Author: Amy Chavez

Younger Partners Brings Rare 707-Acre Parcel to Market

Central Texas region

TEMPLE, Texas (July 9, 2024) – Younger Partners Executive Managing Director John St. Clair and Senior Vice President Michael Ytem have brought the 700+ acre Bell County 707 Ranch, in the fast-growing city of Temple, to the market for immediate sale.

Located about 128 miles south of Dallas and 74 miles north of Austin, the Central Texas tract is currently zoned for agricultural use and offers rare and compelling commercial and residential opportunities in a fast-growing Texas city.

The 707-acre parcel is at West Adams Avenue and Texas 317, two of Temple’s main arteries, just minutes from Interstate 35. On-site amenities include an operational horse ranch, a working stone quarry and several natural springs. Also included is a 4,000-square-foot, 19th-century house built from stones sourced from the land and remodeled in 2015.

“The sellers held the land for decades,” St. Clair said. “Potential buyers expressed interest in the site in the past, but it wasn’t for sale until now.”

The location is in the growth path for Temple, he added. The city has an active health and life sciences sector, anchored by Baylor Scott & White Health. Temple also attracts companies active in the technology and financial services arenas. According to the U.S. Census Bureau, the population increased by 13.4% between 2020 and 2023 to more than 93,000 and is anticipated to reach 100,000 residents by spring 2025.

“Temple’s growth has moved west and gone as far as it can,” Ytem said. “Ranch 707 is between that growth and Lake Belton, which is the property’s western edge.”

The acreage offers a convenient location, situated close to new retail outlets and educational institutions while offering the peace and serenity of the agricultural land. Ranch 707 is also the only parcel of its size available in the immediate area.

St. Clair said the land would be ideal for residential and commercial mixed-use purposes, both of which are in demand. “It’s also a great investment that could offer a good long-term hold strategy,” St. Clair said.

Ytem added that its strategic location also provides an opportunity for a business park with retail and residential components. “It’s about 1.5 hours away from Austin and two or so hours from Dallas,” he said. “With the massive growth along the I-35 corridor and more connectivity between these cities, this ‘tweener’ position could be an ideal home base for companies that do business in both cities.”

St. Clair and Ytem said that Ranch 707 would be an ideal opportunity for an imaginative developer or investor who understands and appreciates the growth occurring west of I-35 in Temple.

“Although Younger Partners is a Dallas-based company, we have successfully transacted Austin-area deals,” St. Clair added. “We anticipate this offering will attract much attention.”

Kelly Stewart Named General Manager of Artisan Circle

FORT WORTH, Texas (June 27, 2024) – Younger Partners announced today the appointment of Kelly Stewart as the new General Manager of Artisan Circle in Fort Worth, Texas. With more than 20 years of experience in commercial real estate, Stewart brings extensive expertise and a proven track record in property management and strategic development.

Artisan Circle is a 282,805-square-foot urban village located at the corner of University Drive and 7th Street. Spanning five walkable blocks, this vibrant destination features salons, spas, gourmet and fast-casual restaurants, virtual reality gaming and a movie theater. It also offers pedestrian-friendly, Class A office space in the heart of the Fort Worth Cultural District.

Stewart previously served as the Director of Property Management for Younger Partners, leading a team managing 5 million square feet of office and retail space. She streamlined operational processes and implemented innovative budgeting software. Her extensive background includes roles as Senior Property Manager and General Manager, highlighting her exceptional financial, operational and client management skills.

Stewart holds a Bachelor of Arts in Chemistry and a master’s degree in Land Economics and Real Estate from Texas A&M University. She is a Certified Property Manager and a licensed Real Estate Salesperson.

“We are excited to see Kelly transition into the role of General Manager at Artisan Circle,” said Kathy Permenter, co-owner of Younger Partners. “Her vast experience and commitment to excellence make her the ideal leader to guide our team as we transform Artisan Circle into a vibrant lifestyle hub for dining, shopping and entertainment. Kelly’s talent for finding innovative solutions to complex challenges aligns perfectly with our mission to establish Artisan Circle as a premier destination for Fort Worth residents and visitors alike.”

Stewart’s leadership will enhance Artisan Circle’s operations, build strategic partnerships and elevate the overall visitor experience. Her dedication to maintaining quality assets while balancing business, technology and people ensures that Artisan Circle will thrive and grow under her guidance. For more information, please visit www.artisancirclefw.com.

Younger Partners Welcomes Three Dynamic Interns

Isabella Dennis, Ben Burke & Cade Doggett

Please join us in welcoming three new interns to Younger Partners this summer. We are pleased to introduce them to the world of commercial real estate and help guide them as they start their career journey.

Our interns are Isabella Dennis, Ben Burke and Cade Doggett.

