Tag: Younger Partners

2022 North Texas Land Absorption Report

As 2022 ended in a rapidly changing market, the year in whole was positive.

By Robert Grunnah and Michael Ytem | March 21, 2023

The North Central Texas land market is still influenced by its prior decade of escalating values, sales and absorption activity. To no surprise, first quarter 2023 land pricing and activity have been primarily affected by rapidly increasing interest rates, the lingering effects of COVID-19, an unstable Global political environment, continued rising inflation, and significant increases in construction costs. A minor disruption in the Oil and Gas market has had a lessening but significant impact on each of the major issues. In reviewing last year’s report, our observations have changed in reaction to the very visible shift in market activity. While listings have slowly increased, prices have seen only a moderate readjustment, sales volume has dramatically declined, and contract defaults (cancellations) are more frequent.

For many years, Younger Partners has produced a report to assist investors in reviewing the viability of acquiring undeveloped land for medium and long-term positive returns. As one of many prognosticators, we utilize our years of brokerage and research experience to add credibility to our observations.

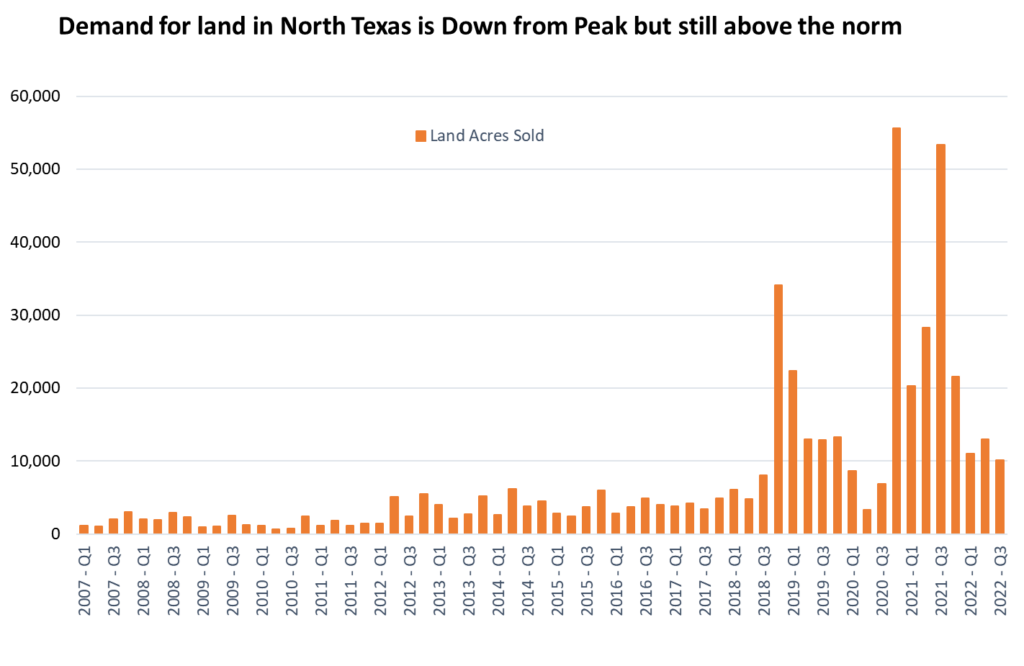

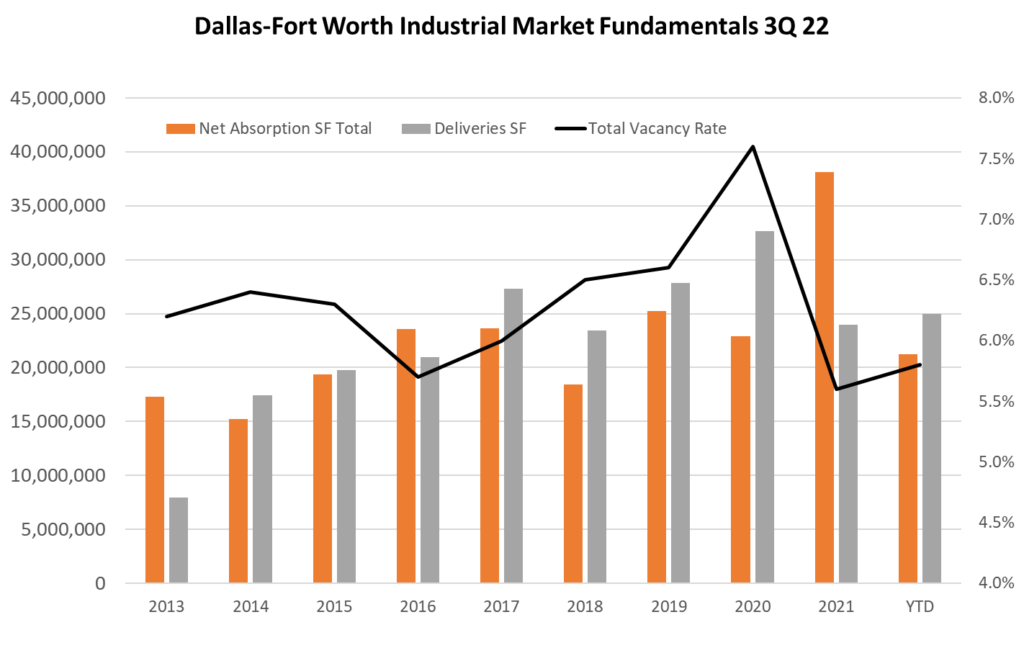

Since our last report in late 2021, DFW has experienced continued growth from the momentum previously gained in most commercial and residential product types, but more recently transitioned to a more limited growth of investment-grade assets. Total transaction volume in the second half of 2022 significantly decreased for both user and investment product for all residential and commercial uses. New absorption of residential land, both developed and undeveloped, and underutilized land, has all but stopped except for well-financed projects currently under construction. One of the few highly respected residential monitoring services recently published a harrowing report for 2023 single-family absorption causing great concern and reactions among major homebuilders. Early 2023, however, has provided an indication that the prior momentum will be moderate and mildly sobering. As sales slow, a pause in planned developments might facilitate the healthy absorption of existing planned products. The single most pressing factor is increasing interest rates, which drives up the cost of construction loans and dramatically reduces the number of qualified home buyers. Year to date, however, while distinctly affected, the result again has been surprisingly moderate. A strong decrease in interest rates would serve pent-up demand in all property types as the single most recovery influence but is not immediately imminent.

Submarkets which were either overlooked or previously bypassed in early 2022 saw significant activity based on proximity and access to core business centers, or much lower land prices. That trend has slowed along with any aggressive, new vertical development projects. The “work from home” popularity has allowed for peripheral residential projects to have more success based on lower land cost and smaller footprints.

