Category: Research Post

Preparing for the Return of Headquarter Relocations to Texas

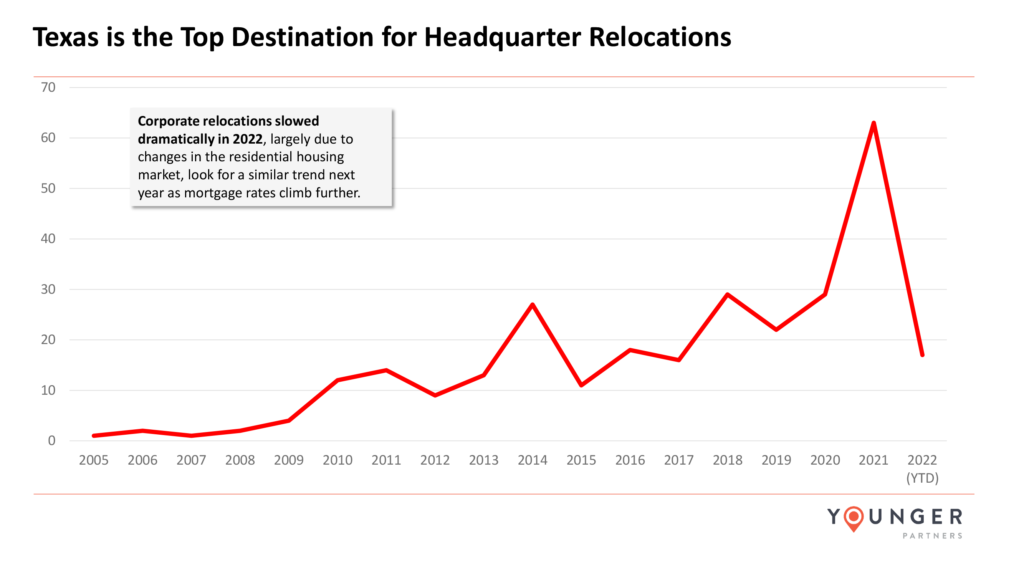

One of the unintended consequences of our sharply rising mortgage rates is the dramatic slowdown in corporate relocations. As the frenzy of commercial real estate activity cools in Texas, savvy business leaders should take this time to reassess their space needs and put thoughtful strategies in place before the market rebounds.

In the near term, C-suite executives understand that most homeowners are extremely hesitant to relocate and purchase a new home because of the higher costs. Over 80 percent of residential mortgages are currently financed at an interest rate less than 3.5 percent, which is well below the 7 percent rate for a 30-year loan today.

Before the recent interest rate hikes, Texas was a hotbed of relocations with 63 companies making a move in 2021. Although this year is not completely over, less than a third of that volume, or 17 companies to be precise, came to the state in 2022.

History proves that the housing market will rise again, just as it did from the recession of 2008 when the recovery was slow and residential markets didn’t stabilize until 2012/2013. Although the future uptick is expected to come quicker than the last cycle, timing is still uncertain.

