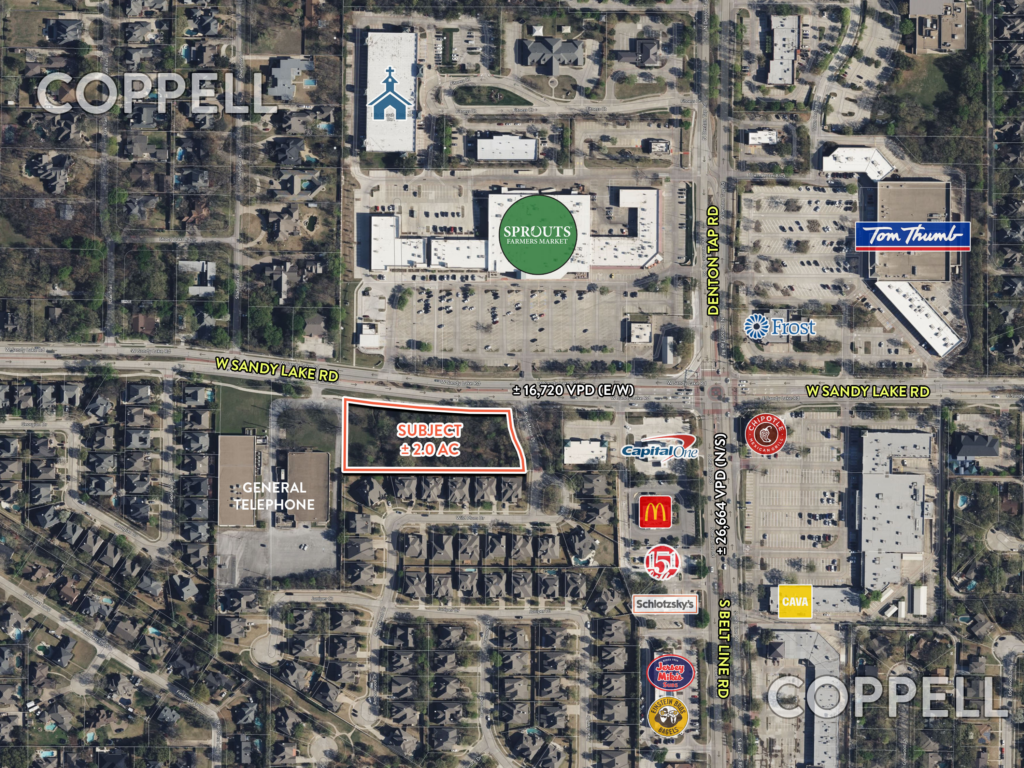

Younger Partners Brokers Sale of Prime Two-Acre Infill Site in the Heart of Coppell

COPPELL, Texas (Feb. 10, 2025) –Younger Partners Associates Davis Willoughby and Luke Nolan successfully negotiated the sale of 2 prime development acres at 1 W. Sandy Lake Road in the Dallas suburb of Coppell.

Located just across from Sprouts and Andys Frozen Custard at West Sandy Lake Road and North Denton Tap Road, the land was sold by Ardinger Properties LLC. The buyer is Dallas-based commercial real estate development firm, Peak Development Partners, which focuses on single-tenant retail spaces. Younger Partners represented both buyer and seller. The sales price was not disclosed.

The property is a future retail development site and fronts a major east-west thoroughfare along Sandy Lake Boulevard, which sees roughly 17,000 VPD on average. The site shares its southern property line with six single-family residences that front Wild Plum Drive.

“This property is just about 500 feet west of Belt Line at the most prominent retail intersection in Coppell with major anchors such as Trader Joe’s, Tom Thumb and Sprouts,” Nolan said.

“This acquisition will transform this underutilized parcel at Coppell’s premier intersection into a cornerstone of opportunity for the community,” Willoughby said. “As the city continues to grow, we want to ensure the real estate keeps up with the demands and needs of Coppell’s booming population.”

“This tract has all the qualities of a prime retail development site—ideal visibility, high traffic and unbeatable location—making it a rare gem in Coppell’s competitive marketplace,” Nolan said.