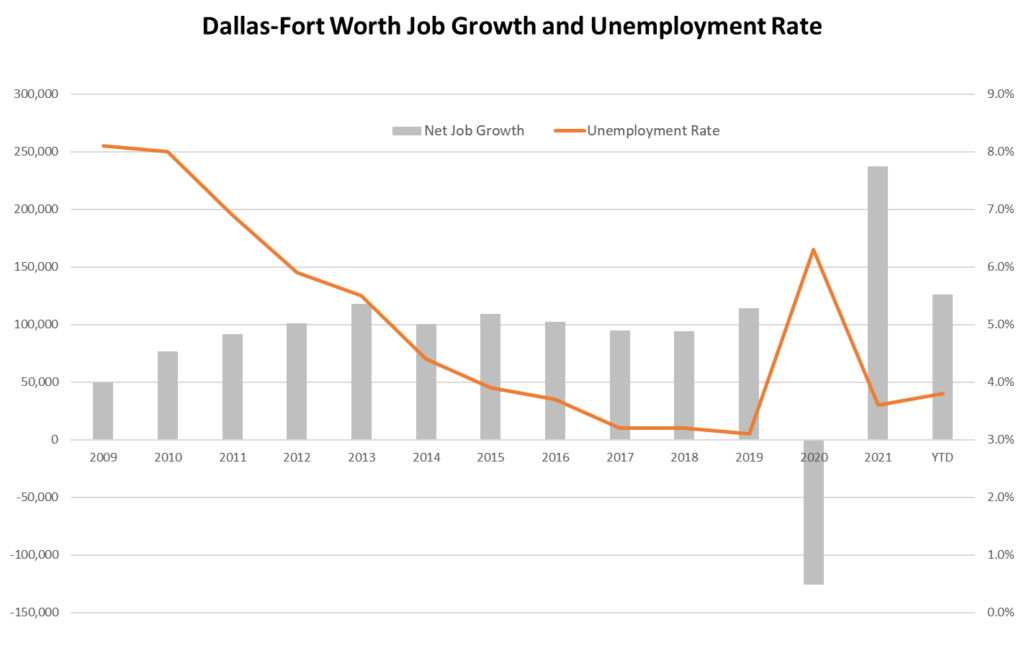

Most peripheral sites are seeing steadily decreasing activity with employers still competing for employees who desire shorter commuting distances despite the COVID-19 flight to home office. “Work from home” continues to gain long-term acceptance by both employees and employers. Older surrounding communities, historically undisturbed by DFW’s growth, have achieved higher than normal growth since 2015. The significant momentum that Texas, and more specifically DFW, gained in company relocations and the commensurate inbound employee increases has moderately decreased, being balanced by the large number of layoffs in tech and finance. While few deny that an extended period of strong economic growth is proving vulnerable, actual project starts and announcements of pending projects still occur, but at a far fewer frequency. Based on the real estate industry’s obvious resistance to all the negative indicators, we have no reason to believe it will be either disastrous or long-term.

Supporting the long-term benefits in land investment, a readjustment should make labor available at a more reasonable cost and at more realistic materials pricing. DFW will remain one of the strongest employment and desired investment markets in the country. Deep cost adjustments, however, are still purely speculative for an undetermined period of time. We do not believe it will sink to levels of the late 1980s, the early 2000s or the 2008 severe down-market recessions. DFW has excellent momentum with a strong defense against a major recession.

Despite sale prices at a multiple of replacement cost and surprisingly moderate positive retail demand, income-producing investments have maintained their active volume due largely to earlier low-interest rates, the need to invest 1031 trade equity and lack of competition by alternative investments. Capitalization rates early in 2022 approached record historical lows. To meet underwriting for either new debt or to remain conforming to existing debt, cap rates must adjust upward signaling initially moderate price reductions if an income property sale is desired. Excessive competition to acquire cash flow assets which remain resistant to the market cap rate adjustment, providing even the thinnest yields, will simply not occur until the financial markets adjust. The cyclical downturn in the national economy and a corresponding drop in physical occupancy will produce a dour impact and threatening or eliminating positive income property cash flows.

Inherently, land investment differs greatly from other types of real estate because of its inability to produce interim cash flow and its vulnerability to cycles. The criteria used to determine potential land opportunities, while becoming more sophisticated over the last two cycles, remains in implementing basic strategies. “Timing” has always determined the net result. We believe that any CRE recession will be short-lived because of the enormous equity investment that has been accumulated a lot of which is awaiting a readjustment and remains undeployed. Because it must produce a return at some point, it will return quickly when opportunity (chaos) is perceived.

Perhaps the most important part of a timing strategy is the ability to project and fund ownership long term. Positive liquidity and the ability to sell for an acceptable profit at the optimum market time can be highly speculative. Leveraging the investment only increases the risk. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

There has yet to be a final cycle, although current sentiment seems to reject that possibility which is an optimistically shallow, inexperienced approach. The financial ability to hold long term investments will affect the yield and does offer a degree of safety. With access to historical data, projecting long-term value, while still speculative, is much more achievable and moderately lessens risk. One observation is watching the pricing of Investment Land migrating from price per acre to price per square foot. This significant change can be attributed more to the inflationary effect of the dollar across the full financial spectrum rather than the intrinsic value of the real estate.