Isabella is a San Antonio native and rising senior marketing major from the University of North Texas. She is ready to shine and showcase her enthusiasm for the industry in the office while reminding everyone that it is possible to work hard and still have fun. When she’s not working, she enjoys hitting the gym, spending time with her friends and doing philanthropy for her sorority, Pi Beta Phi.

Hailing from Oklahoma City, Ben attends Southern Methodist University. He demonstrates his philanthropic spirit, showcased through his volunteer work with St. Jude’s and the Oklahoma City Regional Food Bank. Outside of work, he spends his time golfing, watching football, writing and listening to music.

Rounding out our interns is Cade from Argyle. He is a rising senior at Ole Miss where he studies Business Real Estate. He is a member of the Kappa Sigma fraternity and a volunteer with the Kappa Sigma Military Heroes Foundation. He’s eager to learn more about the CRE industry during his time at Younger Partners. His hobbies include fishing, golfing and anything that involves being outdoors.

New Property Management Assignments for Two Dallas Office Buildings

DALLAS (June 11, 2024) Younger Partners Property Services (YPPS) was awarded property management and leasing assignments for Park Cities Tower at 7001 Preston Rd. in Dallas. YPPS was also awarded the management assignment for Hillcrest Oaks at 6600 Lyndon B. Johnson Fwy. in Dallas.

“We are thrilled to add these properties to our growing portfolio,” said Greg Grainger, president of Younger Partners Property Services. “Our property services platform caters to investor clients who demand an entrepreneurial mindset. We tailor our property services to the client’s needs, not the other way around.”

These assignments boost YPPS’s property portfolio of office, retail and industrial to more than 50 properties.

The five-story, 66,814-square-foot Park Cities Tower was built in 1986 and is ideally located property near University Park at the corner of Lovers Lane and Preston Road, close to the Dallas North Tollway. The building is located within walking distance of multiple amenities, including restaurants and coffee shops. The property offers its tenants ample parking and on-site management. It is owned by Swiss-headquartered PCT Partners Ltd. Younger Partners Managing Principal Sean Dalton leads the leasing efforts for Park Cities Tower.

Hillcrest Oaks is a two-building, 183,967-square-foot office park offering an on-site conference center and café, complimentary 24/7 fitness center, security card access, and covered parking. The location fronts LBJ Freeway (Interstate 635) and provides outstanding access to local restaurants, shopping centers, and all three DFW airports. Baltimore-based Pratt Street Capital owns Hillcrest Oaks. “We are delighted to continue our long-term relationship with Pratt Street Capital. We already oversee the property management for three other Dallas buildings they own – Brookriver Executive Center I & II, Woodview Tower, and Wellington Centre,” Grainger added. “It is a testament to our outstanding team of professionals that we have been awarded this additional assignment.”

Younger Partners Awarded 500 E. John Carpenter Office Tower

LAS COLINAS, Texas (June 4, 2024) – Irving-based Koa Partners selected full-service commercial real estate firm Younger Partners to exclusively lead the leasing efforts of 500 E. John Carpenter Freeway in the upscale Las Colinas-Irving submarket. The eight-story 204,665-square-foot Class-A urban center building is on nine acres with prominent visibility along John Carpenter Freeway (SH 114).

Younger Partners Managing Principal Sean Dalton, Senior Vice President Parker Morgan, and Co-Managing Partner Kathy Permenter will oversee the leasing efforts for the project.

“Discerning tenants will appreciate the building’s unobstructed views, which include downtown Dallas, the Las Colinas Country Club and the surrounding Urban Center,” Dalton said. “Additionally, area amenities are some of the best in class. 500 E. John Carpenter is just minutes

from the Toyota Music Factory and Water Street mixed-use developments, restaurants, hotels and golf courses.”

“This building offers prospective tenants amazing amenities, as well as a great location in Las Colinas,” said Koa Partners Chief Executive Officer Harry Lake. “We strive to offer office space that provides solutions to companies looking to attract and retain top-quality talent, all while emphasizing our core value of stewardship. We have great faith in Sean, Kathy and Parker to make matches that benefit tenants and Koa, alike.”

Morgan said the building offers tenants a spacious conference center equipped with A/V, ample lounge seating, a full-service café, a fitness center with locker rooms and showers, picnic tables and 24-hour building security.

Built in 1986 and renovated in 2009, the building features 44,000-square-foot floor plates on the first three floors with 16,000-square-foot floor plates on floors four through eight. The building also features a 5/1,000 parking ratio in its six-level covered garage, electric car charging station and plenty of visitor parking.

“500 E. John Carpenter is one of the best corporate office locations in the Metroplex just 10 minutes from DFW International Airport, 15 minutes from the Dallas Love Field Airport and 20 minutes from the Dallas CBD,” Permenter said. “The building is also just one mile from DART’s (Dallas Area Rapid Transit) Orange Line running from the Dallas CBD to Las Colinas and into DFW Airport.”