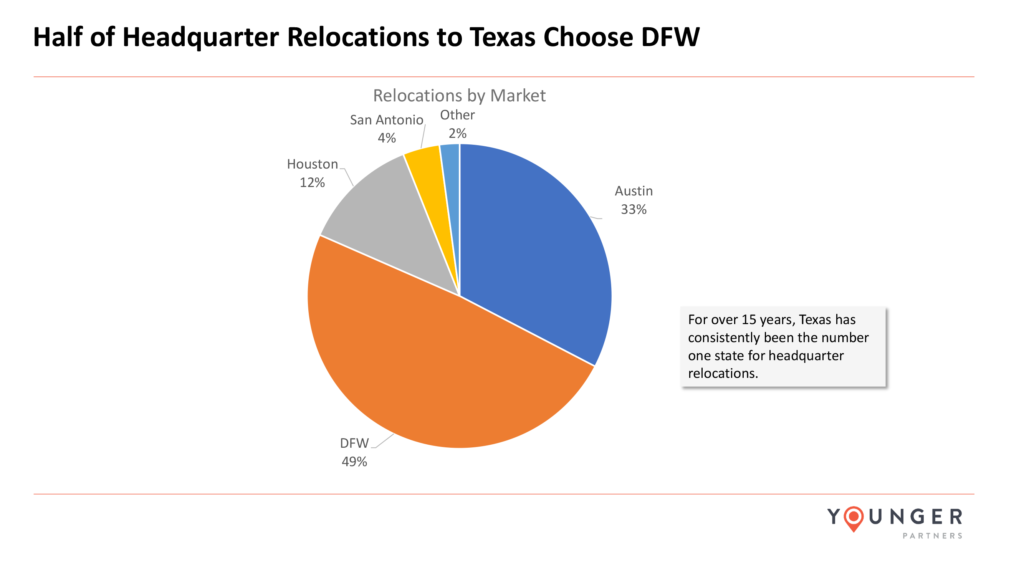

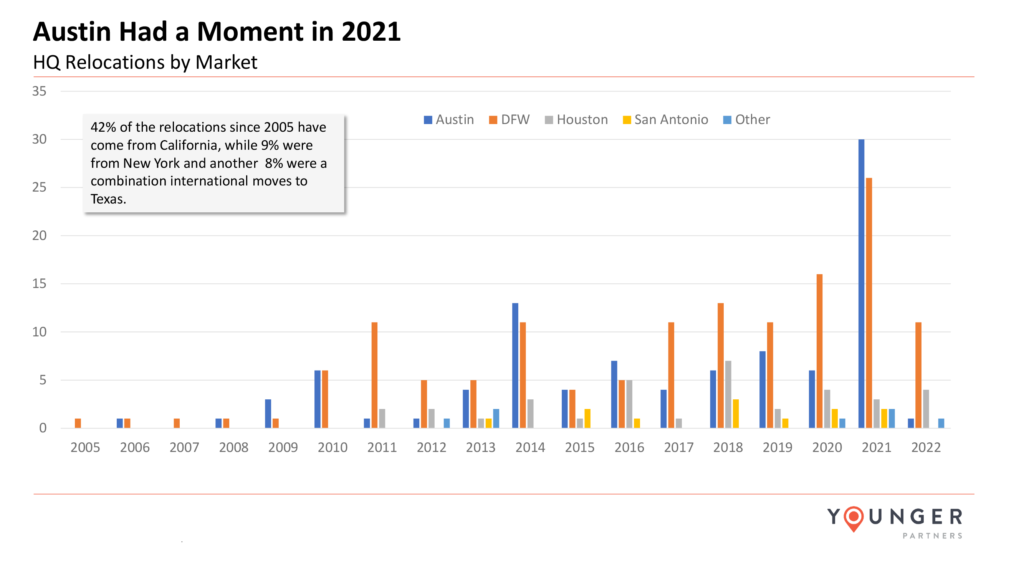

When companies do make the decision to relocate to Texas, almost half will choose Dallas-Fort Worth over the rest of the state. Austin did have a moment in 2021 with a slew of technology relocations, but the historic numbers favor the Dallas-Fort Worth market overall.

With fewer companies touring for potential relocations, office demand is low across Texas. Active large tenants are down roughly 40 percent compared to pre-Covid levels, which is anticipated to last another year or two. Once residential activity adjusts, relocations will be surging into Texas again.

Until that time, corporate leaders should partner with a commercial real estate advisor who can assist with some of the relocation preparations in advance, including:

- Selecting a target submarket that will complement business needs

- Buying land for future development, if needed

- Understanding how major infrastructure developments in the area will affect commutes and labor pools

- Securing economic incentives offered for corporations coming into Texas, or specifically the Dallas-Fort Worth market

- Adjusting the corporate real estate strategy to accommodate hybrid or remote workers

- Creating efficiencies that will reduce relocation costs.