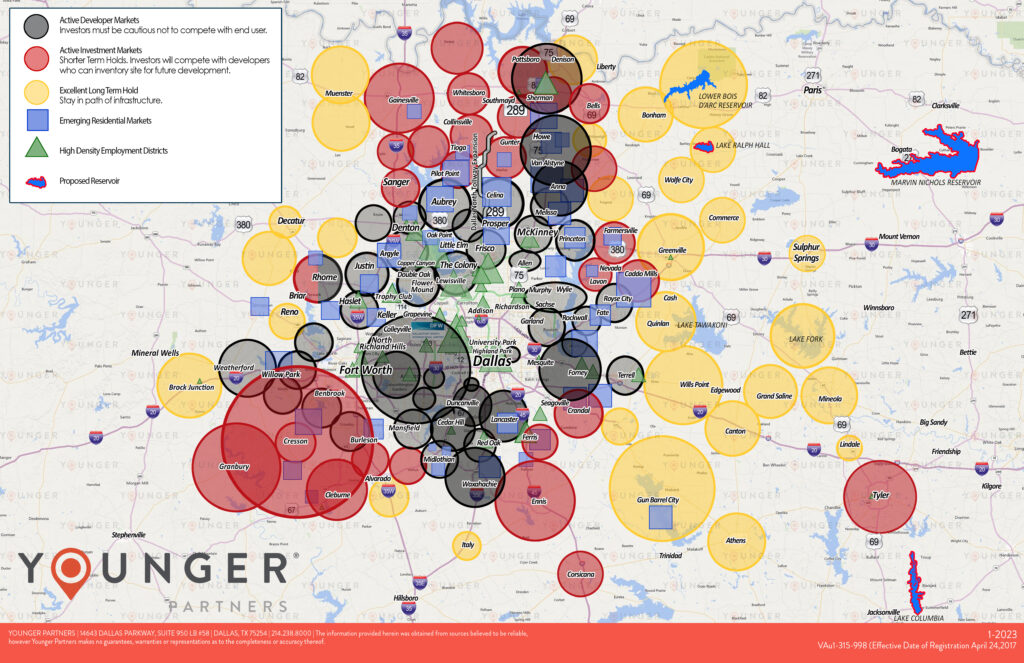

Our Land Absorption Map shows all types of 2022 commercial and residential land activity in specific geographic submarkets. Resources used for the map include actual sales, current listings, and announcements of pending projects. Not difficult to understand, the progression from active to long-term generally follows the availability of infrastructure and newer expanding utility systems, including Municipal Utility Districts. Land currently available for vertical construction will bring significantly higher value over those that must wait for services or possess extraordinarily high-cost offsite access. Over the 20+ years of presenting this map, it is interesting to note that, while the circles have limited movement, the colors change and generally move out from the core in concentric circles. This iteration of the 2022 map displays the first series of circle reductions in 10 years north of DFW and the first set of expansions in south DFW and beyond.

Younger Partners is a founder and member of the highly respected North Texas Land Council (NTLC), a group of 50 active, knowledgeable, and talented land brokers in DFW. Believing that activity generates more activity, the North Texas Land Council, to the advantage of its clients, freely shares information with its competing members and the general market on a level of professionalism unusual within similar organizations. As such, the organization is a benefit to all clients and to those anticipating a land investment. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC, local and national reporting agencies, and our large group of active company partners.

Because of many increased cost factors, single-family new home prices increased almost 25 percent in a single year making affordability more difficult. Additionally, historically low, long-term interest rates dramatically increased single-family affordability through the first quarter of 2022. Less obvious are the increases in completed per square foot costs in all commercial sectors. The surprisingly continued strong national economy, despite disruptions, as well as strong, continued inbound relocations, have provided record employment and income. Short-term projections are predictable–long-term less so. Perhaps one of the strongest influences softening the impact of a correction is the enormous amount of uncommitted cash held by investors of all classes and liquidity awaiting their perception of pending opportunities. Once an opportunity is perceived, that liquid cash will be quickly redeployed and reinvested, steadying prices in the event of a devaluation caused by any number of external influences. Investors, incorrectly or not, wishing to miss an anticipated opportunity (chaos) will move quickly. An improving stock market and strong oil and gas prices have contributed to lessening the attraction of real estate.

Perhaps the most important part of a timing strategy is the ability to project and fund ownership long term. Positive liquidity and the ability to sell for an acceptable profit at the optimum market time can be highly speculative. Leveraging the investment only increases the risk. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

There has yet to be a final cycle, although current sentiment seems to reject that possibility which is an optimistically shallow, inexperienced approach. The financial ability to hold long term investments will affect the yield and does offer a degree of safety. With access to historical data, projecting long-term value, while still speculative, is much more achievable and moderately lessens risk. One observation is watching the pricing of Investment Land migrating from price per acre to price per square foot. This significant change can be attributed more to the inflationary effect of the dollar across the full financial spectrum rather than the intrinsic value of the real estate.