About Younger Partners

Dallas-based Younger Partners is a full-service commercial real estate firm providing investment, leasing, and management services to investors and tenants in the Dallas/Fort Worth region. They also specialize in the acquisition and disposition of land, multifamily, office, industrial, and retail properties. Younger Partners Investments (YPI) is a Younger Partner’s platform designed to acquire retail properties. Launched in July 2020, YPI targets retail properties from lifestyle to neighborhood centers throughout the DFW area. Younger Partners and YPI are also affiliated with the Apricus Realty Capital. For more information, please visit www.youngerpartners.com.

About Koa Partners

Dallas-based Koa Partners is a character-driven team delivering real estate solutions. As a real estate acquisitions, development, and transaction management firm, the firm’s primary focus is on commercial real estate opportunities in US markets. With a proven track record in both entrepreneurial and institutional environments, Koa Partners’ services include real estate acquisition, development, asset management, advisory, and project management in office, healthcare, industrial, and mixed-use projects. For more information, please visit www.koapartners.com.

NTCAR’s Newest Hall of Fame Inductees

As of 2019, it took exactly 288 pages to tell the story of North Texas Commercial Real Estate. That number is about to grow.

Bound in a textured forest-green, the cover of “The Book” features silver-embossed letters, all capitalized, that spell out its title. It tells the story of the region from the context of the people who helped shape it: giants like Trammell Crow, Henry S. Miller Jr., Roger Staubach, Ray L. Hunt and the Stemmons family. The volume’s intent is summed up on page 5: “We strongly believe in the fact that those committed to a successful future must have an appreciation of the past.”

Iconic Stemmons Towers Sale Earns Finalist Recognition as One of the Best 2023 Property Sales in DFW

Younger Partners’ Stemmons Towers sale earned finalist consideration for D CEO’s 2024 Commercial Real Estate Awards in the category of Best Commercial Property Sale alongside NOVEL Turtle Creek, Qorvo Semiconductor and Texas Osprey Portfolio. The CRE firm was also named a finalist in the Dallas Business Journal’s 2024 Best Real Estate Deals in the Commercial Property Sale category, alongside CityLine campus sale, Link Logistics acquisition of Stockbridge business parks and the Plaza of the Americas sale.

Both news organizations selected the iconic four-story four-building Stemmons Towers project for the awards competitions. The historic 285,312 SF project, on 13 acres, at 2700 N. Stemmons Freeway in Dallas was sold to Sava Holdings Ltd. Younger Partners Executive Managing Director John St. Clair and Managing Principal Trae Anderson represented the seller, 2700 Stemmons LP, in the transaction.

“Though we did not end up winning either award, it is an honor to be recognized alongside other transactions of such high caliber,” St. Clair said. “Congratulations to Richardson’s CityLine for its selection by both the D CEO and DBJ BRED awards.”

“We are proud of the work we did in this transaction and can’t wait to see how Sava transforms these buildings,” Anderson added.

Built in the 1960s, the Stemmons Towers have a storied history of being one of the first Dallas high-rise office projects outside of downtown. This project will be one to watch with the transformation of a highly visible four-building office campus on I-35 into a residential complex with 10+ acres of park-like landscaping and amenities.

The location stretching along Stemmons Freeway near the Medical District and Dallas Love Field in conjunction with the property’s iconic history and architecture makes this a prime redevelopment site for Sava Holdings. A huge thank you to Sava Holdings for making the shrewd decision to reposition the properties.

Trae Anderson Shares Insider Tips in Latest CRE Project Podcast Episode

If you’re seeking insights into the dynamic world of commercial real estate (CRE), the latest CRE Project Podcast is a must-listen. In this episode, Trae Anderson, a prominent figure at Younger Partner, shares invaluable wisdom on #RelationshipBuilding, #DealMaking, and #Mentorship within the realm of Commercial Real Estate. With a captivating conversational style, Trae delves into the intricacies of forging meaningful connections, navigating negotiations, and the profound impact of mentorship in this ever-evolving industry. Tune in for an enriching dialogue that promises to enlighten both seasoned professionals and aspiring newcomers alike.