1 Dust Group Takes Space at North Dallas Business Park

1 Dust Group leased 6,686 square feet at North Dallas Business Park, 3109 Garden Brook Dr. in Farmers Branch. Elaine Xu at Younger Partners represented the tenant.

The wholesale electronic products business, which has been providing warehouse and fulfillment services to clients in Asia since 2018, saw an opportunity to expand its existing U.S. business lines with a relocation from Mo. to Texas. North Dallas Business Park’s centralized location will enable 1 Dust Group to provide added storage solutions and quicker fulfillment for customers.

“Dallas-Fort Worth continues to be a magnet for regional, national and even international businesses like 1 Dust Group,” says Xu. “Fulfillment centers such as this benefit from our shipping infrastructure, lower operational costs, favorable tax rates and huge talent pool.”

Front Porch Pantry Delivers Fresh Meals from a 26,000-Square-Foot Food Production Facility

Front Porch Pantry was a relatively unknown contender in the prepared meal delivery business when it launched in 2016 from a small deli kitchen at the back of an Addison liquor store. The Dallas-based company now competes with the likes of Freshly and Factor and ships over 50,000 meals a month across Texas, Oklahoma, Arkansas, and Louisiana.

Founder and Managing Partner Michaelann Dykes claimed her stake in the $10.29 billion global industry with a mission to help busy people eat healthy by delivering tasty home-cooked meals to their doorstep. She began by assembling a cookbook of ‘family favorite’ recipes and started testing her meals.

“The first deli kitchen was fine for making sure my recipes could be precooked from fresh ingredients and reheated without compromise,” says Dykes. Front Porch Pantry initially had two to three customers a week and quickly expanded to a large customer base in the Dallas area. Dykes says the company has an 88% loyalty rate today.

As the menu options for Front Porch Pantry grew, so did the need for more sophisticated real estate. Within the first year, Dykes sought assistance from Tanja McAleavey of Younger Partners who located a commercial gluten-free kitchen with accommodations that were prime for clean cooking. The new facility came with a space expansion option and gave Front Porch Pantry the edge it needed to accelerate in an industry experiencing compound annual growth rate of 13.5%.

In 2019, McAleavey teamed with Jerry Averyt of Younger Partners to find an even larger floor plate that could further scale with company progress. Front Porch Pantry purchased a former office warehouse located at 4600 McEwen Road in Farmers Branch and the pandemic struck during finish-out. Supply chain issues stalled renovations, affecting everything from commercial stoves and plumbing, to build-out on the office and walk-up retail areas. This happened just as Front Porch Pantry’s business, and the prepared meal delivery industry, was skyrocketing.

“No one could have predicted a pandemic that would astronomically affect the industry. Everyone was searching for great meal delivery options, and Front Porch Pantry had them,” says Dykes. “We had difficulty getting many necessary ingredients but with our extensive catalog of recipes, we were able to write and modify recipes according to what was available.”

The doors opened at the new facility in September 2021 and momentum remains strong for Front Porch Pantry. Dykes expects to escalate eight times the current volume as the business takes a national focus.

“Our online ratings speak for themselves. Even customers who love to cook are busy. We give them great taste, great value, and the added convenience of having fully cooked dinners delivered right to the front porch. We deliver in Texas, Oklahoma, Louisiana and Arkansas and look forward to expanding nationwide,” says Dykes.

Front Porch Pantry contact info:

(972) 925-0526

contact@frontporchpantry.com

www.frontporchpantry.com

Kathy Permenter Featured on KRLD CEO Spotlight

Younger Partners Co-Managing Partner Kathy Permenter talks about the company’s recent acquisition of Crockett Row during an interview with David Johnson, host of CEO Spotlight on KRLD 1080-AM.