Our Land Absorption Map shows all types of 2022 commercial and residential land activity in specific geographic submarkets. Resources used for the map include actual sales, current listings, and announcements of pending projects. Not difficult to understand, the progression from active to long-term generally follows the availability of infrastructure and newer expanding utility systems, including Municipal Utility Districts. Land currently available for vertical construction will bring significantly higher value over those that must wait for services or possess extraordinarily high-cost offsite access. Over the 20+ years of presenting this map, it is interesting to note that, while the circles have limited movement, the colors change and generally move out from the core in concentric circles. This iteration of the 2022 map displays the first series of circle reductions in 10 years north of DFW and the first set of expansions in south DFW and beyond.

Younger Partners is a founder and member of the highly respected North Texas Land Council (NTLC), a group of 50 active, knowledgeable, and talented land brokers in DFW. Believing that activity generates more activity, the North Texas Land Council, to the advantage of its clients, freely shares information with its competing members and the general market on a level of professionalism unusual within similar organizations. As such, the organization is a benefit to all clients and to those anticipating a land investment. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC, local and national reporting agencies, and our large group of active company partners.

Because of many increased cost factors, single-family new home prices increased almost 25 percent in a single year making affordability more difficult. Additionally, historically low, long-term interest rates dramatically increased single-family affordability through the first quarter of 2022. Less obvious are the increases in completed per square foot costs in all commercial sectors. The surprisingly continued strong national economy, despite disruptions, as well as strong, continued inbound relocations, have provided record employment and income. Short-term projections are predictable–long-term less so. Perhaps one of the strongest influences softening the impact of a correction is the enormous amount of uncommitted cash held by investors of all classes and liquidity awaiting their perception of pending opportunities. Once an opportunity is perceived that liquid cash will be quickly redeployed and reinvested, steadying prices in the event of a devaluation caused by any number of external influences. Investors, incorrectly or not, wishing to miss an anticipated opportunity (chaos) will move quickly. An improving stock market and strong oil and gas prices have contributed to lessening the attraction of real estate.

Our continuing extended analysis, as displayed on the “Younger Land Absorption Map” (revised December 2022) is principally based on historical data utilizing over 200 years of market experience held by Younger Partners associates, members of the NTLC, and reliable future projections from sources that have traditionally displayed accurate information. Our market demographic information was provided by Younger Partners’ Steve Triolet, Director of Research, and Michael Ytem, Senior Vice President. As projected earlier, the DFW market still expects to absorb an additional expansion of more than 20,000 acres over the next 15 to 20 years. Recent acquisitions by qualified mixed-use developers, if restarted, threaten to shorten the total absorption time to one-half the projections. We have always had cycles, and this too shall pass.

In conclusion, the principles of sophisticated investing must include and utilize primary criteria. Reviewing the history of our land absorption maps provides distinct, valuable trends in growth well applicable to intelligent investing. Access to infrastructure, the admirably increased effort of developers to utilize available land in our fertile southern corridor, absorption of the remaining few infill sites, high suburban infill land costs, and the migration of employment centers will all play significant roles in prudent land investment decisions. Historically in the investment process, the only remaining elements are sound financial strength and patience.

Record Demand for Land in North Texas

The DFW market still expects to absorb an additional expansion of more than 20,000 acres over the next 15 to 20 years, according to Younger Partners’ Robert Grunnah.

By Robert Grunnah | January 27, 2022 | 9:00 am

As 2021 has now come to a very fascinating and positive end, the North Central Texas land market has experienced significant influences modifying its prior accelerating four years of sales and absorption activity. To some surprise, the effects of COVID-19, an unstable political environment, rising inflation in Federal denial, Federal taxes, CRE threats, and significant increases in construction costs have not had a serious impact on land pricing and activity. Additionally, a profound market disruption in retail, entertainment, and hospitality has had an even lesser impact. In reviewing last year’s report, only a few observations have changed to any great degree.

NTCAR Selects Kathy Permenter as 2018 Stemmons Service Award Finalist

The Best Cities For Jobs 2015

By Joel Kotkin and Michael Shires

Since the U.S. economy imploded in 2008, there’s been a steady shift in leadership in job growth among our major metropolitan areas. In the earliest years, the cities that did the best were those on the East Coast that hosted the two prime beneficiaries of Washington’s resuscitation efforts, the financial industry and the federal bureaucracy. Then the baton was passed to metro areas riding the boom in the energy sector, which, if not totally dead in its tracks, is clearly weaker.