Fort Worth Cultural District Alliance Announces 2025 Board Leadership

Leading the CDA as Chair is Moody Younger of Artisan Circle/Younger Partners. Marshall Horn of Texas Air Systems and Kim Tillman of Regions Bank will serve as Vice Chairs. Reagan Ferguson of Pressman Printing takes on the role of Secretary, while Jerry Thompson of Inwood Bank will serve as Treasurer. Scott Wilcox, immediate past Chair, will continue to offer guidance.

“The Cultural District Alliance is the only organization solely committed to preserving and promoting Fort Worth’s Cultural District,” said Moody Younger, CDA Chair. “Through collaboration with our board, corporate partners and community leaders, we will continue to strengthen this vital economic and cultural hub.”

The CDA is committed to connecting corporate and community leaders, residents and visitors to local businesses and cultural initiatives, fostering creativity through premier events and exhibitions, and collaborating with businesses, museums and city officials to ensure a thriving district.

As a cornerstone of Fort Worth’s identity, the Cultural District boasts world-class museums, thriving businesses, and a vibrant arts scene. It is also home to the Will Rogers Memorial Complex, UNT Health Science Center, the Fort Worth Botanic Garden and the Botanical Research Institute of Texas, further solidifying its reputation as a premier destination for education, research and cultural experiences. The CDA plays a vital role in sustaining its success and fostering its continued growth. For more information about the Fort Worth Cultural District Alliance, visit www.fwculture.com.

YPI Sells 3 Restaurant Parcels at Midlothian Towne Crossing

MIDLOTHIAN, Texas (Feb. 4, 2025) – Dallas-based Younger Partners Investments (YPI) recently sold three restaurant land parcels at the Midlothian Towne Crossing shopping center. YPI acquired the 99%-leased retail center in December 2023.

The parcels sold include Chili’s Bar & Grill at 2250 FM 663, McDonald’s at Hwy 287 and FM 664, and Chick-fil-A at 2010 FM 663. CBRE’s Jared Aubrey and Michael Austry represented YPI in the sale to undisclosed buyers. The sale prices were not disclosed.

Midlothian Towne Crossing features 147,161 square feet of retail space on 34 acres at the southeast corner of the FM 633 and Highway 287 intersection in Midlothian, about 25 miles south of Dallas.

Built in 2019, Chili’s is located on a 1.69-acre pad site and has a 10-year lease. The restaurant features a dedicated curbside pick-up, ample parking and excellent ingress and egress along FM 663. The site pad that McDonald’s occupies also has a long-term lease. Built in 2022 on 1.07 acres, the corporate location includes a double drive-thru, abundant parking and excellent ingress/egress. Chick-fil-A was built in 2018 on a 1.73-acre pad site with a 20-year lease. The quick-service restaurant has two drive-thru lanes with indoor seating and ample parking. Chick-fil-A is the third largest fast-food restaurant chain in the U.S.

“Less than a year after we closed on Midlothian Towne Crossing, we are pleased that CBRE has successfully marketed these pad sites, which will be a great addition to any company’s portfolio,” said Younger Partners Investments’ Cort Martin. “This retail center is in a high-traffic location with about 2.9 million visitors a year and a growing Midlothian population, which has grown more than 6.8% since 2010 to now almost 47,000 strong.”

The Class A power center, anchored by Kroger, is comprised of several national brand tenants including Ross, Burkes Outlet, Petco, Ulta Beauty and Famous Footwear serving as junior anchors. Additionally, there is a complementary 65,656 SF of shop space offering a mix of retail, service and restaurant tenants.

“Midlothian Towne Crossing is anchored by the 13th most visited Kroger in Texas, which shows the viability of the power center and these pad sites,” said Aubrey, senior vice president with CBRE’s Private Capital Investment group.

“This location is in the path of growth,” Austry, also a senior vice president with CBRE, added. “With an average household income of more than $120,000, Midlothian is a great place for retail.”

Midlothian Towne Crossing is surrounded by 9,938 planned or under-construction single-family homes and 513 planned or under-construction multifamily units within a five-mile radius of the property, according to Esri 2022.

YPI acquired its first retail asset in 2021. In January, YPI acquired a two-property, 288,063-square-foot retail portfolio from the developer, Weber & Company, bringing YPI’s portfolio to more than 1 million square feet of retail. The acquisition also marks YPI’s expansion into East Texas while strengthening its existing North Texas holdings.