10-Acre Land Parcel Near DFW Airport Acquired

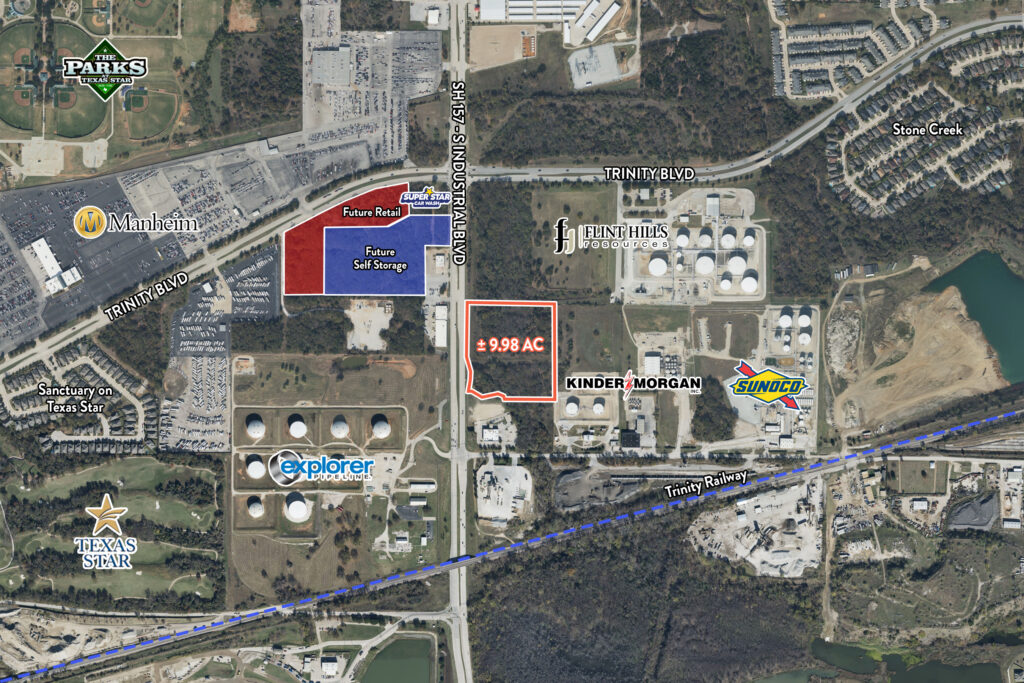

EULESS, Texas (April 16, 2024) – Windhaven Investments Inc. acquired a 9.98-acre infill parcel at 3300 FM 157 in Euless, Texas, near Dallas-Fort Worth International Airport. Younger Partners Executive Managing Director John St. Clair and Associate Luke Nolan brokered the deal between the buyer and seller, Clubwise Finance LP. The sale price was not disclosed.

Zoned light industrial, the acreage fronts Euless’ major north/south FM 157 route. The land’s proximity to DFW Airport and access to Texas Highways 10 and 183 generated potential buyer interest but “Windhaven had the confidence in the tract to close it,” St. Clair said.

The current buyer got the deal across the finish line with plans to hold the land for investment, potentially repositioning it for future sale or attracting developers.

“During the past decade, industrial developers have been focused on larger buildings of at least 200,000 square feet or more,” St. Clair said.

However, Nolan said, the land on FM 157 provides an excellent opportunity to develop smaller buildings that are in demand, thus attracting industrial tenants who don’t require large amounts of square footage.

“That was a big part of the appeal of this transaction,” Nolan added. “This is a great piece of real estate for smaller light-industrial buildings. The new owner won’t have a shortage of tenants or buyers.”