Right now, job creation momentum is the strongest in tech-oriented metropolises and Sun Belt cities with lower costs, particularly the still robust economies of Texas.

Topping our annual ranking of the best big cities for jobs are the main metro areas of Silicon Valley: the San Francisco-Redwood City-South San Francisco Metropolitan Division, followed by San Jose-Sunnyvale-Santa Clara, swapping their positions from last year.

Our rankings are based on short-, medium- and long-term job creation, going back to 2003, and factor in momentum — whether growth is slowing or accelerating. We have compiled separate rankings for America’s 70 largest metropolitan statistical areas (those with nonfarm employment over 450,000), which are our focus this week, as well as medium-size metro areas (between 150,000 and 450,000 nonfarm jobs) and small ones (less than 150,000 nonfarm jobs) in order to make the comparisons more relevant to each category. (For a detailed description of our methodology, click here.)

FORBES

D CEO ~ March 2014: A Big Shake-up in Dallas Commercial Real Estate

Changemakers at three DFW firms are transforming the business—and gaining market share.

Running a commercial real estate firm in Dallas-Fort Worth is not for the faint of heart. Firms here are at the top of their game, and the competition is fierce. But in a market as big and active as North Texas, there are bountiful opportunities, too. “So much of it comes down to hustle,” says Moody Younger of Younger Partners. “If you have good people and work hard and are honest with clients, you’ll get your share.”

Younger and Kathy Permenter, co-founders of Younger Partners, are part of a new leadership class in Dallas real estate, a group that also includes David Pinsel at Colliers International and Steve Everbach at Cushman & Wakefield of Texas Inc. All have been in their current positions for about two years. Younger and Permenter run their own shop; Pinsel and Everbach were both brought in to turn around the DFW offices of their respective companies. All have proven they have the mettle it takes to compete. Here are some of their strategies.

Dallas Business Journal – Billingsley says full sails ahead for Cypress Waters development

By Candace Carlisle, Staff Writer

It’s been more than a decade since Lucy Billingsley initially spotted the large parcel of land near Interstate 635, once owned by Dallas-based TXU Energy, but she still remembers seeing the property and thinking it would make an excellent plot to develop.

The longtime Dallas developer kept in touch with the energy company, hoping to land the 1,000-acre tract, and piece-by-piece, she did.

“It’s so rare to find 1,000 acres of land that’s infill property and near water,” said Billingsley, a partner at Dallas-based Billingsley Co. “In Dallas, you don’t find it.”

Now, Billingsley has jump-started the $3.5 billion master-planned, mixed-use development at the northeast corner of Belt Line Road and Interstate 635 calledCypress Waters, which recently landed the headquarters for Irving-based Cheddar’s Casual Cafe.

“It’s a long-term development that is launching with a lot of momentum,” Billingsley said. “It’s really been thrilling and the speed of development is really exciting.”

Real estate sources say they expectCypress Waters to land some big corporate tenants in the market. The developer has three office buildings underway to attract some of those tenants, as well as a corporate campus park.

Plans for the massive project include a corporate campus of 4.5 million square feet of office space, 10,000 apartments and townhomes, 400,000 square feet of retail space and three one-acre parks.

The project’s proximity to Dallas/Fort Worth International Airport, as well as the rest of North Texas, is one of the reasons why corporate America is taking notice of Cypress Waters, saidMarijke Lantz, a senior vice president at Billingsley Co.

“A company can pull employees together throughout the Metroplex,” Lantz said.

Cheddar’s ability to expand its North Texas headquarters at Cypress Waters drove the restaurant chain’s decision to set up shop in the master-planned community, said Rick Payne, a Cheddar’s senior vice president.

Cheddar’s is Cypress Waters’ first corporate tenant. The single-story, 31,450-square-foot build-to-suit project at 8951 Cypress Waters Blvd. in Irving is expandable to accommodate future growth.

As the restaurant expands, Cheddar’s plans to hire more corporate employees to support the operations in the chain’s 150 restaurants throughout the United States.

Along with Billingsley’s development plans, the city of Coppell is readying to start lowering a 700-acre lake on the site to 362 acres. The downsized lake will be used in the master-planned community, which will include a five-mile nature trail around the lake, a park setting reminiscent of White Rock Lake in Dallas, as well as lakeside dining options.

Billingsley said the firm’s in the midst of plans to develop alongside the water’s edge.