Younger Partners Brokers Sale of Prime Land in Sherman

SHERMAN, Texas (Jan. 14, 2025) – A New York-based investment group acquired 4.7 acres at the northeast quadrant of US 75 and Peyton Street in Sherman, Texas, for multiple commercial uses including possible hospitality opportunities.

Younger Partners Executive Vice President Tom Grunnah and Associate Luke Nolan represented the seller. Younger Partners Associate Nan Li represented the buyer. The all-cash sale closed within 45 days. Sales price was not disclosed.

“The property’s C-1 zoning designation sets this land up to serve the immediate needs of the neighborhood,” Grunnah said. “Its location is immediately adjacent to Furniture Row and a future major bank headquarters development. In addition, the land has an ag exemption, making it an excellent investment hold within the city of Sherman. The buyer has ambitious plans to expand its presence in Texas.”

Located at 320 Payton St. in the heart of Sherman, this property is in the path of growth for a city rapidly becoming an investment hotspot with remarkable development potential. With major players like Texas Instruments, GlobalWafers and other high-end manufacturing companies moving in, Sherman is primed for an economic boom. The land is reachable via U.S. highways 75 and 377 (north/south), U.S. Highway 82 (east/west) and multiple state highways and farm-to-market roads and is located 65 miles north of Dallas.

“The property’s accessibility makes it an ideal location as the city continues to expand,” Grunnah said. “As the DFW area and surrounding cities continue to welcome an influx of people, Sherman seeks to expand its workforce and add new businesses to accommodate this growth.”

“Our approach is truly a collaborative team effort within the Younger Partners Land Group,” Li emphasized. “By working together, we ensure our clients – both seller and buyer – benefit from the full scope of our combined knowledge, resources and industry connections.”

Younger Partners Investments Acquires 288,000-Square Foot Retail Portfolio

MCKINNEY and LONGVIEW, Texas (Jan. 6, 2025) – Dallas-based Younger Partners Investments (YPI) acquired a two-property, 288,063-square-foot retail portfolio from the developer, Weber & Company.

The addition of these properties brings YPI’s portfolio to over 1,000,000 square feet of retail. The acquisition also marks YPI’s expansion into East Texas while strengthening its existing North Texas holdings.

“These high-quality, Class A regional centers built in 2007 & 2008 respectively, have never traded. The centers have very limited vacancy. We are thrilled to enhance value when opportunities arise, such as the recently announced Party City bankruptcy. This creates an opportunity for a freestanding 12,000 square foot user in 380 Towne Crossing,” said Managing Director, Micah Ashford.

The 137,287-square-foot 380 Towne Crossing is at 2014 W. University Drive, at the northwest corner of US 75 and SH 380 in McKinney. The center is shadow anchored by Super Target and Lowe’s Home Improvement. The center’s occupancy is 98.2%, with a diverse tenant mix including FedEx Office, Buffalo Wild Wings, Leslie’s Pool, Cook Children’s Pediatrics, Storming Crab, Jimmy John’s and Sleep Experts.

“McKinney, known for its small-town charm and big-time growth, is the fourth-fastest growing city in the nation,” said Kathy Permenter, Co-Managing Partner. “380 Towne Crossing has prime visibility from two major highways and is close to Raytheon’s McKinney campus. These and other factors make it an ideal location for robust tenant sales.”

The 95.6%-occupied Longview Towne Crossing consists of 150,775 square feet. Located at 3092 N. Eastman Road at the northeast corner of US 259 and Hawkins Parkway, the property’s anchors are PetSmart, Five Below and Old Navy. Target and Kohl’s serve as the center’s shadow anchors. Other tenants include James Avery, Cowboy Chicken, Sport Clips, Ulta Beauty, Crumbl Cookies, Sleep Number and Lane Bryant.

“Longview enjoys an exceptional infrastructure that has attracted companies, including Westlake Chemical, Eastman Chemical and Komatsu. We anticipate more companies will target this region for expansion in the coming years,” said Moody Younger, Co-Managing Partner.