>>Click here to listen to the August 16, 2022, podcast to learn about upgrades planned for the 282,000-square-foot mixed-use development in Fort Worth’s Cultural District.

Younger Partners Investments Acquires Crockett Row

FORT WORTH, Texas (August 9, 2022) – Younger Partners Investments (YPI) acquired Crockett Row, a 282,334-square-foot urban village with five blocks of pedestrian-friendly Class A retail and office space. Located at the southeast corner of University Drive and West 7th Street, the property sits within the city’s Cultural District just west of downtown Fort Worth.

Younger Partners’ Co-Managing Partners Kathy Permenter and Moody Younger, and YPI Managing Director Micah Ashford, represented YPI in the acquisition. Financing was arranged by Adam Mengacci of Hamilton Realty Finance. Mark Sloan and Jacob Dow at Holland & Knight provided legal representation. Terms of the deal, which was the third acquisition for YPI, were undisclosed.

Embedded within Fort Worth’s larger live-work-play West 7th development, Crockett Row is surrounded by world-class museums, eateries, pubs and entertainment venues, including the new state-of-the-art Dickies Arena. Developed in 2009, Crockett Row’s overall occupancy at the time of closing was 74.6 percent, presenting lucrative opportunities for new tenants to join Movie Tavern, LA Fitness, Fidelity Investments, PMG and Common Desk on the property roster. Younger Partners will handle the property management and leasing of the property.

YPI has plans to freshen the brand and to make improvements to enhance customer experience through the addition of gathering spaces, parking technology to help locate open spaces, improved signage and additional elevators. “We also plan to work with the City to enhance accessibility throughout the property,” said Younger.

“Crockett Row was a target investment for us because of its strong supporting demographic and iconic location in the Cultural District, next to some of Fort Worth’s most affluent neighborhoods,” said Permenter. “The amount of tenant interest in this neighborhood has already far exceeded expectations.”

Crockett Row will benefit from upcoming developments to the area, including Crescent-Fort Worth, bringing 200 luxury hotel rooms, 170,000 square feet of office, and 17 multifamily units within a block from the property in mid-2023. Directly across the street from Crockett Row, the Van Zandt will deliver 147 multifamily units, 100,000 square feet of office and 11,000 square feet of retail, along with upcoming additions Triune Centre, Burnett Lofts and Encore Panther Island.

About Younger Partners

Dallas-based Younger Partners is a full-service boutique commercial real estate firm providing investment, leasing, and management services to investors and tenants in the Dallas/Fort Worth region. They specialize in the acquisition and disposition of land, multifamily, office, industrial and retail properties. Younger Partners Investments (YPI) is a Younger Partner platform designed to acquire retail properties. Launched in July 2020, YPI targets retail properties from lifestyle to neighborhood centers throughout the DFW area. Younger Partners and YPI are also affiliated with newly formed Apricus Realty Capital.