Younger Partners Brokers 76-Acre Land Sale in Growing Grayson County

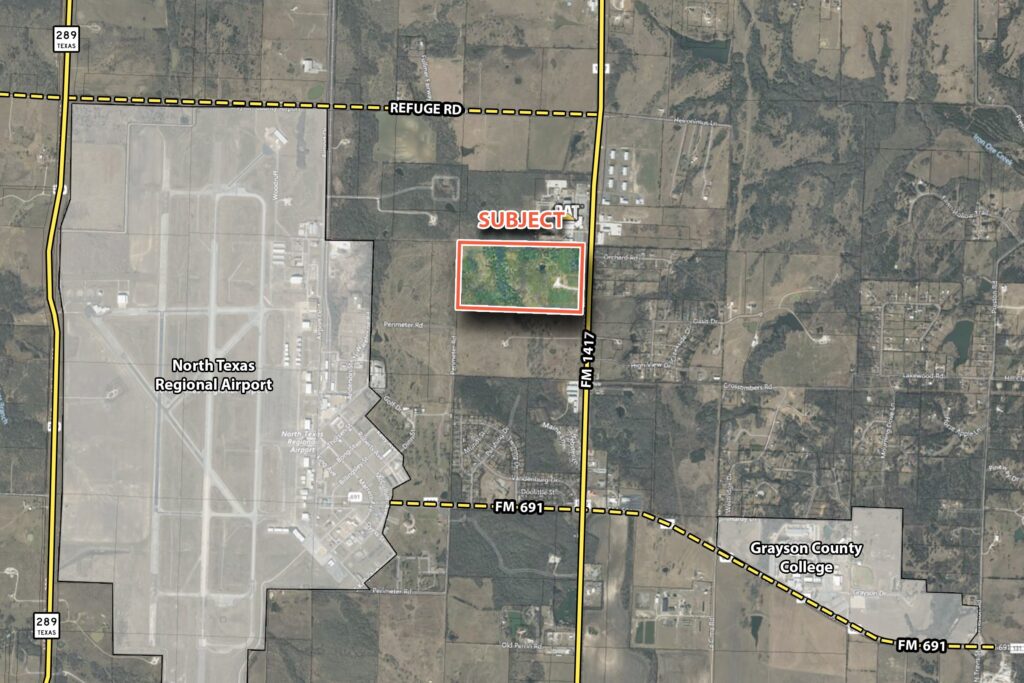

GRAYSON COUNTY, Texas (April 10, 2024) – Investment Catalysts LLC of Southlake, Texas, acquired 75.9 acres on Farm-to-Market Road 1417 in Grayson County, about 70 miles north of Dallas, with the intent to hold the parcel for investment purposes.

Younger Partners Executive Managing Director John St. Clair, Associate Davis Willoughby and Executive Vice President Tyler Hemenway represented the seller, the Estate of Douglas Lee Shankles. The sale price was not disclosed.

“This land acquisition represents perfect timing by the buyer,” St. Clair said. “They made this purchase right there in the bullseye, where everyone is looking for this type of land today. The estate has additional tracts nearby that are available and just as desirable.”

Grayson County borders Oklahoma and is reachable from other parts of Texas via U.S. highways 75 and 377 (north/south), U.S. Highway 82 (east/west) and multiple state highways and farm-to-market roads. The county also benefits from Lake Texoma, one of America’s largest reservoirs, multiple farm-to-market roads, and Texas highways, Hemenway said. The infrastructure and Lake Texoma attracted the interest of Texas Instruments and GlobiTech, who are building multibillion-dollar chip plants near the county seat of Sherman, Texas.

Because of all of these factors, Younger Partners has received significant interest in the land tract, which fronts FM 1417, a major north-south route, Willoughby said.

“Light distribution or light manufacturing companies will need access to these chip plants,” St. Clair said. “The Shankles tract is well-suited for this purpose. Investment Catalysts is the ideal buyer because of its excellent reputation, the best offer and its ability to close.”

“The buyer has a reputation of getting things done and paid a good price for the land,” Hemenway added. “They’re placing money in the path of growth and have an outstanding exit strategy.”

Younger Partners’ Kathy Permenter and Michael Ytem selected for 2024 TREC Executive Committee

Congratulations to Younger Partners’ Co-Managing Partner Kathy Permenter and Senior Vice President Michael Ytem for their selection to The Real Estate Council (TREC) 2024 Executive Committee. TREC is the state’s largest real estate organization, representing more than 600 companies and 95% of North Texas’ commercial real estate industry. Executive committee members provide the expertise and leadership that support the growth of TREC, the Dallas real estate industry and the development of the area’s most underserved communities.

Kathy has more than three decades of commercial real estate industry experience and has been involved with Younger Partners’ overall strategy, vision and growth since its inception in April 2012.

Kathy has served on the TREC Programs Committee and joined the Board of Directors in 2022. As an executive committee member, she will serve as programs chair leading the way for the TREC Speaker Series.

“What I enjoy about TREC is the high level of exposure it has with every company that touches real estate,” she said. “We started this year with a Speaker Series called ‘A Global Perspective.’ We had a great panel talking about events going on globally that affect us locally.”

Joining Kathy on the executive committee, Michael will serve as the Associate Leadership Council (ALC) Class Representative. The ALC program is designed to inspire and educate future commercial real estate leaders in Dallas-Fort Worth. Michael graduated from the 10-month program in 2023, where he participated in monthly leadership development programs and lunches, received personalized executive training, and implemented a community investment project.

Michael focuses on land transactions including development opportunities and long-term holds. A consistent top producer at the company and industry award-winner, he has brokered more than 800 acres of sales totaling some $92 million. He was selected as a D CEO Power Broker from 2019 to 2022 and named a finalist in the 2023 D CEO Emerging Commercial Real Estate Professional of the Year.

“ALC is one of the best opportunities someone in this industry can do for themselves,” said Michael. “Being an active member in this organization has opened the door to a tremendous number of possibilities by connecting me with several folks of the same mindset and objectives in life. It goes beyond what the industry can do for you and allows you to tap into a cause much greater than what you stand to gain.”

Andrew Boster Selected to 2024 NTCAR Board of Directors

Andrew Boster, Senior Vice President at Younger Partners, has been named to the 2024 NTCAR Board of Directors. Founded in 1993, NTCAR (North Texas Commercial Association of Realtors) exists to enhance the business opportunities of its members through real-time access to critical real estate information, education, recognition and networking events. Members benefit from proprietary industry resources and customized services.

In his role, Andrew hopes to enhance business opportunities by creating favorable circumstances for people to get to know each other and do business together. He values spending time with other board members and appreciates each member’s expansive professional network and knowledge within the industry.