Younger Partners Brokers Sale of Midway Square in Addison to AMLI for Mixed-Use Development

ADDISON, Texas (Dec. 12, 2024) — Younger Partners Executive Vice President Ben McCutchin and Consultant Sam Kartalis brokered the sale of the eight-acre former Midway Square Shopping Center, at 14833 Midway Road in Addison to AMLI Residential. Located within the 79-acre Midway South neighborhood, the aging center was earmarked for redevelopment and now will become a key addition to AMLI’s highly anticipated AMLI Treehouse mixed-use development. McCutchin and Kartalis represented both the seller, VVI, Inc. and the buyer, AMLI Residential.

McCutchin has close ties to the property as this was an integral component of the 150-acre homestead that his mother purchased some 60 years ago when it was farmland. Over the years, the McCutchin family selectively developed the 150-acre farm into various successful projects, which included the Midway Square Shopping Center.

First developed in the early 1980s, the Midway Square Shopping Center served as a local destination with several well-known restaurants including the Midway Point and Jaxx Steakhouse, among others. Since 2020, the Midway Square Shopping Center grew increasingly difficult to maintain.

“This was one of the last large-acre, single-owner development sites on Midway between LBJ and Belt Line,” McCutchin said. “The shopping center was aging and would have required millions of dollars to bring it up to date. The ownership decided it was best to put it on the market and felt that it could fit in well with AMLI’s existing development next door.”

Kartalis noted that this property attracted multiple premier multifamily developers interested in its acquisition. “We went with AMLI because of its excellent reputation within the Town of Addison and its proposal to create a truly mixed-use development, a requirement of the Midway South neighborhood overlay.”

“Soon, AMLI will commence demolition of the 40-plus-year-old structures and incorporate the site into its AMLI Treehouse development south of the site, which broke ground about a year ago and will now extend up to Beltway Road,” Kartalis said.

“AMLI’s experience with its existing AMLI Addison apartment community and AMLI Treehouse mixed-use development is visible evidence of its ability to create something iconic on this property to the satisfaction of the neighborhood and the Town,” he added.

AMLI Treehouse is slated for its first resident move-ins in the first half of 2026 and completion by the middle of 2027. Once complete, the overall community will include 570 luxury apartments, 30 luxury rental townhomes, 56 for-sale townhomes, 3.7 acres of green space and 12,500 square feet of stand-alone retail. The retail is actively being marketed by Thomas Glendenning with SHOP Companies.

“Special thanks to Ben and Sam for entrusting AMLI to honor the McCutchin legacy through a continuation of our existing AMLI Treehouse development. Redevelopment of Midway Square unlocks numerous community benefits and completes the Town’s vision for the burgeoning Midway South neighborhood. The mixed-use community will offer plentiful green space, desirable destination retail and outstanding housing choices,” said Robert Lapp, AMLI Development Co. Vice President.

“This will be a high-end project that really benefits the Town of Addison,” McCutchin said. “My family would be pleased with the legacy of what is happening on the land.”

About AMLI Residential

A 2023 USGBC LEED Homes Awards Outstanding Developer and Power Builder and a 2023 EPA ENERGY STAR PARTNER of the Year, AMLI Residential focuses on the development, acquisition and management of environmentally responsible apartment communities throughout the U.S. Founded in 1980, AMLI is owned by PRIME Property Fund, a core commingled institutional fund. AMLI owns and manages 78 apartment communities, including approximately 25,600 apartment homes, and has over 3,100 additional apartment homes under development at seven new communities. AMLI is a leader in multifamily sustainability. Forty-nine AMLI communities are LEED®-certified and 47 communities are ENERGY STAR®-certified. For more information, visit AMLI.com.

Younger Partners Brokers Site for Carwash in Adaptive Reuse Project

LAKE HIGHLANDS, Texas (Dec. 10, 2024)— Younger Partners Senior Vice President Michael Ytem and Associate Luke Nolan successfully brokered an off-market sale of a vacant 11,200 square feet CVS at 10666 E Northwest Highway in the Old Lake Highlands area in Northeast Dallas for an out-of-the-ordinary adaptive reuse project.

Younger Partners brokered the deal between the seller, Sierra Properties, and the buyer, Victron Energy Inc. Vice President Mohamed Sharaf.