“We have the opportunity to create a space that’s quite special,” she said.

Moody Younger: Hog Hunting and Commercial Real Estate ~ DRealEstate Daily, February 17, 2014

One recent Saturday I went on what has become an annual hog hunt with NAI Robert Lynn broker Sam Hocker. Sam introduced me to this sport a few years ago, and I have been hooked on it ever since.

Hog hunting with Sam on the Red River is not for the faint of heart. We hunt the hogs on mules, with dogs. Your only weapon is a Bowie knife, and you only have one knife, so you are not throwing it. This is brutal “hand-to-hog” combat.

The hogs fight back and sometimes win, by injuring the dogs, or you, and getting away. You have to keep your wits about you to avoid serious injury. The goal is to “bring home some bacon”, or a nice boar’s head as a trophy.

Fortunately, we did both on that Saturday.

How does this relate to commercial real estate brokerage?

Dallas Business Journal – Billingsley to develop Cheddars’ new corporate headquarters in Irving

By Candace Carlisle, Staff Writer

Dallas-based development firm Billingsley Co. plans to build the new Irving corporate headquarters for Cheddar’s Casual Cafe, which marks the beginning of a number of construction projects at Cypress Waters.

Cypress Waters is Billingsley’s 1,000-acre master-planned development underway in Dallas and Irving, which has been developing the corporate campus portion of the project.

The developer will start construction on the single-story, 31,450-square-foot build-to-suit project in May at 8951 Cypress WatersBlvd. near Ranch Trail and Interstate 635 in Irving. Cheddar’s will have the ability to expand the building for future growth.

“As Cheddar’s continues to expand nationwide and our support center increases to support 150 restaurants in 28 states, it was clear we needed a headquarters that could accommodate our growing team,” Rick Payne, a Cheddar’s senior vice president, said in a written statement.

“Our new space at Cypress Waters will offer an open, collaborative design flow, a test kitchen for research and development and a training wing,” he said.

Jim Montgomery and William T. Mason of Swearingen Realty Group LLC represented Cheddar’s Restaurants. Moody Younger of Younger Partners represented the developer in the deal.

The new Cheddar’s headquarters will be Cypress Waters‘ first corporate office tenant.

DallasNews: Billingsley Co lands major tenant for its Cypress Waters project

Restaurant chain Cheddar’s Casual Cafe is moving its headquarters to developer Billingsley Co’s new Cypress Waters office park.

The company will relocate to a new 31,450 square foot office project that will start in late May at on Ranch Trail and Interstate 635.

Behind the Scenes: Preston Plaza Sale – Bisnow February 5, 2014

All the stars aligned for both the buyer, Caddo Holdings, and the seller, Granite Properties, to get what they wanted out of the sale of the 261k SF Preston Plaza. Full article.

Bisnow Scoop: Younger Partners’ Dustin Volz and Zane Marcell

A new year, a new look: The vacant, 64k SF 1400 Corporate Dr in Irving has been snatched up by Triad Real Estate Consulting, which plans to upgrading the lobby and common areas, among other renovations, we learned exclusively from the seller’s rep. (This is your chance to put a bowling alley in the basement… just sayin’.)

Younger Partners’ Dustin Volz and Zane Marcell (whom we snapped over lunch) repped the seller, an out-of-state investment group. Sales price was not disclosed. Dustin says he’s continuing to see a major price recovery, especially in the Class-B and C assets over the last nine to 12 months in DFW. Things have particularly picked up since March. (Everyone got through St. Patty’s Day alive and decided to buckle down.) A few reasons: the shortage of product, a very aggressive leasing market, and out-of-state buyers back in full force, helping bump up prices.

Bisnow’s New Construction and Development Summit

Billingsley SVP investments and build-to-suits Marijke Lantz (far right, with Pegasus Ablon asset management VP Mark Roppolo and Younger Partners partner Moody Younger) says Billingsley’s 1,000-acre Cypress Waters project at LBJ and Belt Line opened 675 multifamily units (that were pre-leased) and has three buildings under construction, one with a HQ company, one spec, and activity is so strong that the firm is following up with another spec building. Her advice to people entering real estate world: Learn new things and learn all sides of the business to help your clients. Having a good reputation for being ethical and moral will benefit you throughout your career.

citybizlist: Billingsley Company Pours Slab for 6111 West Plano Parkway

Billingsley Company, one of Dallas’ most active and well-regarded real estate development companies, is making progress on construction of 6111 West Plano Parkway in International Business Park. Complete article.