“I believe there are many varying recipes for success,” Andrew says about his membership. “Two key ingredients are education within an industry and involvement within the industry. Being on the NTCAR board allows me to get to know the people I want to do business with, not just a voice on the phone or a faceless email signature. More importantly than that, service on the board allows me to promote and improve the broad array of NTCAR initiatives which afford members more opportunities for making long-term business connections.”

With his emphasis on a personal touch in business, Andrew demonstrates the importance of putting a face to a business transaction.

“Andrew is the only currently serving board member who exclusively has a land focus. Though it was not intentional, it puts Andrew in a great place to be the household expert on land-exclusive opportunities,” said Younger Partners Executive Managing Director John St. Clair.

At Younger Partners, Andrew is known for cultivating collaborative partnerships between the landowner and developer. His specialty is finding and assembling off-market opportunities for investors and developers in sought-after submarkets in North Texas. Through the years, Andrew’s efforts have proven his ability to focus on an area considered by many to be too picked over, and quickly pull out off-market opportunities with willing sellers, previously unknown to investors and developers. The results of his work are mutually beneficial arrangements between landowners and developers, maximizing returns for both. Andrew’s present-oriented approach and industry knowledge make him a great asset to the NTCAR Board of Directors.

Elizabeth Meredith selected to join BOMA Greater Dallas Board of Directors

Younger Partners’ Senior Property Manager Elizabeth Meredith was selected to join The Building Owners and Managers Association of Greater Dallas’ Board of Directors. BOMA is a professional organization representing the commercial real estate industry and related service providers by establishing the industry standard of excellence through advocacy, education and networking.

Elizabeth is a seasoned Senior Property Manager with 18 years of expertise in commercial property management, specializing in industrial, retail, office, and new construction properties. She started with BOMA Greater Dallas by joining the Gala Committee. She has served on the Gala Committee as a member and chair and the Networking Committee. She has been active in BOMA attending trade shows, educational seminars, monthly luncheons and various charity drives. In her new role, she will be the board liaison for the Networking Committee and will assist the chairman and co-chairman to ensure they are following the bylaws and reporting back to the board. Elizabeth will serve for three years starting March 2024.

“Elizabeth is an indispensable member of our property management team, tackling day-to-day challenges with tenacity and ingenuity,” said Greg Grainger, Younger Partners Property Services (YPPS) principal. “Clients and tenants alike trust Elizabeth for her reliable and professional approach, which has cemented lasting partnerships. Her ability to cultivate strong relationships and drive success in even the most demanding environments makes her an invaluable asset to our team.”

Elizabeth’s illustrious career includes notable tenures at several well-respected commercial real estate firms, where she consistently delivered outstanding results. As a licensed Real Estate Agent, she brings an understanding of the industry’s intricacies, and handling diverse property portfolios has equipped her with the adaptability required to excel in the real estate market.

“It is an honor to receive this invitation to join the boards of directors,” Elizabeth said. “I feel like this is a significant achievement for me considering the amazing real estate professionals vying for this role.”

With over 700 members, BOMA Greater Dallas is one of the biggest and most successful local associations in the BOMA International Network. YPPS is a dedicated member of the property industry through its BOMA service. Greg was elected to serve on BOMA International’s Executive Committee and was selected as a BOMA Fellow, a group of selected individuals who have displayed exemplary and sustained contributions to commercial real estate and have continually answered the call to leadership and service throughout their careers. An active BOMA member at every level, Greg was president of BOMA/Greater Dallas in 2009 and chair of the BOMA Southwest Region in 2012. He has also served as a chairman on the board of trustees for BOMI International, where his efforts helped facilitate the new BOMA/BOMI joint education initiative and the launch of the Certified Manager of Commercial Properties (CMCP) certification.

Top 10 Producers Shine Bright: Celebrating Excellence

In a year marked by challenges and opportunities, our top 10 producers have undoubtedly risen to the occasion and exceeded expectations! We’re thrilled to extend our warmest congratulations to Ben McCutchin, Trae Anderson, John St.Clair, Tom Grunnah, Andrew Boster, Scot C. Farber, Tom Strohbehn (not pictured), Sean Dalton, Byron McCoy, and Parker Morgan for their exceptional achievements. Their unwavering dedication, expertise, and tireless efforts have not only bolstered our team but also set a remarkable standard for excellence in our industry. We are grateful for their contributions and look forward to continued success together!

DCEO Recognizing Region’s Top Industry Leaders

We’re thrilled to share that 10 members of the Younger Partners team have been honored on the D CEO Power Brokers 2024 list, recognizing the region’s top brokers. Congratulations to Ben McCutchin, Trae Anderson, John St.Clair, Tom Grunnah, Andrew Boster, Scot C. Farber, Tom Strohbehn, Sean Dalton, Byron McCoy, and Parker Morgan for their well-deserved inclusion. This recognition highlights their dedication and expertise in the industry. We’re grateful for their outstanding contributions to our team.