“When CVS did not renew its lease, I recognized there was an incredible opportunity to leverage the existing building that was soon to go dark,” Ytem said. “I brought in a buyer that saw the potential in an adaptive reuse play, transforming the empty CVS into a state-of-the-art carwash facility.”

“Pharmacy brands like CVS continue to reevaluate their real estate strategies, driven by oversaturation and a shift to smaller, more efficient formats. This trend has made larger stores increasingly obsolete, opening the door for groups to repurpose highly sought-after real estate,” Nolan said.

This site, on 1.15 acres on the hard corner of E. Northwest Highway and Plano Road, is a major intersection, heavily trafficked for morning and evening commuters, Ytem added. “Establishing a carwash site fills a major void between 635 and 75.”

“I was looking to repurpose the building after CVS closed. Michael Ytem and his team were able to locate numerous potential buyers and tenants in a timely fashion. They followed up every step of the way and their detail-oriented approach made this process seamless,” said Sierra Properties Owner John Kenny.

Sharaf added that the site’s location is in a key urban market on a busy corner which is one of the main attributes that makes the property so attractive.

“Breathing life back into an abandoned site provides a unique opportunity to be creative as we need to find a way to cut entrances, windows, fit equipment, tear out the mezzanine, change the grading and flooring to accommodate vehicular instead of pedestrian traffic,” he said.

Wash Masters is owned by Victron Energy and was started by Ali Sharaf in 2004 when the first location opened in Irving. Securing this deal in the company’s 20th year means a lot to Mohamed Sharaf.

“We recently became the largest car wash chain in the DFW area and are excited to open our second location in Dallas proper,” he said.

Lake Highlands boasts a population of 99,360 and is primarily a residential community. The addition of a new car wash facility demonstrates the area’s commitment to accommodating new residents as the area continues to boom.

“As a Lake Highlands resident, I was personally vested in bringing positive change to a premier corner with much-needed services,” Ytem said. “This is the second deal we’ve brokered for John at that intersection.”