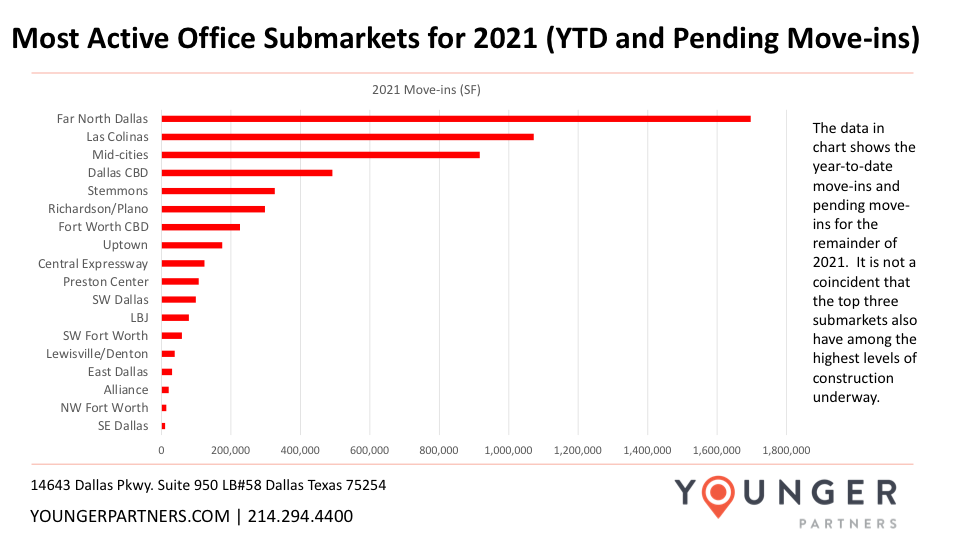

Most Active Office Submarkets for 2021 (YTD and Pending Move-ins)

Far North Dallas and Las Colinas are the two most active submarkets. They both have high levels of construction (both recently completed and projects currently underway). For Far North Dallas, JPMorgan Chase has a phase 2 built-to-suit and along with other construction projects in the Legacy area (Keurig Dr Pepper, Reata Pharmaceuticals) and various spec projects. Las Colinas has Cypress Waters, which continues to deliver multiple properties per year. Mid-Cities has emerged over the past couple of years as a very active submarket due almost exclusively to large built-to-suits like the American Airlines Headquarters that was completed in late 2019 or the multiple phases of Charles Schwab built-to-suits.

Submarket outliers to watch in the future include Uptown and Preston Center (with 1 million and 700K SF, currently underway, respectively). These two smaller, more expensive submarkets have high levels of construction underway, but leasing activity and pending move-ins has not been keeping pace.

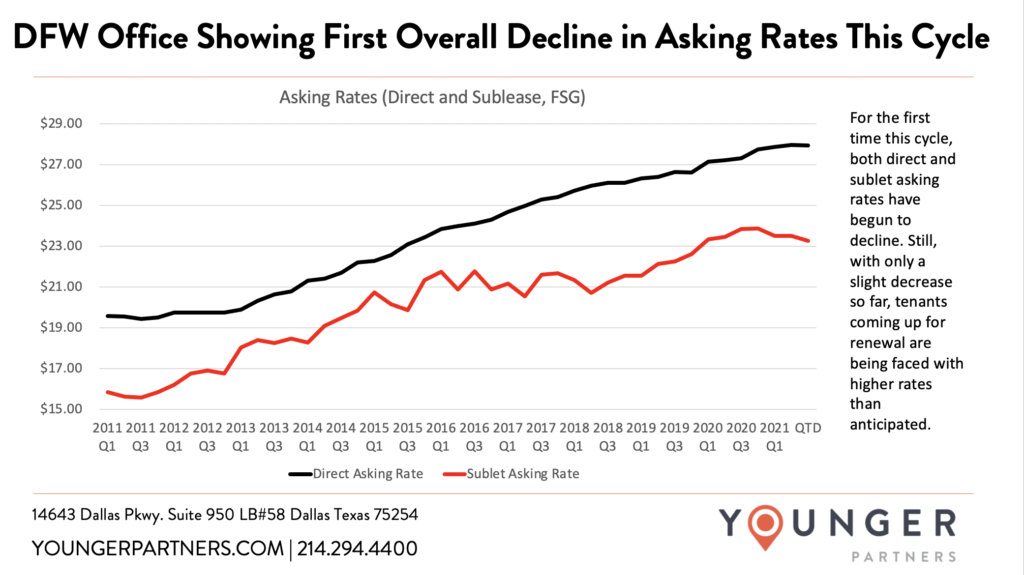

DFW Office Rates Showing First Overall Decline in Asking Rates This Cycle

Asking rates are a lagging indicator to the market fundamentals. After a market downturn, asking rates are not typically significantly impacted until 4 to 6 quarters after the market has shifted. The decline in both direct and sublet asking rates since the end of the second quarter of 2021 should not be surprising as it falls into the typical time range. This decrease in rates, however, has only been slight to date, with overall averages still up on a year-over-year basis.