Promotion Milestones: Recognizing Growth and Excellence

In February, Younger Partners announced a wave of promotions, signaling both recognition of talent and strategic growth within the company. Among the highlights were advancements in key roles, showcasing the firm’s commitment to nurturing internal expertise and fostering career progression. These promotions spanned various departments, including brokerage, property management, and support services, reinforcing Younger Partners’ dedication to delivering exceptional service across all facets of commercial real estate. With these advancements, the company continues to solidify its position as a leading player in the industry while empowering its team members to thrive and excel in their respective roles.

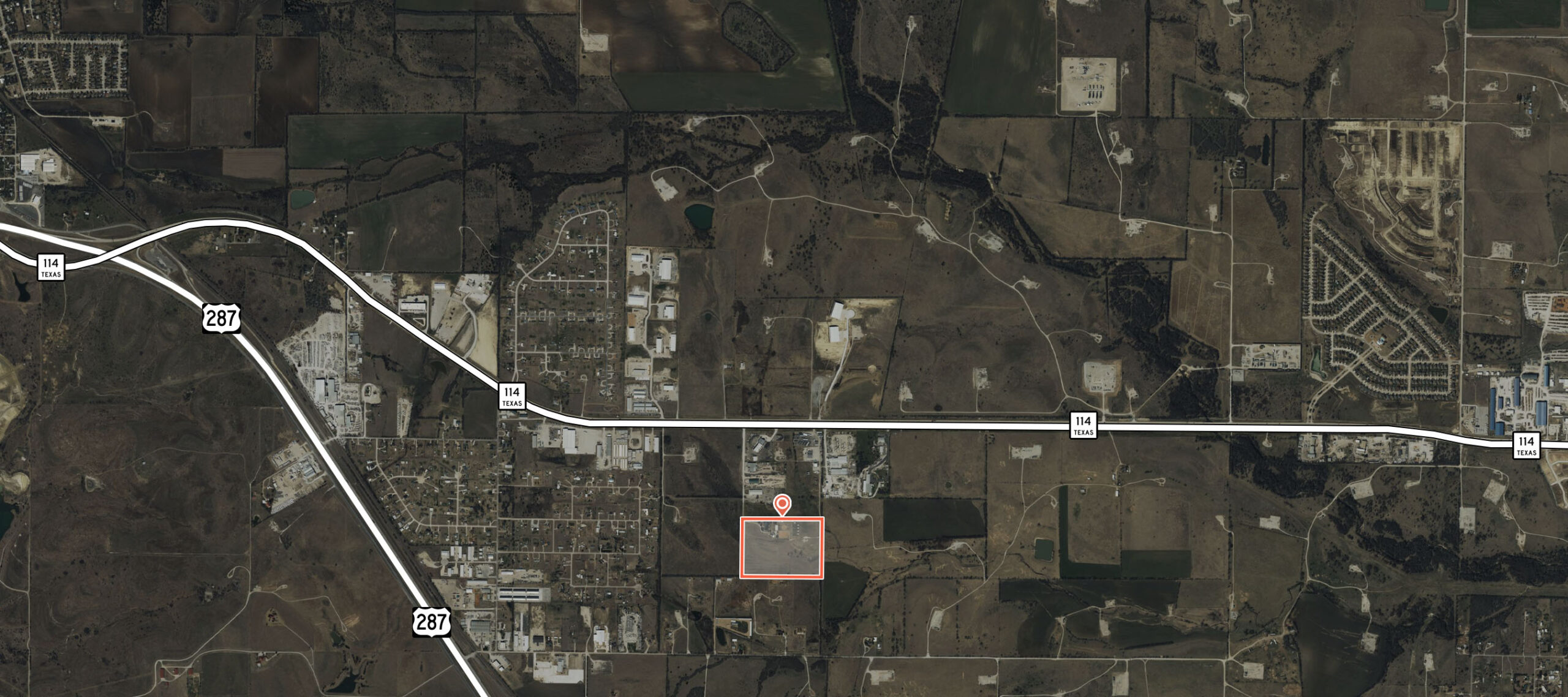

58 Acres of Prime Southwest Fort Worth Land Sold

FORT WORTH, Texas (Feb. 21, 2024) – Younger Partners Principal Carter T. Crow and Senior Vice President Michael Ytem brokered the sale of 58 acres at 5921 South Freeway in Fort Worth on behalf of an undisclosed seller. Justin Toon with Industrial Reserve represented the buyer, which plans to use the site for future development.

The property, near the intersection of Interstates 20 and 35W, has ramp access to both roads. The acreage is within easy access to major southwest Fort Worth employers including Alcon Laboratories, Miller Coors and Ben E. Keith Foods.

“This property possesses great potential for the buyer with its location near major roadways in a fast-growing area of the southwest Metroplex,” Crow said.