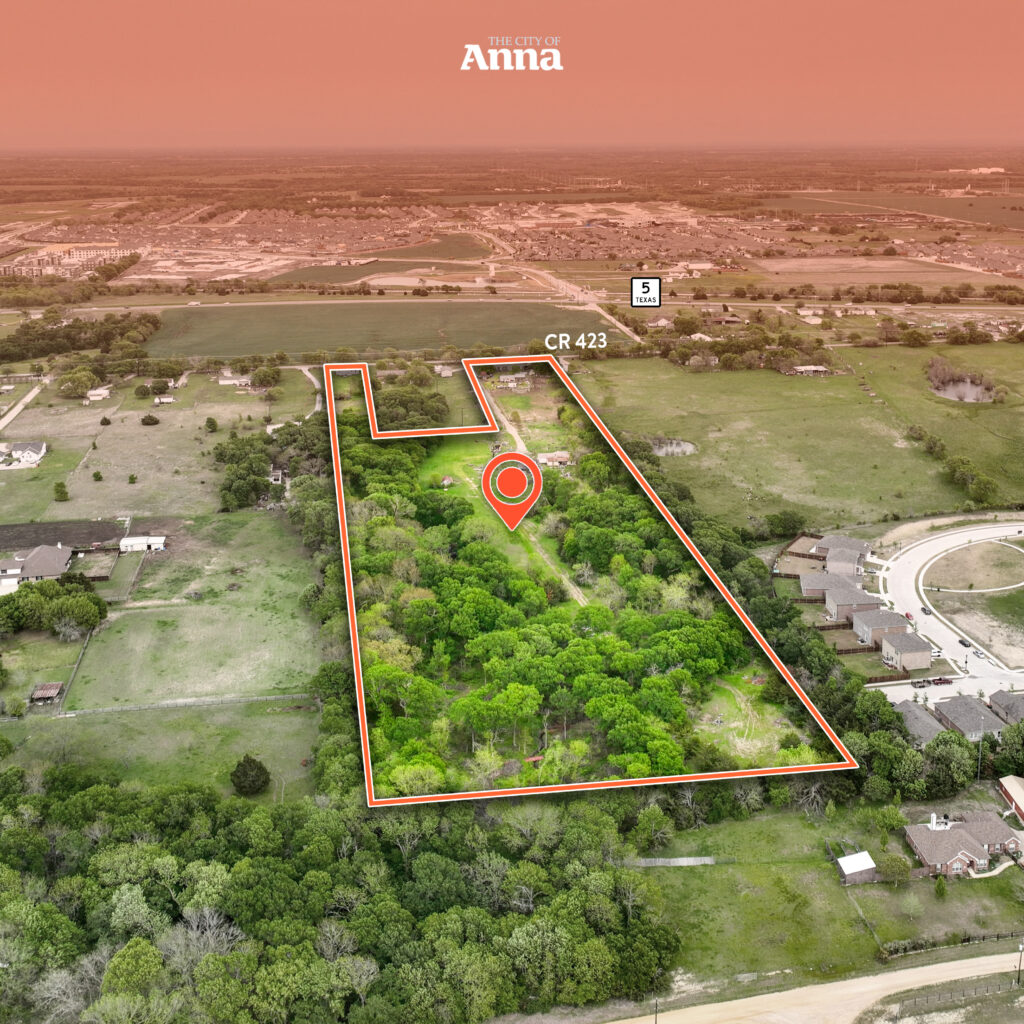

Younger Partners Negotiates Sale of 116 Acres in Anna for Mixed-Use Development

ANNA, Texas (Nov. 19, 2024)— Rockhill Capital & Investments struck a deal with the Cox Family to acquire 116 acres in the North Texas city of Anna, 45 miles north of Dallas. The Frisco buyer will sell fully entitled tracts of land to homebuilders, multifamily and commercial developers, as well as end-users at County Road 371 and State Highway 5, approximately two miles east of the booming U.S. 75 corridor.

Younger Partners Executive Managing Director John St. Clair, Vice President Tyler Hemenway and Associate Davis Willoughby represented the seller in the transaction. The sales price was not disclosed.

The single-family portion will be built in phases with development of 325 single-family lots, said Rockhill Chief Development Officer Brent Libby.

“Construction will likely begin early in Q2 2025,” Libby said. “We’ve already sold 82 of the 116 acres to homebuilder Taylor Morrison and they should break ground first.”

Libby added that 9.5 acres on SH 5 is under contract to a commercial developer. Meanwhile, Rockhill is negotiating with a user/developer on the remaining 24 acres, which is zoned for multifamily.

The seller, the Cox Family, owned the land for decades before this sale, Hemenway said, noting that the seller received multiple offers on the property over the years but wasn’t prepared to sell.

“Ultimately, the family wanted to capitalize on the land market before unforeseen market factors took place,” St. Clair added. “This deal took place at the right time with the right buyer.”

The acquisition involved a lengthy zoning process to acquire the land, Willoughby said.

“The Cox Tract is essentially infill on the east side of Anna, and we were able to secure a great entitlement package, which included single-family, multifamily and commercial zoning,” Libby explained. He added that Rockhill created a Public Improvement District (PID) on the single-family portion of the land, which helped the deal move forward.

“The City of Anna was great to work with and supported the project all the way through the process, which was a fairly complicated zoning case,” Libby said.

The transaction made sense to Rockhill, as it expands their current land holdings located in the nearby high-growth cities of Howe, Van Alstyne and Sherman.

“We’ll continue to source and acquire land in the area where we can add value through entitlements, and either develop the property or hold it for some time and exit to another developer or end user,” Libby said.

In addition to this deal in Anna, Hemenway and Younger Partners Senior Vice President Michael Ytem brokered the sale of more than 17 acres of family land in far north Collin County to Ascent Land Ventures for future development. Ytem and Hemenway also have 10.3 acres on the market for sale at a future hard corner of 923 E. FM 455 in Anna.