Specific properties that have reduced their rates since the end of the second quarter include International Plaza II, The Palace Office Center, Westpark Plaza and the Lakes at Bent Tree.

Top Office Design Trends for 2021

By CeCe Grosz, Marketing Intern

Many companies in the Dallas-Fort Worth Metroplex are enjoying the normalcy of returning to the office, with employees once again able to chat by the coffee machine or mingle in the break room. However, some aspects of office design will continue to adapt to the post-pandemic state of the world, and likely won’t return to how they were before. These new office design trends will incorporate new technology and practices into the work environment to improve employee wellness boost employee morale, promote collaboration and corporate culture. Here are the top office design trends we are noticing for 2021:

Hybrid Office

COVID-19 prompted most companies to have their employees work fully from home for several weeks or months. This rapid change in the work environment resulted in employees realizing that they could be productive outside of the office, while being in closer proximity to family and the comfort of their homes. While most employees have already returned to the office, many expect to maintain some remote work, even for one or two days a week: according to Fortune, 63% of high-growth companies are embracing a hybrid work model. Companies can adjust to that by requiring less office space and having employees come into the office in shifts.

Employers are adjusting their office design to feel more “homey” and reduce the stark contrast between working at home versus the office. This includes natural lighting, relaxing spaces around the office for rest or social interaction, as well as incorporating more artwork into the environment.

Increased Sanitization Practices

A trend that has manifested itself throughout the past year is the importance of employees feeling safe when coming to work. Office spaces now feature hand sanitizing stations, increased cleaning of surfaces and touchpoints such as elevator buttons, and the addition of handwashing sinks in kitchen/break room areas.

Kitchen area at Republic Center.

Hot Desks

A new phenomenon for most offices is unassigned seating for employees, also known as “hot desks.” While previously thought that Coronavirus particles were transmitted heavily through shared surfaces, now that we know transmission mainly happens through the air which means unassigned seating could have many benefits for your office.

Research from the University of Arizona found the average office desk to be covered in 400 times the number of bacteria that a toilet seat has. This unsettling finding is the result of office cleaning crews being told not to touch employees’ desks and personal areas. If offices forgo assigning desks and have employees reserve their space before work, the desks can be sanitized after hours to promote a much cleaner workspace.

Biophilic Design

This concept, which aims to incorporate living plants into the corporate office, is taking off in 2021. Biophilic design is inspired by the visual connection between humans and nature. Bringing the outdoors inside boosts the overall quality of life for employees, as well as improving air quality of the office. Companies should consider investing in a “living wall” or adding more plants around the office to improve the health and happiness of their employees. Offices that incorporate plants see increased productivity, improved oxygen flow, and reduced toxins in the air.

Air Quality

In addition to biophilic design, companies have many options to choose from to promote improved air quality around the office. Since COVID-19 began, many offices are updating HVAC systems to enhance the circulation and filtration of air throughout the space.

According to Younger Partners’ Roy Smith, we should be on the lookout for updating HVAC systems to a rating of MERV13. The MERV rating scale stands for Minimum Efficiency Reporting Value and measures the efficiency of the air filter based on what particles it can filter out. “The higher the number, the higher the efficiency of filtration,” says Smith.

While the highest ratings of 16-20 are used mostly in hospitals or nuclear power plants, many offices are upgrading their filtration systems to MERV 13. This rating means that pollen, dust, dust mites, mold, bacteria, pet dander, cooking oil smoke, smoke, smog, AND virus carriers are all filtered out of the air. This would be an excellent investment for the health and safety of your workplace.

When new office spaces are built, companies should seek smart materials that resist mold and have antimicrobial properties, such as copper. The use of these materials will promote better air quality for employees.