Dallas News: Fashion retailer J. Hilburn leases a north Dallas HQ

Men’s fashion retailer J. Hilburn has rented space in a North Dallas office tower for its home office. The company leased 26,000 square feet in the Park Central 3 building on LBJ Freeway.

Brant Landry of E. Smith Realty Partners negotiated the lease with Nora Hogan, Robert Deptula and Natalie Snyder of Transwestern and Kathy Permenter and Sean Dalton with Younger Partners. J. Hilburn is currently located at 2601 W. Mockingbird Lane in Dallas.

“Park Central 3 is allowing J. Hilburn to take the next step in our company growth plan,” said co-founder Veeral Rathod. “Our new corporate headquarters provides a cohesive work environment and an efficient layout.” Complete article.

Dallas Business Journal – September 5, 2013 – Billingsley to begin work on ReachLocal office building

Dallas-based development firm Billingsley Co. will begin construction on its latest office project in Plano by the end of the month.

Once developed, the 180,000-square-foot, three-story building at 6111 W. Plano Pkwy. will serve as the regional offices for Woodland Hills, Calif.-based online marketing firm ReachLocal Inc., which currently operates from the International Business Park.

Complete article

Dallas Business Journal – Younger Partners hires Carter T. Crow, expands industrial division

Dallas-based Younger Partners has grown its industrial division by hiring Carter T. Crow, who brings 1.2 million square feet of industrial leasing assignments to the company. Full Article

D Real Estate Daily: Carter Crow Joins Younger Partners

Younger Partners has tapped Carter Crow to help the company grow its industrial real estate services business. He’ll bring with him 1.2 million square feet of leasing assignments to the company, including Billingsley Co.’s Turnpike portfolio. Full article

DallasNews BizBeatBlog – Dallas real estate firm expands industrial operations

Dallas commercial real estate company Younger Partners is expanding its industrial property operations with the addition of a new exec.

Carter T. Crow has joined the firm as a managing partner charged with growing the company’s warehouse business. Full Article

Insight: Quick Stats – GDP

According to the final estimate from the Bureau of Economic Analysis (BEA), real gross domestic product (GDP) in the U.S. grew at an annualized rate of 1.8 percent during the first quarter of 2013, a downward revision from the prior estimate of 2.4 percent annual growth. In comparison, real GDP growth was was a very weak 0.4 percent in the fourth quarter of 2012. Growth in real GDP during the first quarter of 2013 was tempered by government spending which contracted at an 8.7 percent annual rate and consumer spending which grew at a tepid 2.4 percent annual rate.

The Federal Reserve Bank of Dallas expects modest to moderate economic growth through the remainder of the year as employment growth is projected to accelerate to an annualized rate between 1.8 and 2.2 percent during the second half of 2013, while inflation is forecast in the range of 1.5 to 2 percent over the next year. As of June 2013, the Federal Reserve Board Members and Federal Reserve Bank Presidents projected the change in real GDP for 2013 would be in the range of 2.0 to 2.6 percent.

Fortunately, we live in Texas which accounted for 9 percent of the the total U.S. GDP in 2012 and should continue to garner a large portion of future gains in total U.S. economic growth. Although the largest share of Texas’ annual growth in 2012 GDP (1.38 percent) occurred in the mining, logging and construction sector resulting from the boom in energy-related businesses, the Texas economy is diversified with a highly educated workforce and relatively low business costs that position the state for sustained economic expansion. The Texas Comptroller of Public Accounts expects Texas to achieve 3.4 percent annual growth in GDP in 2013, much stronger than the 2 to 2.6 percent growth anticipated for the U.S., led by gains in the Professional and Business Services, Trade, Transportation and Utilities, and Manufacturing sectors.

Insight: Quick Stats – Texas Economic Analysis

All the world’s a stage, but if Texas were a country where would it rank on the global stage? One measure of comparison is the Gross Domestic Product (GDP) or total output of goods and services produced by a country or, in this case, Texas. According to statistics just released by the Bureau of Economic Analysis, the GDP produced by Texas in 2012 totaled $1,397,369 million and would rank 13th in the world, behind Canada and Spain but ahead of Australia and Mexico.