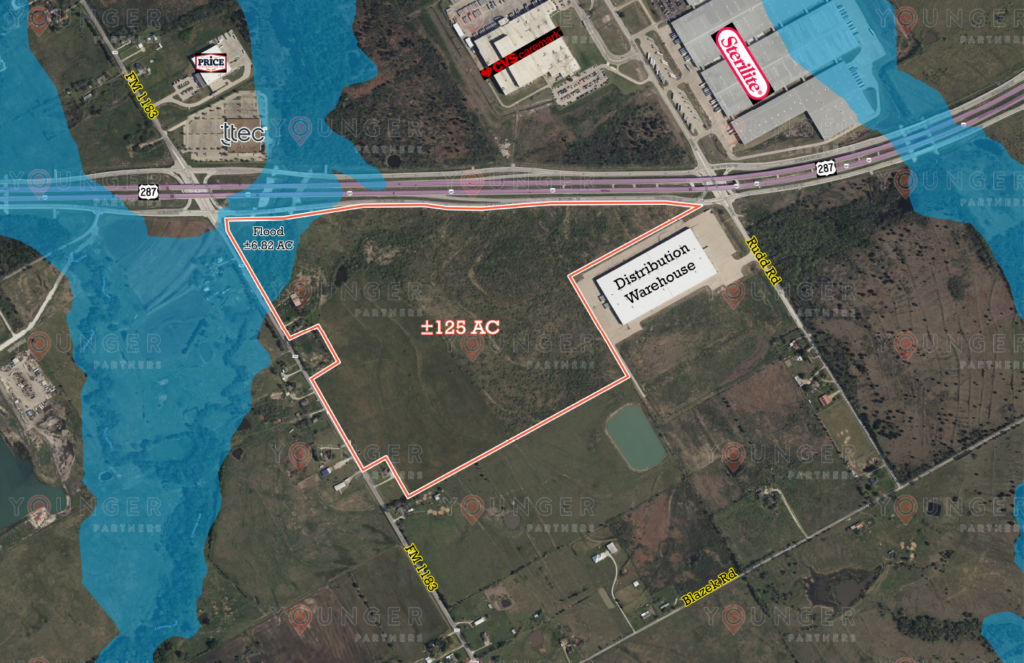

Dallas Company Buys 125 Acres in Ennis; Plans to Consolidate Operations and Distribution Activities

ENNIS, Texas (Oct. 31, 2024)—Younger Partners represented a Dallas company in its acquisition of 125 acres in Ennis, approximately 35 miles south of downtown Dallas. The new landowner plans to use the acreage at U.S. 287 and Oak Grove Road to expand its Metroplex operations.

Younger Partners’ Executive Managing Director—Land Division John St. Clair represented the buyer. The seller and sales price were undisclosed.

The buyer selected the land for its operations because of its proximity to major highway systems and land availability. In addition, Ennis and Ellis County offered the buyer economic incentives to add appeal to the relocation of its operations to the site.

“The buyer had been looking for the ideal site for distribution,” St. Clair said. The company had targeted developed areas in the region of South Dallas but could not find the right property at a reasonable price point.

St. Clair explained that Ennis and Ellis County have been under most developers’ radars. But that might not be the case for much longer. The U.S. Census reported that Ellis County’s population grew by 4.9% in 2023, making it one of the 10 fastest-growing counties in the South. Ennis is also experiencing a population boom, increasing by 17.7% between 2020 and 2023.

St. Clair said Ellis County could become a target for future commercial development along Dallas-Fort Worth’s southern region. The area contains a major highway (U.S. 287), interstates (IH-45 and easy access to IH-35), with plenty of undeveloped land. With people moving to the region it also means a larger skilled labor force, he said.

“Ellis County and Ennis are ideal for industrial development, particularly distribution,” St. Clair observed. “Ennis hasn’t been on the radar for projects like this, but when I brought the buyer down there, they immediately recognized the potential of the location.”

Younger Partners Brokers 17-Acre Land Sale in Far North Collin County Town of Anna

ANNA, Texas (Oct. 29, 2024)— Younger Partners Senior Vice President Michael Ytem and Vice President Tyler Hemenway brokered the sale of more than 17 acres of family land in Anna, TX to Ascent Land Ventures LLC, represented by Brandon Kendall and Tom Dosch from Dosch Marshall Real Estate (DMRE) for future development.

Ytem and Hemenway represented the seller, the heirs of the Copeland/Cottrell/Adams family in the transaction. DMRE Associate Brendon Kendall and Principal Tom Dosch negotiated on behalf of the buyer.

Located about 45 miles north of Dallas, the 17.26-acre parcel (at 9391 County Road 423) is intersected by County Road 422, west of Anna’s Town Square. The land is just minutes away from the under-construction Collin County Outer Loop, which will link the area with the Dallas North Tollway and State Highways 5, 121 and 78.