“The continuum of a competitive market has forced developers to look at geographic areas they would have initially put on the back burner,” Ytem said. “The southern sectors of both Tarrant and Dallas counties have kept me busy.”

Cities near the just-sold property, including Burleson, Everman and Crowley, have been attracting more people and businesses over the past five years, Ytem said. This makes the crossroads of I-20 and I-35W a prime target for owners and developers interested in taking advantage of this growth.

About Younger Partners

Dallas-based Younger Partners is a full-service commercial real estate firm providing investment, leasing, and management services to investors and tenants in the Dallas/Fort Worth region. They also specialize in the acquisition and disposition of land, multifamily, office, industrial, and retail properties. Younger Partners Investments (YPI) is a Younger Partner’s platform designed to acquire retail properties. Launched in July 2020, YPI targets retail properties from lifestyle to neighborhood centers throughout the DFW area. Younger Partners and YPI are also affiliated with the newly formed Apricus Realty Capital. For more information, please visit www.youngerpartners.com.

Younger Partners Brokers 28-Acre Ranch Sale

Younger Partners’ Ben McCutchin Ends 2023 with Sales Totaling $47M+

Bisnow

By Olivia Lueckemeyer

February 19, 2024

Coppell-based New Dimension Investments II acquired the 27.5-acre Iron Horse Ranch at 265 Iron Horse Court in Rhome. The seller, Black Friesian Stays and Horse Ranch, was represented by Younger Partners Executive Vice President Ben McCutchin. The buyer owns the adjacent property and plans to turn the land into an industrial park.

YOUNGER PARTNERS INVESTMENTS ACQUIRES FORMER FRED’S TEXAS CAFE SITE ADJACENT TO ARTISAN CIRCLE

Fort Worth Texas

By FWTX Staff

11:37 AM on Jan 30, 2024

he Fred’s Texas Café era in the West Seventh corridor is now officially complete.

The 6,500-square-foot property at 915 Currie St., once home to the renowned carefree Fort Worth burger watering hole, has been sold to Younger Partners, the Dallas commercial real estate firm announced on Tuesday morning.

Terms of the deal were not disclosed.

The firm said that it had not decided on a specific redevelopment plan for the property.

The acquisition expands Younger Partners’ footprint in the Artisan Circle, formerly known as Crockett Row, a mixed-use urban village covering five blocks in the southeast quadrant of University Drive and West Seventh. Younger Partners investments acquired the development in August 2022 with plans to infuse millions of new capital.

“We believe in the transformative power of real estate, and with this acquisition, we are poised to bring additional positive changes that will enrich the entire community,” said Kathy Permenter, co-managing partner of Younger Partners, in a statement.

The sellers were Fred’s original owners, JD and Gari Chandler. The original Fred’s restaurant opened in 1978, but the property has been home to a series of diners and cafes since the 1940s. Quincy Wallace, the new owner and operating partner, closed this location in 2021, opening a new location on Camp Bowie the next year. Another store is located on Western Center in north Fort Worth.

Younger Partners recently unveiled a comprehensive revitalization plan for Artisan Circle, which includes enhancements such as new gathering spaces, improved wayfinding, updated signage, and enhanced accessibility.

The development extends to Foch Street on the east and Morton to the south.

“Our vision extends beyond the property lines — it’s about fostering growth, creating value, and ensuring that Artisan Circle becomes an even more integral part of the fabric of Fort Worth’s Cultural District,” Permenter said. “We are excited about the possibilities this acquisition presents for the neighborhood and look forward to playing a key role in its continued development.”

Younger Partners specializes in the acquisition and disposition of land, multifamily, office, industrial and retail properties. Younger Partners Investments is a Younger Partners platform designed to acquire retail properties. Launched in July 2020, YPI targets retail properties from lifestyle to neighborhood centers throughout Fort Worth and Dallas. Younger Partners and YPI are also affiliated with newly formed Apricus Realty Capital.

DALLAS’ LANDMARK STEMMONS TOWERS SELL FOR CONVERSION TO APARTMENTS

Four high-rises near Southwestern Medical District set for redo into residential.

Dallas Morning News

By Steve Brown

2:07 PM on Dec 14, 2023

A landmark Dallas office tower development will get new life as a residential community.

The Stemmons Towers northwest of downtown were originally built by legendary Dallas developers John Stemmons and Trammell Crow. The white concrete and glass towers were patterned after post-World War II modern buildings the developers had toured in Europe and South America. Several of the buildings have small floors with wide roof overhangs between each level.

The more than 13-acre office campus on Stemmons Freeway just sold to Sava Holdings Ltd., an Irving-based hotel development firm. Sava Holdings plans to convert the four office high-rises into an apartment project called the Lumiere.

It’s the latest example of developers reusing older office buildings in Dallas for new residential space.