“Anna is a hot market. Since 2015, the city’s growth has skyrocketed by 1,915% with nearly 6,000 new rooftops added. Its location halfway between Dallas and Sherman is on a growth path coming from Plano and McKinney along U.S. 75,” Hemenway said. “Ranked as North Texas’ ninth fastest-growing city, the town’s appeal is its residential, commercial and industrial real estate development potential.”

Anna’s commercial presence continues to expand, highlighted by the upcoming construction of Home Depot and numerous chain restaurants along the Highway 75 corridor, he added.

“The town’s well-planned infrastructure supports this rapid growth with several key projects in the pipeline, catalyzed by significant additions such as Walmart and expanded city infrastructure extending west of U.S. 75,” he added. “These developments underscore Anna’s evolution from a gas station stop on the way to Lake Texoma to a vibrant community poised for substantial economic and residential expansion.”

“Closing on this property in one of the fastest-growing suburbs of Dallas-Fort Worth is a big win,” Kendall added, noting that the site will be held for future development.

“Despite tight market conditions, deals are still getting done and to the closing table,” Ytem said. “This deal, which is part of a larger assemblage of land that DMRE is developing there, resulted from a relationship with a classmate in The Real Estate Council’s Associate Leadership Council. It demonstrates the power of cultivating connections and operating with integrity and trust.”

Ytem and Hemenway also have 10.3 acres on the market for sale at a future hard corner of 923 E. FM 455 in Anna. Located in the ETJ (extraterritorial jurisdiction) of Anna, the land is designated as a Transitional Development area in Anna’s newly authored Downtown Master Plan. This parcel is also adjacent to the proposed 970-acre Sherley Farms single-family residential community set to include 3,000 homes with 125 acres of open space featuring a central green, pocket parks, along with hike and bike trails. Prosper-based developer Tellus Group – the developer of North Texas large-scale communities from Windsong Ranch in Aubrey to Mosaic in Celina – is the mastermind of Sherley Farms.

Younger Partners Closes Four-Acre Deal in Active East Fort Worth Submarket

Site Near Loop 820 & SH 121 Closed Within Three Months of Listing

RICHLAND HILLS, Texas (Sept. 24, 2024) – Younger Partners Senior Vice President Michael Ytem successfully negotiated the sale of a four-acre parcel zoned business park in the active East Fort Worth submarket.

Ytem represented the seller, Bridge Cap Partners, in the 2525 Handley Ederville Rd. transaction. Forrest Cook, a Senior Vice President at Stream Realty Partners, represented the buyer, G-Catch LLC.

The site near Interstate 820 and State Highway 121 once held the 150,000-square-foot Advanced Foam Recycling which was destroyed in a fire in 2021. Following that event, the structure was razed, and the pad scraped, with the seller acquiring it in 2022 as an opportunistic play.

“The location drove interest in the site. It’s at the very edge of where the East Fort Worth submarket ends and the Mid-Cities begins,” Ytem added. “With major thoroughfare access, it’s ideal for servicing both Fort Worth and Dallas.”

The property sold within three months of its listing date.

“The buyer was highly motivated to close on this deal,” Ytem said.

Cook said that the new owner is an established player in the DFW market, with plans to build flex and retail buildings on the acreage.

“East Fort Worth continues to be a highly sought-after industrial market due to high barriers to entry coupled with excellent labor and connectivity with the Dallas-Fort Worth Metroplex,” he added.

Ytem explained that the seller is a long-term client of Younger Partners Managing Principals Trae Anderson and Sean Dalton.

“It was a true privilege working for Sean and Trae’s client as the designated land expert.” Ytem said, adding that the transaction sailed through with few obstacles. “Forrest Cook was easy to work with on this transaction.”

Ytem, along with Younger Partners Executive Managing Director John St. Clair, recently listed Bell County 707 Ranch in the fast-growing Central Texas city of Temple to the market for immediate sale. The 707-acre ranch at West Adams Avenue and Texas 317, two of Temple’s main arteries, just minutes from Interstate 35 has a starting list price of $40 million. On-site amenities include an operational horse ranch, a working stone quarry and several natural springs. Also included is a 4,000-square-foot, 19th-century house built from stones sourced from the land and remodeled in 2015.